The US dollar continues to hit new levels against the yen, as USD/JPY was trading in the 102.60 range in Thursday’s European session. The US released disappointing inflation and manufacturing data, and will try to turn things around on Thursday, with the release of four major events – Building Permits, Core CPI, Unemployment Claims and the Philly Fed Manufacturing Index. In Japan, Preliminary GDP hit a four-month high. The sole Japanese release on Thursday is Core Machinery Orders.

There was disappointment on Wednesday for US numbers. PPI, a key inflation indicator, declined by 0.7%, missing the estimate of -0.6%. This was the second consecutive decline. The manufacturing sector continues to struggle, as underscored by the Empire State Manufacturing Index, which slid from 3.1 points to -1.4, way off the estimate of 3.6. This marked the third straight month that the indicator has fallen short of the estimate. In Japan, Preliminary GDP recorded a gain of 0.9%, beating the forecast of 0.7%. Revised Industrial Production also looked good, climbing to 0.9%. The estimate stood at 0.2%. Japan continues to struggle with deflation, despite the strenuous efforts of the Bank of Japan. The GDP Price Index declined 1.2%, missing the estimate of -1.0%.

The dollar has shown some broad strength against the major currencies, in part due to speculation that the Federal Reserve might terminate its current round of quantitative easing, thanks to an improving employment picture in the US. The Fed has not given any clues that it might scale back QE, which involves asset purchases of $85 billion every month. However, if the US recovery shows stronger signs of recovery, pressure will increase on the Fed to ease up on the QE, which would be dollar-positive. Any statements from the Fed regarding QE will likely have an impact on the movement of USD/JPY.

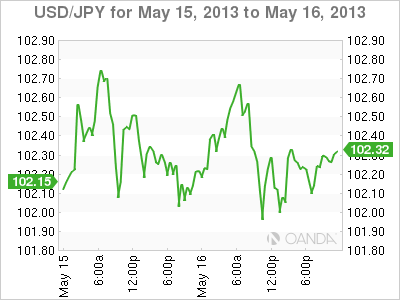

USD/JPY May 16 at 11:25 GMT

USD/JPY 102.58 H: 102.68 L: 101.97  USD/JPY Technical" title="USD/JPY Technical" width="598" height="83">

USD/JPY Technical" title="USD/JPY Technical" width="598" height="83">

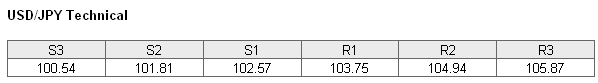

USD/JPY continues to move higher, and is trading in the mid-102 range. The pair is facing resistance at 103.75. This is followed by resistance at 104.95. On the downside, the pair is testing support at 102.57. This line could fall if the yen can muster some strength. This is followed by a support level at 101.87.

- Current range: 102.57 to 103.75

- Below: 102.57, 101.81, 100.54, 100 and 99.57

- Above: 103.75, 104.94, 105.87 and 106.55

USD/JPY is showing almost no change in the Thursday session. This is consistent with what we are seeing from the pair, which is not showing much movement. The ratio remains evenly divided between open long and short positions, indicating a split among traders as to what to expect next from the volatile pair.

USD/JPY continues to trade at multi-year highs, as it trades in the mid-102 range. We could see some increased volatility later in the day, as the US releases four major events.

USD/JPY Fundamentals

- 11:45 US FOMC Member Eric Rosengren Speaks.

- 12:30 US Building Permits. Estimate 0.94M.

- 12:30 US Core CPI. Estimate 0.2%.

- 12:30 US Unemployment Claims. Estimate 332K.

- 12:30 US CPI. Estimate -0.3%.

- 12:30 US Housing Starts. Estimate 0.98M.

- 14:00 US Philly Fed Manufacturing Index. Estimate 2.5 points.

- 14:30 US Natural Gas Storage. Estimate 96B.

- 16:30 US FOMC Member Sarah Bloom Rosengren Speaks.

- 23:50 Japanese Core Machinery Orders. Estimate 3.1%.