Recent reports have said the opposite of market sentiment in the Japanese economy, as it's reported that members of the Bank of Japan (BoJ) are now seeking ways to exit quantitative easing, which so far has been deemed to be a success in lifting inflation rates. This may come as a shock for some market participants -- especially as Kuroda is seen as a “dove” who would do anything to make sure his country succeeded in increasing inflation. However, it’s not a shock for a central bank looking at its options for a timely exit from quantitative easing.

Central banks when forced to act; do act. The problem is never the easing part, it's always exiting the easing without causing shocks to the economy. The Fed has so far done a good job of actually exiting a massive stimulus programme, and many market watchers will be looking at the model set by the Fed, of complete transparency regarding its outlook as well leaving the door open for a slowdown if needed. This will most likely be the model adopted by the BoJ in regards to going about such action, the question is --is it actually feasible with markets? While the BoJ would like to go about exiting quantitative easing, I believe the process and announcement of such a move would greatly impact the foreign exchange markets -- something which is a prime concern for the BoJ and Japanese exporters. The yen going back below 100 may cause further problems for the Japanese economy, and I myself believe that it would force an about turn from officials at the BoJ.

In the event that they do go through a period of exiting the quantitative easing, it’s most likely to be very gradual so as not to cause any shocks on the open market, and may even take a number of years (2-3 years) to wind down.

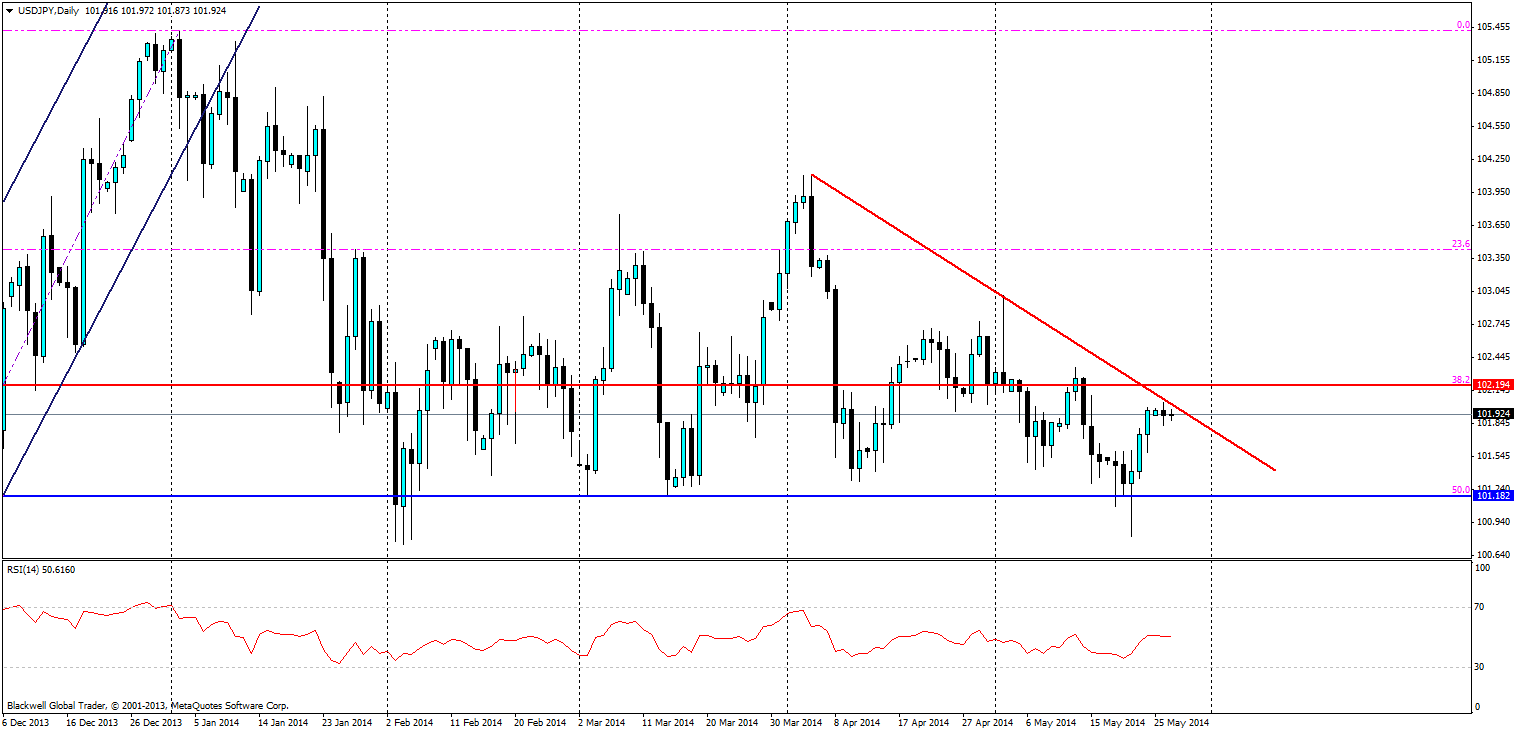

Source: Blackwell Trader (USD/JPY, D1)

Certainly this could be a worry for the Japanese economy, but investors are aiming at the Yen trendline in play and could benefit from this further. With the fundamental changes appreciation down to the 50.0 Fibonacci level could be next on the cards.

Personally, I feel that there is a lot of ground still to be had and certainly the talk of exiting is still a while off actually happening. The way forward is likely down on the charts for the USD/JPY and any target should be at 101.18. While it seems like a distant target, time and time again we have seen the market push lower and so far each wave has been lower highs, which signals the bearish nature of the market at the present moment.