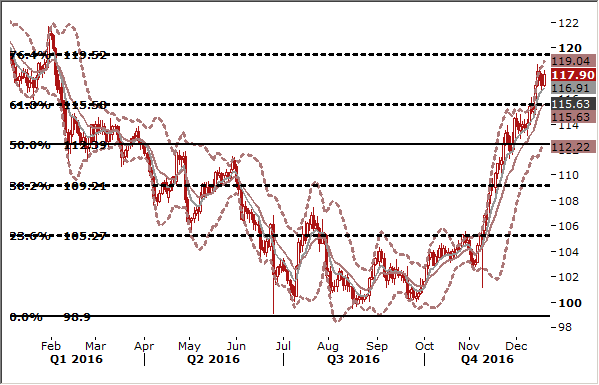

USD/JPY: BOJ revises upwards its outlook for economy

- The Bank of Japan affirmed its twin targets of minus 0.10% interest on some excess reserves and the zero percent 10-year government bond yield. The central bank expressed a more optimistic view on the country's economy with exports picking up on a weaker yen.

- "Exports have picked up" as the global economy has remained on a moderate growth path, the bank said, adding "private consumption has been resilient" with the employment and income situation improving.

- BOJ Governor Haruhiko Kuroda, however, voiced reluctance to raise the central bank's government debt yield target in the near future, despite recent increases in Japan's long-term interest rates in tandem with rising U.S. Treasury yields. "Yield curve control" policy has "functioned well" since it was introduced in September, Kuroda said, indicating the BOJ will maintain efforts to push down long-term interest rates.

- Regarding recently increasing Japanese long-term interest rates, two out of nine policy board members voted against the proposal to keep the 10-Year government debt yield unchanged around zero percent. One member said the policy "would entail a risk that the bank might need to further increase the pace of its Japanese government bond purchases."

- As for economic conditions, the BOJ's quarterly Tankan survey, released last week, showed business sentiment among large Japanese manufacturers improved in December for the first time in six quarters, as the JPY depreciation and a recovery in emerging economies raises hopes for an expansion of exports.

- The core consumer price index, which fell for the eighth straight month in October, is also set to move out of negative territory on the back of higher oil prices and a pickup in consumer spending, improving the outlook for the BOJ to attain its 2% inflation goal.

- Although BOJ meeting outcome was widely expected, the move appeared to set it apart from other major central banks that are scaling back stimulus.

- The dollar also rose to above 118.00 yen, quickly recovering from Monday's low of 116.55 yen. The dollar was helped in part by upbeat comments from Federal Reserve Chair Janet Yellen on the U.S. jobs market.

- In our opinion the nearest target for bulls is 119.52, 76.4% retrace of the 2015-2016 fall. Our USD/JPY bid was not filled yesterday, but we used JPY rise to get long on the EUR/JPY, CHF/JPY and GBP/JPY pairs. We think it would be reasonable to cancel the USD/JPY bid for now.

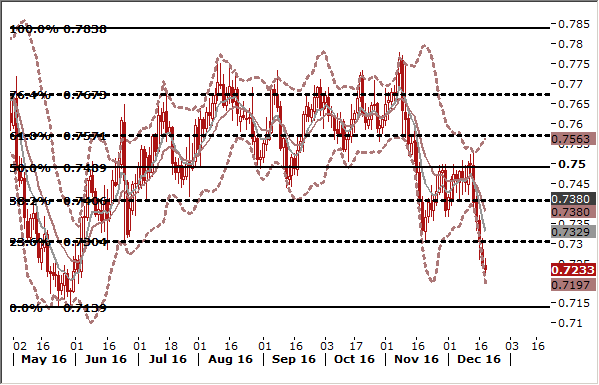

AUD/USD: Lower Aussie and higher commodity prices boost Australian terms of trade

- Minutes of the latest Reserve Bank of Australia policy meeting showed the board was trying to balance the benefits of easy policy against the risks of encouraging a renewed borrowing binge by households, who are already heavily in debt.

- RBA Governor Philip Lowe has repeatedly argued that cutting rates further could carry risks for debt that outweighed any economic benefit.

- Domestic data has not been that encouraging. Board members spent considerable time discussing the labour market, where employment growth had disappointed for some months with jobs being heavily skewed toward part-time work.

- Australia's GDP shrank in the third quarter, the first contraction since early 2011. Slower growth combined with subdued wages has also eaten into government revenues, with Treasurer Scott Morrison this week warning the budget deficit would be A$10 billion larger over the next four years.

- Interbank futures imply the market sees scant chance of another cut in rates. We do not expect further monetary easing.

- Since the RBA last met, the AUD has tumbled to a six-and-a-half-month low against the greenback. The Aussie has given up all of its gains this year after being 6.5% higher in early November. The drop in the Aussie coupled with higher commodity prices would be a relief for the RBA as it would boost Australia's terms of trade.

- Another argument against further stimulus is a recent acceleration in house prices in Australia's two largest cities, Sydney and Melbourne.

- There is a risk that the AUD/USD is will fall to May's low in the near term, but we see upside potential for the AUD in the long term as the Australian yield level in real terms remains one of the highest in G10. Our short-term AUD/JPY was stopped due to unexpectedly rapid AUD drop in recent days, however we stay long on this pair in the long-term part of our portfolio. The AUD should be supported by the low likelihood of monetary easing by the Reserve Bank of Australia. The AUD is also likely to rise on the back of higher commodity prices and hence, an further improvement in terms of trade.