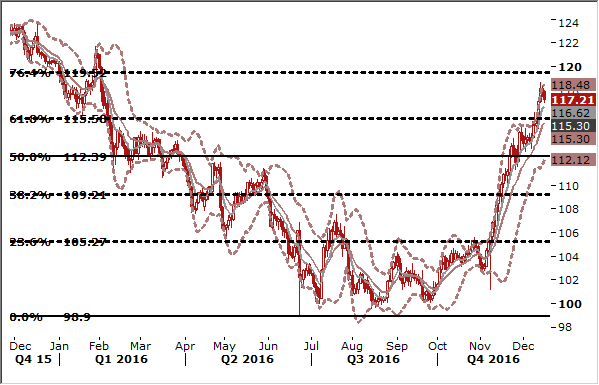

USD/JPY: BOJ is likely to keep monetary policy on hold this week

- The Bank of Japan is expected to hold its negative interest rates and 10-year government bond yield target steady this week as a weaker yen and positive overseas conditions augur well for Japan's economic prospects. The BOJ is also expected to keep the pace of the annual increase in JGB holdings at around JPY 80 trillion.

- The BOJ's 2% inflation target is a long way to reach. But a need for more stimulus by the BOJ has declined further because of the weaker yen and higher share prices.

- The focus for this week will be how the BOJ will change its view on the economy and how it assesses recent rises in long-term yields. BOJ Governor Haruhiko Kuroda may once again send the message that wage increases are badly needed to meet the BOJ's inflation target, as he did recently.

- Under a new policy framework announced in September, the BOJ pledged to guide short-term rates to minus 0.1% and the 10-Year JGB yield to around zero percent.

- Ministry of Finance data showed on Monday that exports fell 0.4% in the year to November. That compares with the 2.0% annual decline expected by the market, and follows a 10.3% decline in the year to October. The data is likely to offer encouragement to the Bank of Japan, which is leaning toward upgrading its economic outlook at a meeting ending December 20 because officials are becoming increasingly confident that global trade is emerging from the doldrums

- Imports fell an annual 8.8% vs. the median estimate of a 12.6% fall. The trade balance came to a surplus JPY 152.5 billion, versus the median estimate for a JPY 227.4 billion surplus.

- The bull cycle on the USD/JPY has stalled but the overall bias remains on the upside for 119.52 – 76.4% retrace of the 2015-2016 fall.

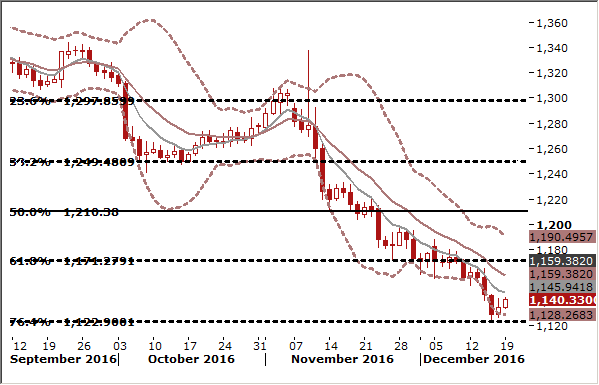

Gold may bounce moderately, but medium-term outlook remains unclear

- Gold rose today, extending its recovery from a 10-and-a-half-month low hit last week, as the USD slipped from a 14-year peak against a basket of currencies.

- Gold now appears to have found a base near 76.4% fibo of 2015-2016 rise, however, upside will be limited as investors look to other markets for yield. Gold is highly sensitive to rising rates, which lift the opportunity cost of holding non-yielding assets such as bullion, while boosting the dollar, in which it is priced.

- Richmond Fed President Jeffrey Lacker said on Friday the Fed will likely need to raise interest rates more than three times next year and faces challenges in gradually cooling off the U.S. economy. Lacker, who did not have a vote but participated in the Fed's policy meetings this year, said the U.S. economy would likely receive some fiscal stimulus under the Trump administration. He said the Fed would still be able to raise rates gradually, but perhaps not as slowly as is expected by the majority of policymakers. Lacker said he will be looking out for signs of rising inflation given the apparent strength of the labor market, but that it would likely be a couple of years before policymakers know if they waited too long to raise rates in 2016.

- The Fed hiked rates for the first time in a year last week and projected three more increases in 2017, up from the two projected in September. Hawkish interest rate forecasts put gold under pressure. That is why investors may be moving away from gold at least for the medium term.

- We think that a slight recovery to 1.150/60 per ounce is likely, but medium-term outlook remains unclear. In our opinion no position is justified from risk/reward perspective.