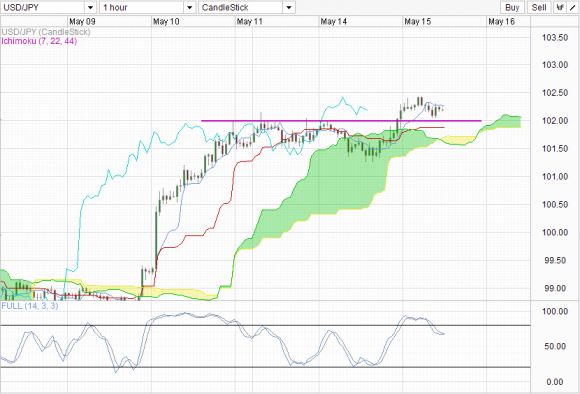

USD/JPY broke 102 yesterday during U.S. trading hours. The USD was again the main driver as the Greenback gained strength on the back of higher S&P 500 prices. However, price did not manage to move beyond the 50 pips of the 102.0 ceiling, but nonetheless it should be said that it is a good days for the bulls, as bulls managed to pull away from the Kumo and form a bullish Kumo Twist in the process of breaking 102.

Hourly Chart USD/JPY: Hourly" title="USD/JPY" width="580" height="394">

USD/JPY: Hourly" title="USD/JPY" width="580" height="394">

The pullback that was experienced early Asian hours only served to bring price slightly above 102 instead of testing it convincingly, suggesting that overall bullish sentiment is still strong. Stochastic curves are also flattening, which is the early sign of a potential interim trough forming. This adds credence to the scenario where price will be able to push higher from here and potentially give 102.5 a good test this time round.

Daily Chart USD/JPY: Daily" title="USD/JPY" width="580" height="394">

USD/JPY: Daily" title="USD/JPY" width="580" height="394">

Not much to be said from the bullish chart, just that bull trend is continuing to be strong. Stochastic readings appear to be peaking but that is not very helpful as counter trend signals tended not to be reliable during a strong trend -- and current price action and fundamentals definitely point to a strong up trend.

However there are some concerns to be had -- JGB yields are steadily increasing despite BoJ’s purchasing efforts. This is directly opposite of what the BoJ wants and places doubt on the effectiveness of Abenomics on the market. In fact, the “better” economic data that has come out recently seems to point to weak JPY as the biggest reason why everything is improving, with important fundamentals such as consumer consumption and industrial production figures still shrinking. As such, if bond yields continue to climb higher, the goodwill speculators have been lending to BoJ will evaporate quickly, and potentially pull USD/JPY back below 100 sharply if negativity toward Japan creeps in.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD/JPY: 102 New Footing For Bulls

Published 05/15/2013, 08:10 AM

Updated 07/09/2023, 06:31 AM

USD/JPY: 102 New Footing For Bulls

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.