The Japanese yen flexed some muscle on Wednesday but was unable to consolidate these gains, as USD/JPY trades at the 114 line in the European session. In economic news, it’s a busy day in the US, with the release of two major indicators – Building Permits and PPI. As well, the Federal Reserve will release the minutes from its January policy meeting. There is just one Japanese event on the calendar, Trade Balance.

Japanese fundamentals continue to point to a limping economy, hobbled by weak growth and low inflation. The week started badly, as Preliminary Japanese GDP for Q4 slipped by 0.4%. This followed a decline of 0.2% in Final GDP for Q3. The Chinese slowdown has taken a big bite out of the Japanese economy, as China is one of Japan’s major trading partners. To make matters worse, Japanese consumer spending has fallen off, hurting growth and raising the specter of deflation, which would be a nightmarish scenario for policymakers. Despite all the gloom and doom, the Japanese yen has not only held its own against the strong US dollar, but posted a superb rally. The secret to the yen’s recent success? The Japanese currency has benefited from its traditional safe-haven status, as global financial instability has driven investors away from risk assets towards safer waters like the yen. However, the recent stampede to safety will not last indefinitely, and the recent shock move by the BOJ of adopting negative rates underscores the malaise gripping the Japanese economy. Given these backdrop, there is speculation that the BOJ will take further monetary action at its next policy meeting in March.

The Federal Reserve will again take center stage on Wednesday, with the release of the minutes of the January policy meeting. In the policy statement after the meeting, Janet Yellen & Co. sounded cautious, saying that the Fed was “closely monitoring global economic and financial developments and is assessing their implications for the labor market and inflation”. The decision to hold interest rates at 0.25% was unanimous, and the Fed acknowledged that the US economy was slowing down. Gone was the optimism which characterized the December meeting, when the Fed raised rates and hinted at further rate hikes in 2016. Given the current economic situation, many experts expect no more than two rate hikes this year, perhaps in June and December. At the same time, any improvement in key US numbers will heat up speculation about a possible March hike. There was an interesting development last week when Janet Yellen appeared before Congress and refused to rule out negative interest rates. The Fed has rejected making such a move in the past, and this is unlikely to change. Still, Negative Interest Rate Policies (NIRP) has become a relevant tool for central banks. The Bank of Japan shocked the markets in January when it adopted negative rates, and the ECB has had this policy in place for some time on deposits, and has hinted that it could adopt this scheme to its benchmark rate, which currently stands at 0.05%. Such a scheme is supposed to combat deflation and boost economic growth by pressuring banks to increase lending.

USD/JPY Fundamentals

Wednesday (Feb. 17)

- 8:30 US Building Permits. Estimate 1.21M

- 8:30 US PPI. Estimate -0.2%

- 8:30 US Core CPI. Estimate 0.1%

- 8:30 US Housing Starts. Estimate 1.16M

- 9:15 US Capacity Utilization Rate. Estimate 76.7%

- 9:15 US Industrial Production. Estimate 0.3%

- 14:00 FOMC Meeting Minutes

- 18:00 FOMC James Bullard Speaks

- 18:50 Japanese Trade Balance. Estimate 0.06T

Upcoming Key Events

Thursday (Feb. 18)

- 8:30 US Philly Fed Manufacturing Index. Estimate -2.9 points

- 8:30 US Unemployment Claims. Estimate 275K

*Key releases are highlighted in bold

*All release times are EST

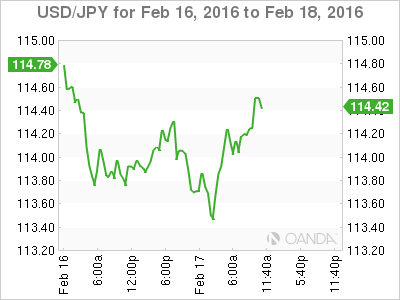

USD/JPY for Wednesday, February 17, 2016

USD/JPY February 17 at 7:15 EST

Open: 114.13 Low: 113.35 High: 114.39 Close: 114.09

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 111.50 | 112.48 | 113.86 | 114.65 | 115.90 | 116.88 |

- USD/JPY posted losses in the Asian session but has recovered in European trade

- 113.86 remains busy and has switched to a support role. It remains under pressure

- There is resistance at 114.65

- Current range: 113.86 to 114.65

Further levels in both directions:

- Below: 113.86, 112.48, 111.50 and 109.87

- Above: 114.65, 115.90 and 116.88

OANDA’s Open Positions Ratio

USD/JPY ratio is unchanged, consistent with the lack of movement we’re seeing from USD/JPY. Long positions retain a strong majority (59%). This is indicative of strong trader bias towards the pair moving to lower ground.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.