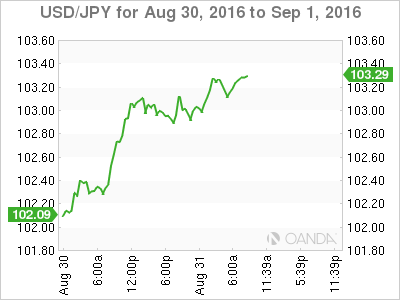

The Japanese yen has lost ground on Wednesday, following sharp losses in the Tuesday session. Currently, USD/JPY is trading at 103.30, its highest level in the month of August. On the release front, Japanese Preliminary Industrial Production posted a flat reading of 0.0%, well short of the estimate of 0.7%. Later in the day, Japan releases Capital Spending. In the US, we’ll get a look at two key indicators – ADP Nonfarm Employment Change and Pending Home Sales. On Thursday, the US releases unemployment claims and the ISM Manufacturing PMI.

Will she or won’t she? The markets are again talking rate hike, following an upbeat speech from Fed chair Janet Yellen on Friday at the Jackson Hole summit. Yellen’s message to the markets was refreshingly clear, as she said that the case for a rate increase had “strengthened in recent months”. Yellen noted that the key economic indicators were performing well – the labor market was approaching maximum employment, inflation was steady, and consumer spending remained solid. Still, Yellen did not provide any timeline on a rate hike nor did she spell out what the Fed wants to see before pressing the rate trigger. On Friday, Fed members Dennis Lockhart and Stanley Fischer both came out in favor of two rate hikes in 2016, and these comments helped the dollar record broad gains on Friday. The Fed’s stance has raised the odds of a rate move according to the CME Group FedWatch tool, with a September hike priced at 30% in September and 57% for a December hike. However, given that any move by the Fed will be data-dependent, US numbers ahead of the Fed policy meeting on September 21 could significantly change the rate outlook.

Japan’s economy remains mired in deflation, as underscored by weak inflation numbers in August. Inflation levels have failed to move upwards, despite the government’s Abenomics program and radical monetary easing by the Bank of Japan earlier in the year. The government unveiled an ambitious stimulus plan this summer, but even if successful, it will take time for inflation to gain traction. Tokyo Core CPI, the primary gauge of consumer spending, continued its losing ways with a decline of 0.4% in August, shy of the estimate of -0.3%. Since May 2015, the indicator has managed just two gains, and both of those were a paltry 0.1%. National Core CPI posted a decline of -0.5%, short of the forecast of -0.4%.

Tuesday (August 30)

- 19:50 Japanese Preliminary Industrial Production. Estimate 0.7%. Actual 0.0%

Wednesday (August 31)

- 1:00 Japanese Housing Starts. Estimate 7.6%. Actual 8.9%

- 8:15 US ADP Non-Farm Employment Change. Estimate 174K

- 9:45 US Chicago PMI. Estimate 54.1

- 10:00 US Pending Home Sales. Estimate 0.7%

- 10:30 US Crude Oil Inventories. Estimate 1.1M

- 19:50 Japanese Capital Spending. Estimate 5.6%

- 22:00 Japanese Final Manufacturing PMI. Estimate 49.6

- 23:45 Japanese 10-year Bond Auction

Thursday (September 1)

- 18:30 US Unemployment Claims. Estimate 265K

- 10:00 US ISM Manufacturing PMI. Estimate 52.0

*Key events are in bold

USD/JPY for Wednesday, August 31, 2016

USD/JPY August 31 at 7:35 EDT

Open: 102.88 High: 103.34 Low: 102.85 Close: 103.28

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 99.71 | 101.20 | 102.36 | 103.73 | 104.99 | 106.38 |

- USD/JPY was flat in the Asian session and has posted small gains in European trade

- 102.36 is providing support

- There is resistance at 103.73

- Current range:102.36 to 103.73

Further levels in both directions:

- Below: 102.36, 101.20, 99.71 and 98.95

- Above: 103.73, 104.99 and 106.38

OANDA’s Open Positions Ratio

USD/JPY ratio is unchanged on Wednesday, consistent with the lack of significant movement from USD/JPY. Currently, long positions have a strong majority (68%), indicative of trader bias towards USD/JPY continuing to move to higher ground.