USD/JPY is almost unchanged in the Wednesday session. Currently, the pair is trading at 114.70. On the release front, Japanese Revised Industrial Production declined 0.4%, above expectations. In the US, there were no surprises from key consumer reports, as retail sales and CPI posted small gains in February. Today’s highlight is the Federal Reserve policy meeting, with the central bank widely expected to raise the benchmark rate a quarter-point, from 0.50% to 0.75%. On Thursday, the US publishes a host of key indicators, led by unemployment claims.

The Bank of Japan will set its interest rate shortly after the Federal Reserve makes its announcement. Unlike the Fed meeting, the BoJ meeting will likely be a non-event, with the BoJ expected to hold pat and maintain rates at -0.10%. If, as expected, the Fed does raise rates, monetary divergence will widen and the yen could lose more ground against the US dollar. The Japanese economy has showed improvement, recording four consecutive quarters of growth. Still, analysts are not expecting the BoJ to make any changes to its ultra-loose monetary policy, as inflation levels remain well below the BoJ’s target of around 2.0%.

With the markets expecting a quarter-point rate hike on Wednesday, will the currency markets react to a Fed move? Although a rate hike has been priced in by the markets at 93%, there have been disappointments in the past, so a rate move could boost the dollar at the expense of gold. Strong US employment numbers in February have reinforced market speculation that the Fed will raise rates for the first time this year. Nonfarm payrolls sparkled in February, as the indicator jumped to 235 thousand, easily beating the estimate of 196 thousand. Wage growth climbed 2.6% compared to February 2016, while the participation rate edged up to 63.0%, up from 62.9%. These solid job numbers have also provided President Trump with a much-needed boost. Trump is under pressure to present an economic agenda, but the markets won’t mind giving him some additional breathing room, with the economy performing so well.

USD/JPY Fundamentals

Tuesday (March 14)

- 00:30 Japanese Revised Industrial Production. Estimate -0.8%. Actual -0.4%

Wednesday (March 15)

- 8:30 US CPI. Estimate 0.0%. Actual 0.1%

- 8:30 US Core CPI. Estimate 0.2%. Actual 0.2%

- 8:30 US Core Retail Sales. Estimate 0.1%. Actual 0.2%

- 8:30 US Retail Sales. Estimate 0.2%. Actual 0.1%

- 8:30 US Empire State Manufacturing Index. Estimate 15.3. Actual 16.4

- 10:00 US Business Inventories. Estimate 0.3%.

- 10:00 US NAHB Housing Market Index. Estimate 65

- 10:30 US Crude Oil Inventories. Estimate 3.3M

- 14:00 US FOMC Economic Projections

- 14:00 US FOMC Statement

- 14:00 US Federal Funds Rate. Estimate <1.00%

- 14:00 US FOMC Press Conference

- 16:00 US TIC Long-Term Purchases. Estimate 13.4B

Upcoming Key Events

Thursday (March 16)

- 8:30 US Building Permits. Estimate 1.26M

- 8:30 US Philly Fed Manufacturing Index. Estimate 30.2

- 8:30 US Unemployment Claims. Estimate 245K

- 10:00 US JOLTS Openings. Estimate 5.45M

- Tentative – BoJ Policy Rate

- Tentative – BoJ Monetary Policy Statement

- 14:30 BoJ Press Conference

*All release times are GMT

*Key events are in bold

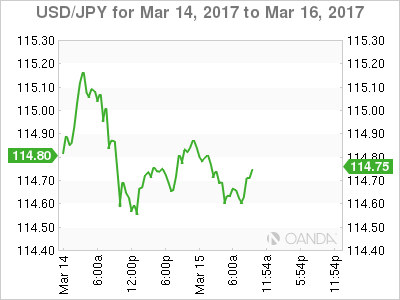

USD/JPY for Wednesday, March 15, 2017

USD/JPY March 15 at 9:00 EST

Open: 114.66 High: 114.88 Low: 114.54 Close: 114.71

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 110.94 | 112.57 | 113.80 | 114.83 | 115.90 | 116.88 |

USD/JPY edged higher in the Asian session and has ticked lower in European trade

- 113.80 is providing support

- 114.83 remains a weak line. It was tested in resistance earlier

- Current range: 113.80 to 114.83

Further levels in both directions:

- Below: 113.80, 112.57, 110.94, and 109.77

- Above: 114.83, 115.90 and 116.88

OANDA’s Open Positions Ratio

USD/JPY ratio is showing slight movement towards long positions. Currently, long positions have a majority (55%), indicative of trader bias towards USD/JPY breaking out and moving higher.