The Japanese yen has edged up in Friday trading against the US dollar. The pair pushed below the 101 line late in Friday’s Asian session, as the yen continues to post gains. The Japanese currency benefited from better inflation numbers, as the Tokyo Core CPI posted a gain for the first time in almost two years. In the US, there are plenty of releases for the market to scrutinize as we wrap up the trading week. Today’s highlights include inflation and consumer confidence releases.

We’ve been treated to a lot of movement from USD/JPY this week, much of which can be attributed to volatility in the Japanese bond markets. The uncertainty in the bond markets has thrown a monkey wrench into the BOJ’s monetary easing program, which involves large purchases of Japanese bonds. The BOJ quickly sought to reassure the bond markets and announced that it would “fine-tune market operations” in order to ensure that long and short-term interest rates remain stable.

The Japanese government and Bank of Japan have been waging a relentless war against deflation by resorting to an aggressive monetary easing policy. This has resulted in the value of the yen plunging, but economic indicators have stubbornly continued to point to deflation. There was finally some good news on this front, Tokyo Core CPI, an important inflation indicator, posted a gain of 0.1%. Although a very modest gain, this marked the first time that the indicator pointed to inflation since July 2011. National Core CPI was not as sharp, declining by 0.4%, which matched the forecast. There was more good news from Preliminary Industrial Production, which hit a six-month high, climbing 1.7%. This easily surpassed the estimate of 0.8%.

In the US, the Federal Reserve hasn’t made any changes to the current round of quantitative easing, which stands at $85 billion in asset purchases each month. Fed policymakers, including Fed Chair Bernanke, have not been shy about dropping clues that QE could be altered or even terminated in the next few months. The currency markets have reacted sharply to such talk, and much of the volatility we are seeing in the currency markets is a reflection of market uncertainty as to what the Fed plans to do. Talk of an end to QE has given a boost to the dollar, and we can expect the currency markets to continue to be very sensitive to further talk of tapering QE.

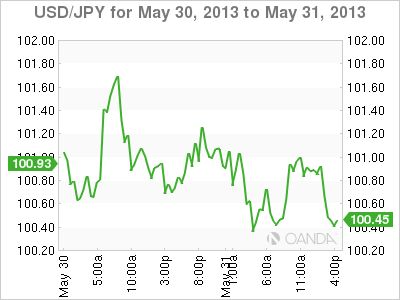

USD/JPY May 31 at 10:05 GMT

USD/JPY 100.50 H: 101.38 L: 100.30 USD/JPY Technical" title="USD/JPY Technical" width="602" height="83">

USD/JPY Technical" title="USD/JPY Technical" width="602" height="83">

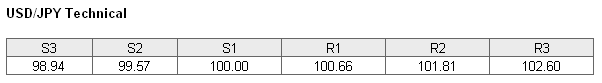

USD/JPY has dropped below the 101 line, and is trading in the mid-100 range. The pair is facing resistance at the 100.66 line. This is a weak line, and could be tested if the US dollar shows any signs of recovery. This is followed by resistance at 101.81. USD/JPY is receiving support at the all-important 100 level. This is followed by a support line at 99.57.

- Current range: 100.00 to 100.66

- Below: 100, 99.57, 98.94 and 97.18.

- Above: 100.66, 101.81, 102.60, 103.75, 104.94 and 105.87

USD/JPY ratio continues to point to movement towards long positions. We have seen this trend for the past week, as the ratio is now dominated by long positions. This indicates a strong bias towards the dollar bouncing back and posting gains.

USD/JPY has shown a lot of volatility, and currently the yen has the upper hand, as it has improved, pushing below the 101 level. With a host of US releases due later in the day, we could see more activity before the trading week wraps up.

USD/JPY Fundamentals

- 23:15 Japanese Manufacturing PMI. Actual 51.5 points.

- 23:30 Japanese Household Spending. Estimate 3.1%. Actual 1.5%.

- 23:30 Japanese Tokyo Core CPI. Estimate -0.2%. Actual 0.1%.

- 23:30 Japanese National Core CPI. Estimate -0.4%. Actual -0.4%.

- 23:30 Japanese Unemployment Rate. Estimate 4.1%. Actual 4.1%.

- 23:50 Japanese Preliminary Industrial Production. Estimate 0.8%. Actual 1.7%.

- 12:30 US Core PCE Price Index. Estimate 0.1%.

- 12:30 US Personal Spending. Estimate 0.2%.

- 12:30 US Personal Income. Estimate 0.2%.

- 13:45 US Chicago PMI. Estimate 50.3 points.

- 13:55 US Revised UoM Consumer Sentiment. Estimate 84.1 points.

- 13:55 US Revised UoM Inflation Expectations.

- 15:00 US Crude Oil Inventories. Estimate -0.8M.