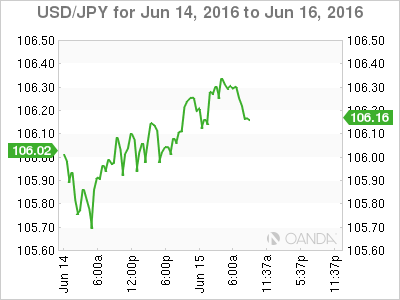

The Japanese yen has edged lower, as the yen continues to show limited movement. USD/JPY is trading slightly above the 106 line. On the release front, today’s highlight is the FOMC rate statement, with the markets expecting the Fed to maintain the current benchmark rate of 0.25%. As well, the US will release PPI, with the estimate standing at 0.3%. Thursday promises to be busy, with the US releasing Unemployment Claims and CPI reports. As well, the Bank of Japan releases its monetary policy statement.

USD/JPY continues to show little movement, but the yen has recorded strong gains against the euro and the British pound. EUR/JPY and GBP/JPY are at 3-year lows, in response to continuing uncertainty over the Brexit referendum, as the “Leave” camp has gained strength in recent polls. The referendum on whether the UK will remain in the European Union has ramifications for the global economy, and key figures are weighing in on the repercussions if the UK votes to exit the EU. British Prime Minister David Cameron, Germany chancellor Angela Merkel and International Monetary Fund managing director Christine Lagarde have warned that a British departure could hurt the global economy. Federal Reserve Chair Janet Yellen has said that a vote to leave the EU could delay a rate hike in the US. For its part, Japan is extremely concerned about a strong yen, and on Tuesday, Japanese Finance Minister Taro Aso on Tuesday sent a fresh warning that Japan would “firmly respond” against speculative moves in the currency markets. The US is staunchly against any unilateral currency intervention by Japan, and the countries’ finance ministers were involved in a public spat over this issue at the recent G-7 meeting in Tokyo.

USD/JPY Fundamentals

Wednesday (June 15)

- 8:30 US PPI. Estimate 0.3%

- 8:30 US Core PPI. Estimate 0.1%

- 8:30 US Empire State Manufacturing Index. Estimate -3.4

- 9:15 US Capacity Utilization Rate. Estimate 75.2%

- 9:15 US Industrial Production. Estimate -0.2%

- 10:30 US Crude Oil Inventories

- 14:00 US FOMC Economic Projections

- 14:00 FOMC Statement

- 14:00 US Federal Funds Rate. Estimate

- 14:30 US FOMC Press Conference

- 16:00 US TIC Long-Term Purchases

Upcoming Key Releases

Thursday (June 16)

- Tentative – Japanese Monetary Policy Statement

- Tentative – BOJ Press Conference

- 8:30 US CPI. Estimate 0.3%

- 8:30 US Core CPI. Estimate 0.2%

- 8:30 US Philly Fed Manufacturing Index. Estimate 1.1

- 8:30 US Unemployment Claims. Estimate 267K

*Key events are in bold

*All release times are EDT

USD/JPY for Wednesday, June 15, 2016

USD/JPY June 15 at 8:00 EDT

Open: 106.08 Low: 105.95 High: 106.39 Close: 106.21

USD/JPY Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 103.73 | 104.99 | 105.87 | 107.16 | 108.37 | 109.87 |

- USD/JPY has shown limited movement in the Asian and European sessions

- 107.16 is a strong resistance line

- 105.87 is providing weak support

- Current range: 105.87 to 107.16

Further levels in both directions:

- Below: 105.87, 104.99 and 103.73

- Above: 107.16, 108.37, 109.87 and 110.66

OANDA’s Open Positions Ratio

The USD/JPY ratio is showing little movement on Wednesday, consistent with the lack of movement from USD/JPY. Long positions have a strong majority (70%), indicative of trader bias towards USD/JPY breaking out and moving to higher ground.