Market Brief

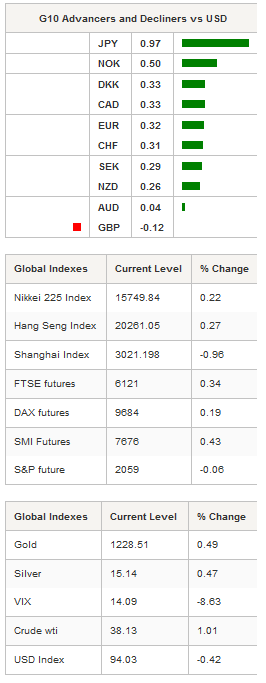

As expected the March FOMC minutes were roughly in line with the remarks made by Janet Yellen during the press conference following the release of the rate decision. However, the minutes further dampened the market’s sentiment towards the greenback by highlighting the growing divisions among Fed members, especially concerning a potential rate hike in April. We can now also certainly rule out an April rate hike. EUR/USD held ground above the 1.14 threshold after testing 1.1392 in Tokyo. Over the last few days, the pair has traded range bound between the 1.1310 support and the 1.1438 resistance, with traders wondering whether further dollar weakness is sustainable.

The Japanese yen surged massively against the USD amid the release of the FOMC minutes, with USD/JPY reaching its lowest level since October 2014. USD/JPY fell more than 13% since June 2015, down to 108.95 from 125.86. The BoJ is most likely unhappy with the yen’s current strength as it further reduced the odds of the Japanese economy reaching the 2% inflation target. We therefore expect Governor Kuroda to take action to put an end to the yen rally. This could be done either by expanding the Qualitative and Quantitative Easing program, and/or by cutting rates further into negative territory. The 1-month USD/JPY risk reversal shifted to -1.48 on Thursday as traders rushed to buy protection against further yen strengthening, suggesting that investors do not believe the BoJ has the tool (or the credibility?) to remedy the situation. On the downside, the next support can be found at 105.23 (low from mid-October 2014), while on the upside a resistance can be found at 110.81 (high from April 5th).

Crude oil extended gains in the late European session as US stockpiles contracted unexpectedly during the week ending April 1st. Crude inventories contracted by 4937k barrels, while the market was expecting an increase of 2850k. Inventories increased by 2299k in the previous week. West Texas Intermediate crude futures rose to $38.16 a barrel on the New York Mercantile Exchange, up 8.15% from Tuesday’s low. The global benchmark, the Brent crude, passed the $40 threshold, up 7.75% over the same period. Overall, commodities gained ground in Asia, with gold and silver surging 0.49% and 0.47% respectively. Iron ore active contracts on the Dalian commodity exchange were up 0.95%, while palladium and platinum rose 0.06% and 0.46% respectively.

The CAD and the NOK took advantage of the crude oil rally, both surging 0.33% against the greenback. USD/CAD continues to reverse the early week gains as it moves towards 1.30. On the downside, a support lies at 1.2858 (low from March 31st). USD/NOK tested the 8.2528 support once again, but the number of sellers was not sufficient to break it to the downside.

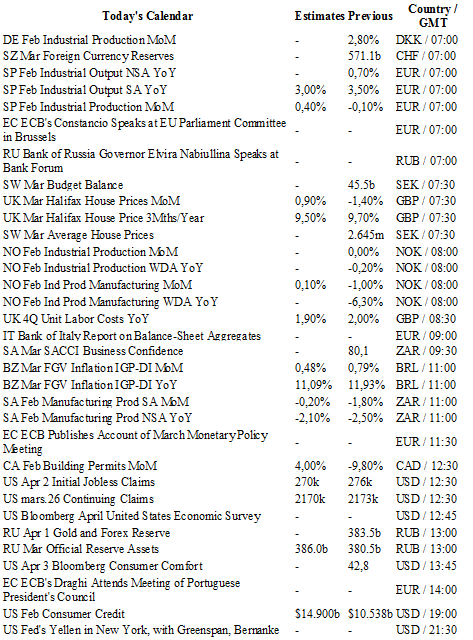

Today traders will be watching foreign currency reserves from Switzerland; industrial output from Spain; budget balance from Sweden; Halifax house price from UK; industrial production from Norway; manufacturing production South Africa; building permits from Canada; initial jobless claims from the US.

Currency Technicals

EUR/USD

R 2: 1.1714

R 1: 1.1495

CURRENT: 1.1410

S 1: 1.1144

S 2: 1.1058

GBP/USD

R 2: 1.4591

R 1: 1.4459

CURRENT: 1.4072

S 1: 1.3836

S 2: 1.3657

USD/JPY

R 2: 113.80

R 1: 112.68

CURRENT: 108.80

S 1: 107.61

S 2: 105.23

USD/CHF

R 2: 0.9913

R 1: 0.9788

CURRENT: 0.9544

S 1: 0.9476

S 2: 0.9259