:

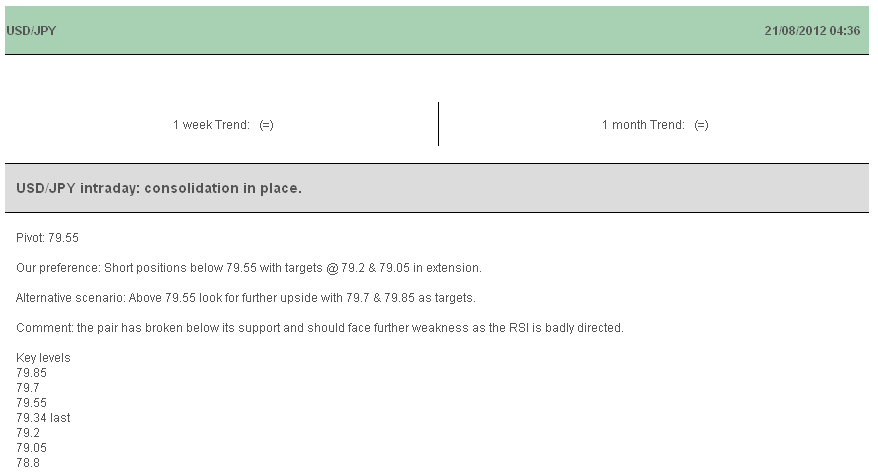

The USD/JPY was the currency in the spotlight last week as technical resistance was broken and daily highs saw the major sitting at Y79.50 by the weeks close. Analysts are pointing to the recent string of better than expected US data and the dampening call for more QE3. US Treasury Yields are creeping higher and widening the gap between US and Japanese funding costs. The Bank of Japan is expected to keeps low for an extended period of time and it is the comparison with the US Fed monetary policy that creates most of the USD/JPY movement.

The AUD/USD was another currency in focus last week with substantial losses across the board as the AUD crosses led by EUR/AUD and GBP/AUD finally reversed direction. The AUD has been a favorite for many months and has built up very large long positions against nearly all currencies. Growing concerns about the slowdown in the Chinese economy added to the selling pressure and on Friday we saw the pair break month lows at 1.0430 to hit 1.0410 before a small recovery. Longer term bulls will likely step back and see if the underlying strength in the Aussie still remains.

Currency Movement last week:

EUR/USD was up +0.33% closing at 1.2330, after opening the week at 1.2289.

USD/JPY was down +1.62% closing at 79.54, after opening at 78.25.

GBP/USD was up +0.03% closing at 1.5689 after opening at 1.5684.

AUD/USD was down -1.53% closing at 1.0416 after opening at 1.0575.

This Week’s Trading Preview:

Forex Economic Data Preview :

In the States: On Wednesday, July Existing Homes Sales forecast at 4.52m vs. 4.37m. Also released, July FOMC meeting minutes. On Thursday, Weekly Jobless Claims forecast at 365k vs. 366k previously. Also, July New Home Sales forecast 363k vs. 350k previously. On Friday, July Core Durable Goods forecast at 0.5% vs. -1.4% previously.

In the Eurozone: On Thursday, German Manufacturing PMI forecast at 43.6 vs. 43.0. German Services PMI forecast at 50.2 vs. 50.3 previously.

In the UK: On Tuesday, Public Sector Borrowing forecast a t-2.7bn vs. 12.1bn previously. On Friday, Q2 Revised GDP forecast at -0.5% vs. -0.7% previously.

In Japan: On Wednesday, July Trade Balance forecast at -0.46T forecast at -0.3T.

In Australia: RBA July Minutes are released Tuesday. On Friday RBA Govenor Stevens Due to testify before congress.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD/JPY Starting To Move Higher, AUD In Trouble

Published 08/21/2012, 07:42 AM

Updated 03/09/2019, 08:30 AM

USD/JPY Starting To Move Higher, AUD In Trouble

Last week’s currency trading review

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.