USD/JPY stands guard against the 100.00 door, makes a rebound to 100.60 zone

The BOJ decision to leave the interest rate unchanged and take on a new policy keeping 10-year bond yields near zero caused massive wave of selling volumes. Add to that later on, the FOMC left rates the same, unchanged, but changed ground rules as analytics were expecting an increase. The greenback looked weak and dragged USD/JPY into a one-month low.

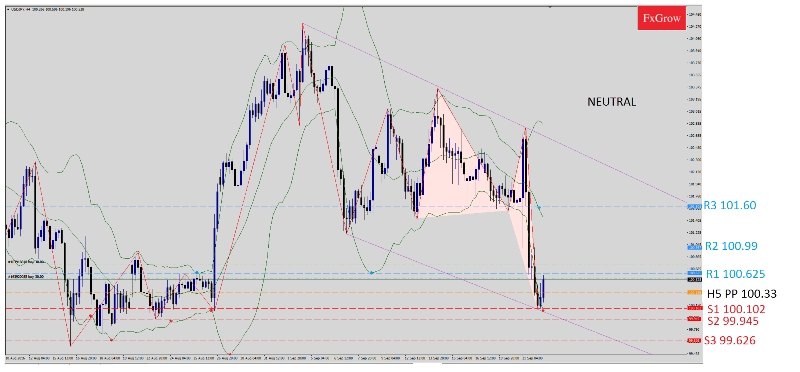

The USD/JPY is expected to trade in neutral area between first support S1 100.102 and first resistance R1 100.625. The only reason to break these barriers today is the U.S. unemployment claims report at 1:30 PM GMT, which will cause an increase in buying and selling by traders that will either break support levels or resistance levels.

Trend: neutral between R1 and S1.

Key levels to watch: H5 PP 100.33 , R1 100.625, R2 100.99, R3 101.60

S1 100.102, S2 99.945, S3 99.626

Remark: Trend is set by selling and buying volumes. Look forward at 1:30 PM GMT for the U.S. unemployment claims report which will determine either bearish or bullish charts depending on how the U.S will move in the market with pairs.

Disclaimer: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.