USD/JPY Rises On Clinton’s FBI Boost

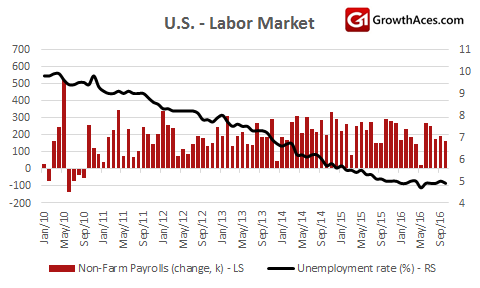

- U.S. nonfarm payrolls increased by 161k jobs last month amid gains in construction, healthcare and professional and business services.

- The solid labor market fundamentals were also underscored by revisions to August and September data, which showed 44k more jobs created than previously reported. Average hourly earnings rose 10 cents or 0.4% in October. As a result, the year-on-year gain in wages last month rose to 2.8%, the biggest advance since June 2009.

- The unemployment rate fell one-tenth of a percentage point to 4.9% last month, in part as people dropped out of the labor force.

- The trend in employment growth has slowed as the labor market nears full employment. Employment growth so far this year has averaged 181k jobs per month, down from an average gain of 229k per month in 2015. Still, the monthly job gains are more than enough to absorb new entrants into the labor market. Fed Chair Janet Yellen has said the economy needs to create just under 100k jobs a month to keep up with growth in the work-age population.

- The participation rate, or the share of working-age Americans who are employed or at least looking for a job, fell 0.1 percentage point to 62.8% last month, not too far from multi-decade lows, in part reflecting demographic changes.

- The solid payrolls gain accompanied by the surge in wages could support consumer spending heading into the holiday season, and in turn keep the economy on a relatively higher growth path.

- Atlanta Federal Reserve bank president Dennis Lockhart said it would take a lot for the Fed to not raise interest rates in December, with a solid employment report on Friday and only one more jobs report before the next policy meeting.

- Dallas Federal Reserve Bank President Robert Kaplan on Friday said he believes there is increasing reason to raise U.S. interest rates, though he declined to say when the next rate hike should take place. He added he sees no hint of political influence in U.S. central bank decision-making, adding that he and others "screen out" politics in their analysis and deliberations.

- Fed Vice Chairman Stanley Fischer said the U.S. labor market is close to full strength and the economy could at some point overshoot the Federal Reserve's goals for employment and inflation. Fischer did not say whether the Fed was likely to raise interest rates in December but he noted that investors in financial markets were betting on a hike that month.

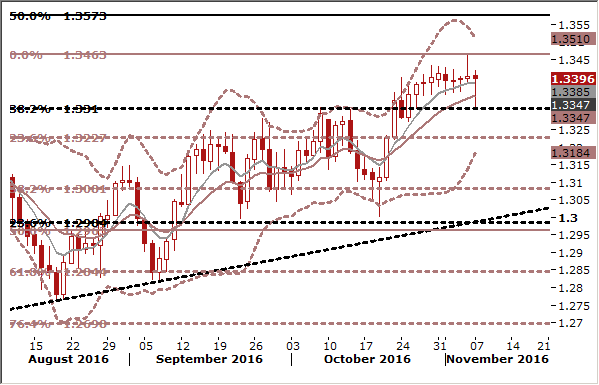

- The USD jumped on Monday vs. the JPY as news that Hillary Clinton would not face criminal charges related to her use of a private e-mail server gave the U.S. presidential contender an eleventh hour boost before tomorrow’s election. Clinton has been on the defensive for 10 days since the FBI said it was looking at another large batch of emails, strengthening the chances of a victory for her opponent Donald Trump that would send a shockwave through financial markets. FX market investors were now leaning heavily again towards a Clinton victory that would clear the way for a rise in U.S. interest rates next month.

- We stay flat on the USD/JPY, as technical signals are unclear on this pair. We expect the JPY to weaken against the AUD, as risk appetite is likely to get a boost from Clinton victory and the AUD/JPY is a good measure of risk appetite.

USD/CAD In Consolidation Mode

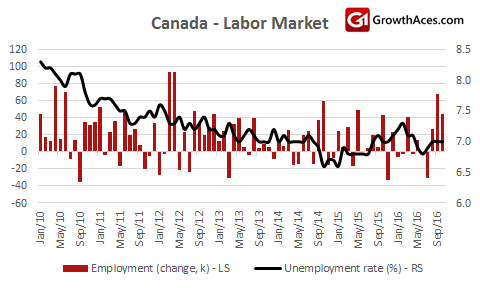

- Statistics Canada said employment jumped by 43.9k jobs, while the jobless rate stayed at 7.0% as more people looked for work. But Canada shed 23.1k full-time jobs as it gained 67.1k part-time positions. The market had expected a loss of 10k jobs after September's outsized gain of 67.2k. The increase in part-time hiring made the details less upbeat.

- Canada posted a record trade deficit of CAD 4.1 billion in September but the figure was boosted by the one-off import of machinery for an oil project. Statscan said the deficit would have been CAD 1.2 billion had it not been for a jump in imports of machinery, much of it accounted for by a South Korean module destined for an offshore oil rig. That helped push imports up by 4.7%, the biggest month-on-month gain in more than six years.

- Strong U.S. hiring in October could effectively seal the case for a December interest rate increase from the Federal Reserve, while Canada's reliance on new part-time positions for job growth suggests the Bank of Canada will remain cautious.

- Oil futures, crucial for the CAD, fell last week by the most since January as signs of tensions resurfaced between Saudi Arabia and Iran that could scupper the key supply cut pact.

- Speculators raised bearish bets on the CAD to the most since March, Commodity Futures Trading Commission data showed. Net short Canadian dollar positions rose to 15,960 contracts in the week ended November 1 from 13,324 in the prior week.

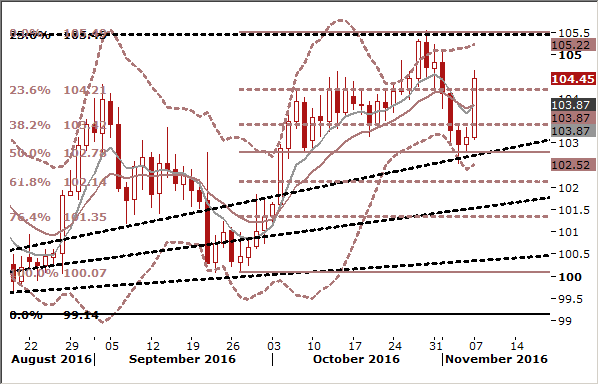

- We are clearly in consolidation mode on the USD/CAD and technical situation is unclear. Daily MACD is rolling over, the RSI is very slowly grinding lower, which is neutral. Long upper shadow of Friday candlestick is in conflict with long lower shadow today. The USD/CAD appears to be forming a rounded top, but we stay sideways on this pair as in our opinion no position is justified from risk/reward perspective now.