USD/JPY Remains Bullish Despite Collapsing U.S Dollar, Awaiting Kuroda's Speech

USD/JPY managed to nail -171 pips after clocking a high yesterday 114.88 despite U.S Fed hike +0.25%. Traders anticipated the Fed hike with 95% chance of happening, as a result, markets were already trading on that fact and trades were set in a position, leaving FOMC meeting meaningless as the news itself was consumed. As a result, U.S Index shed -$1.35 since yesterday with a 100.22 March-fresh-lows.

On the other hand, The Bank of Japan (BOJ) kept interest rates unchanged at current -.010% and maintained Japan 10-Year yield target around 0%. BOJ also kept central bank assessment unchanged too. Now, analysts are awaiting Koruda's speech and his take on yield curve target with possible change in the coming time. A steeper yield curve helps improve banking sector profitability, however, this could lead to Yen strength and tackle the exports driven economic growth.

Fundamentals :

1- JPY Kuroda speech today tentative.

2- USD Unemployment Claims today at 12:30 PM GMT.

Technical:

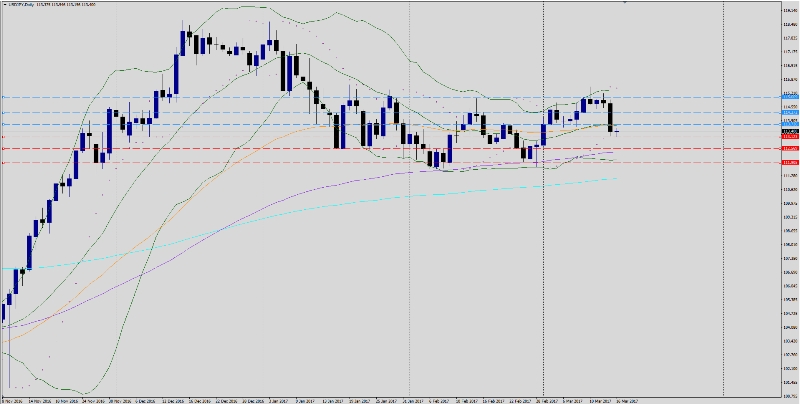

Trend : Bullish Sideways

Daily Pp 113.81

Resistance levels : R1 113.72, R2 114.27, R3 115.09

Support levels : S1 113.12, S2 112.56, S3 111.90

Remark : Look forward for Kurod's Speech and U.S data today which will give new perspectives for the pair. A penetration for R1 level will set a course for erasing yesterday's losses with R3 as a target. Stalling below S2 level will spark additional bearish candles and selloffs with S2&S3 levels. Closing below S2 level is needed for trend reversal.

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.