USD/JPY rebounds from 7-day ema, but deeper corrective move is likely

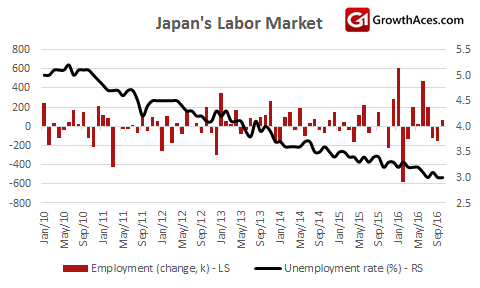

- Japan's unemployment rate held steady in October as the availability of jobs improved and household spending fell at a slower pace, a tentative sign that a robust labour market is lending support to domestic demand.

- The seasonally adjusted unemployment rate in October was 3.0%, unchanged from the previous month and in line with market expectations. The jobs-to-applicants ratio rose to 1.40 from 1.38 in the previous month to reach the highest level since August 1991.

- Household spending fell 0.4% in October from a year earlier, less than the median market estimate for a 0.6% annual decline

- Separate data showed retail sales fell 0.1% in October from a year ago, less than the median estimate for a 1.2% annual decline and less than a 1.7% annual decline in the previous month.

- Rising spending on clothes, food and transportation lead to the slower decline in overall retail sales, the data showed.

- Signs that the pace of decline in household spending is easing would be welcome for Japan's fragile economic outlook.

- Japan's economy expanded for a third straight quarter in July-September as exports recovered, but domestic activity remained weak.

- Later on Tuesday, investors will look to U.S. third-quarter GDP data as well as readings on consumer confidence and consumption for trading cues. They will be followed by the November employment report on Friday.

- The USD/JPY drop stopped at 7-day exponential moving average yesterday, but we think a deeper corrective move is likely. However, our and long-term outlook remains bullish. We keep USD/JPY bid near 14-day exponential moving average (currently at 110.48).

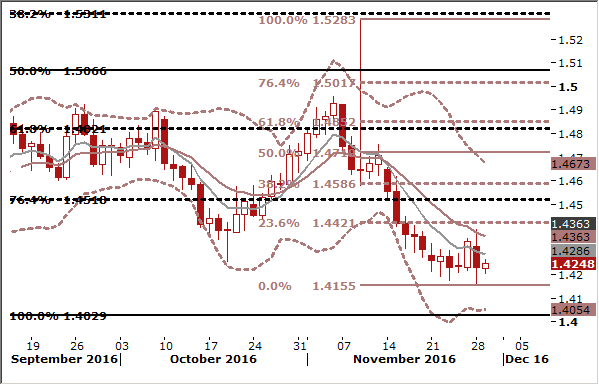

EUR/CAD: Volatility may be high in oil market and CAD pairs in the days ahead

- Bank of Canada Governor Stephen Poloz said that the Canadian economy has some pockets of weakness but it would take a significant disruption to the Bank of Canada's outlook on inflation for the bank to consider more stimulus. He added that some of the weak data seen recently was part of the bank's expectation that fourth-quarter growth will slow after a strong rebound in the third quarter. The central bank considered a cut last month before holding its policy rate steady at 0.50%.

- The Canadian dollar strengthened to a nearly one-week high against the USD on Monday after Bank of Canada Governor Stephen Poloz had indicated a high bar to cut interest rates.

- Investors’ focus turns to Vienna OPEC meeting. Key OPEC members appear to disagree over details of the agreement cut output. Non-OPEC producer Russia confirmed on Tuesday it would not attend the OPEC gathering, but added that a meeting between the group and non-affiliated producers at a later stage was possible.

- Volatility is set to be high in the oil market in the days ahead. This may translate into higher volatility on the CAD pairs.

- We are looking to use EUR/CAD upticks to get short. Our trading strategy remains unchanged – we keep our sell order at 1.4440.

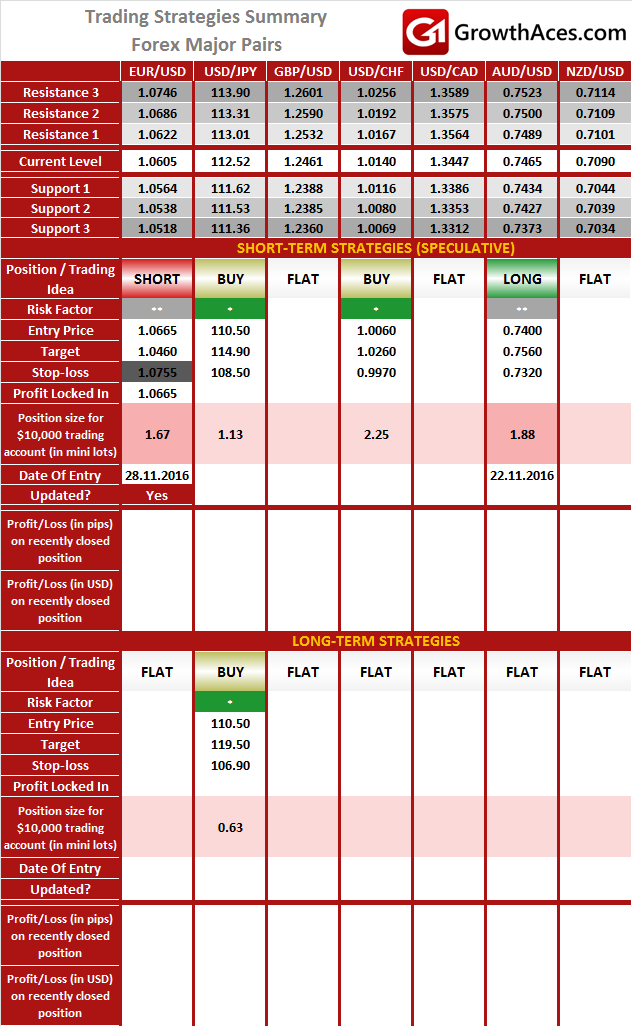

TRADING STRATEGIES:

Forex - Major Pairs:

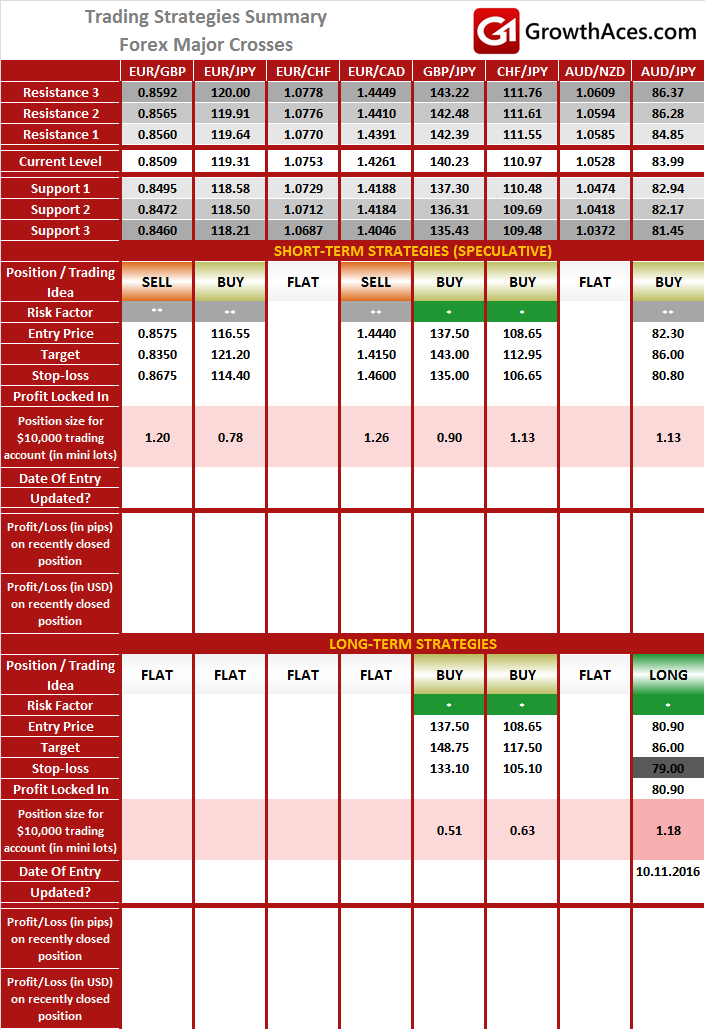

Forex - Major Crosses:

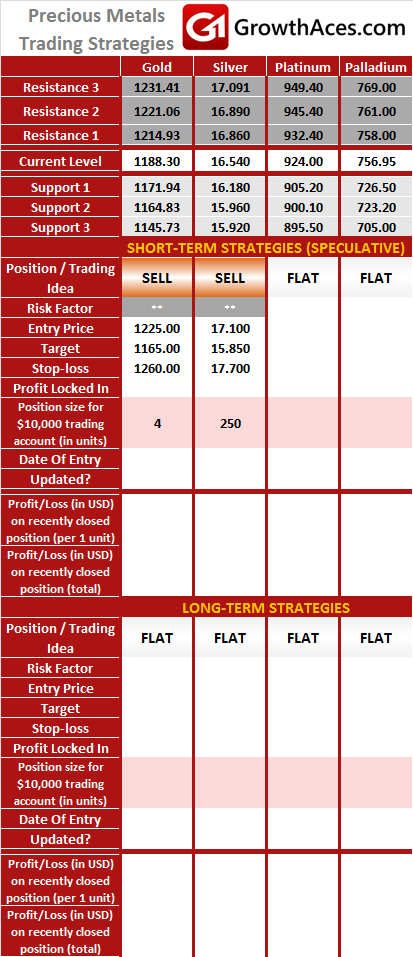

Precious Metals:

It is usually reasonable to divide your portfolio into two parts: the core investment part and the satellite speculative part. The core part is the one you would want to make profit with in the long term thanks to the long-term trend in price changes. Such an approach is a clear investment as you are bound to keep your position opened for a considerable amount of time in order to realize the profit.

The speculative part is quite the contrary. You would open a speculative position with short-term gains in your mind and with the awareness that even though potentially more profitable than investments, speculation is also way more risky. In typical circumstances, investments should account for 60-90% of your portfolio, the rest being speculative positions. This way, you may enjoy a possibly higher rate of return than in the case of putting all of your money into investment positions and at the same time you may not have to be afraid of severe losses in the short-term.

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size (forex)- position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Position size (precious metals) - position size suggested for a USD 10,000 trading account in units. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size).

6. Profit/Loss on recently closed position (forex) - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Profit/Loss on recently closed position (precious metals) - is profit/loss we have earned/lost per unit on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.