The Japanese yen and US dollar continue to fight a see-saw battle around the all-important 100 level. In Wednesday’s European session, it’s the yen that has the upper hand, with the pair trading in the mid-99 range. The yen got a boost after a poor reaction from the stock market to a speech from Prime Minister Shinzo Abe, who discussed plans to achieve growth of 2% per year over the next decade through economic reforms. Taking a look at economic releases, there are two key events out of the US later today – ADP Non-Farm Employment Change and ISM Non-Manufacturing PMI. There are no Japanese releases on Wednesday.

What a difference a week makes in the life of a currency. A week ago, the yen was struggling, as it traded in the 1.0250 range. Fast forward to the first week in June, and it’s the US dollar that finds itself on the defensive, as the pair trades below the 100 line. Recent Japanese major indicators have pointed upwards, highlighted by Tokyo Core CPI, an important inflation gauge. Although the indicator gained only 0.1%, this was an important milestone, as it was the first sign of inflation from the indicator in almost a year. The markets will be paying close attention to other inflation releases. There is a growing feeling that Abenomics and its war on deflation is starting to bear fruit, as deflation slowly recedes and economic activity increases. However, the markets will want to see more positive numbers before being convinced that the Japanese economy is on the right track.

On Wednesday, Prime Minister Abe gave a speech on improving growth in the Japanese economy, but the markets were not impressed, as Abe did not provide any specifics on new stimulus measures. The Japanese stock market fell, which was good news for the yen, as nervous investors snapped up the safe-haven currency. This gave the yen some momentum, and USD/JPY is back below the 100 level. Abe used the speech to introduce economic growth as the ”third arrow” in the fight against deflation, together with fiscal and monetary stimulus. However, the stock markets gave the speech a thumbs-down, and as we saw last month, volatility in the stock markets impacts on the yen.

Will the US Federal Reserve scale back its current QE program? This question has been preoccupying the markets for some time now. Although the Fed hasn’t made any changes so far, Fed policymakers, including Fed Chair Bernanke, continue to hint that QE could be scaled back in the next few months. With the US continuing to alternate between good and bad economic releases, the Fed may continue to hold off on any changes to QE before it is convinced that the US economy is improving. The currency markets have reacted sharply to talk about terminating QE, and any moves related to QE will likely impact USD/JPY.

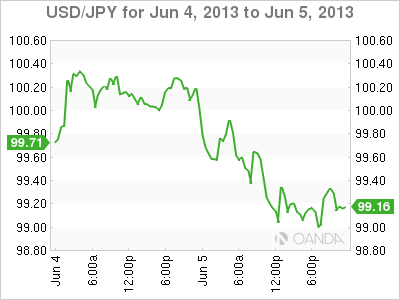

USD/JPY June 5 at 11:45 GMT

USD/JPY 99.41 H: 100.46 L: 99.38

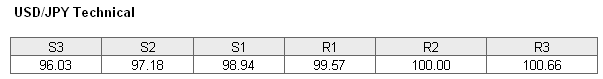

USD/JPY has moved lower on Wednesday, and is back below the 100 line. On the upside, the pair is testing 99.57 . This line could see more activity during the day. This is followed by resistance at the key 100 level. On the downside, the pair is receiving support at 98.94. The next support level is at 97.18.

- Current range: 98.94 to 99.57

Further levels in both directions:

- Below: 98.94, 97.18, 96.03 and 94.91

- Above: 99.57, 100.00, 100.66, 101.81 and 102.60

USD/JPY ratio has shifted positions in Wednesday trading, pointing to movement towards long positions. This is not reflected in the current movement of the pair, as the yen has posted gains against the US dollar. We continue to see a dominance by the open long positions, indicative of a bias towards the dollar moving higher. This could be a sign of a correction in which the dollar will recover and move higher.

USD/JPY has been testing the 100 line all week, and currently is trading in the mid-99 range. Will the yen continue to improve? We could see some movement from the pair during the day, as the US releases two major events later today.

USD/JPY Fundamentals

- 12:15 US ADP Non-Farm Employment Change. Estimate 171K.

- 12:30 US Revised Non-Farm Productivity. Estimate 0.7%.

- 12:30 US Revised Unit Labor Costs. Estimate 0.5%.

- 14:00 US ISM Non-Manufacturing PMI. Estimate 53.4 points.

- 14:00 US Factory Orders. Estimate 1.6%.

- 14:30 US Crude Oil Inventories. Estimate -0.8M.

- 18:00 US Beige Book.