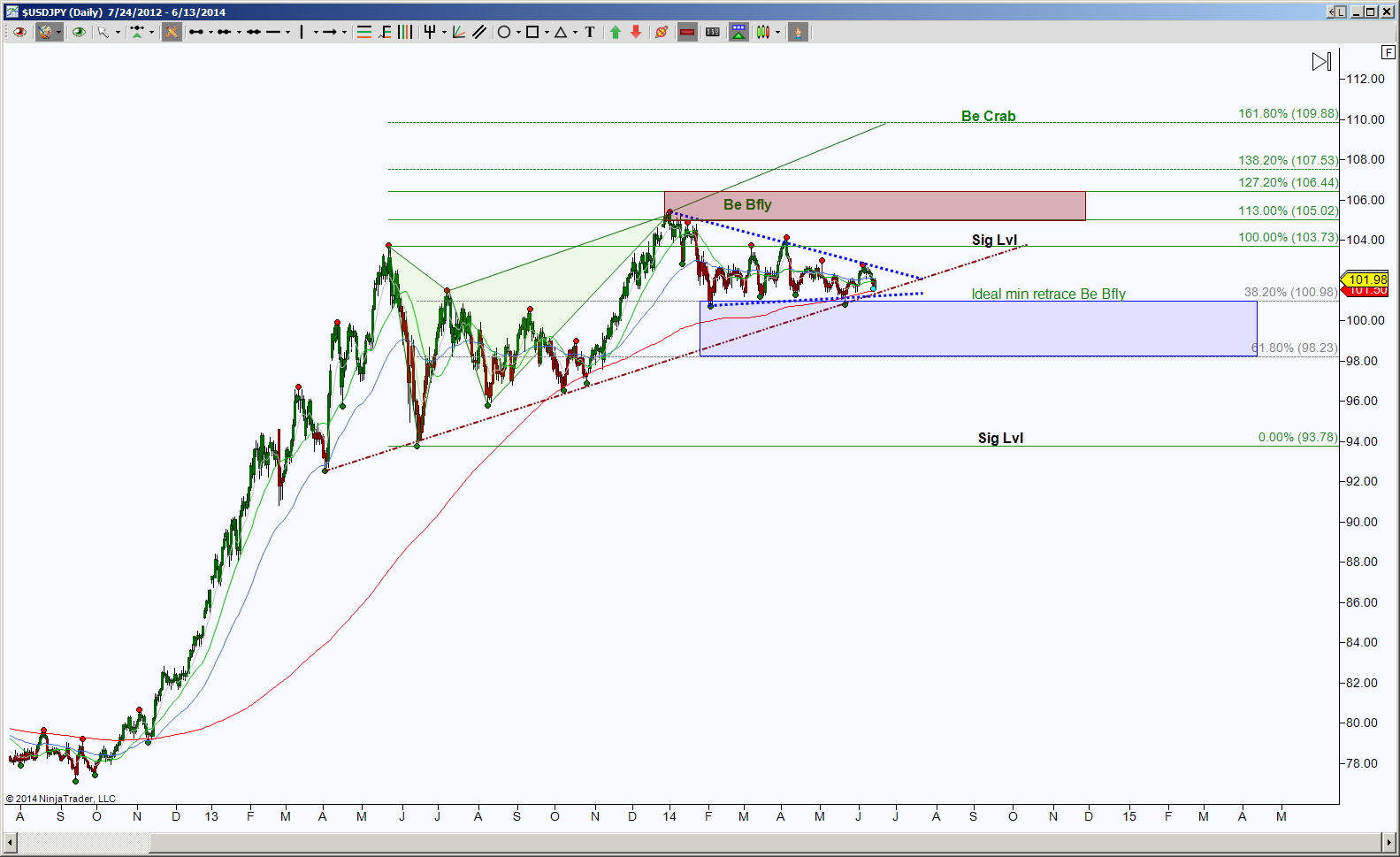

The USD/JPY intraday chart (CCY:JPY=X) shows price is between opposing emerging patterns, which is typical when there’s contraction or consolidation.

There’s a potential Inverse Head & Shoulders formation, which happens to have a two-fold purpose of testing 101.23, a completion of a small bullish pattern, as well as a symmetrical move to form the second shoulder. This offers the first caution for upside if price cannot hold there.

Below it invalidates the bullish Gartley and threatens the Head & Shoulders scenario, bringing the 100.81 Line in Sand level into play.

So the initial levels to break and hold are either the 101.57 significant level or the Inverse Head & Shoulders neckline or 102.79, then the noted targets come into play. Below 100.81 has 100.27 and 99.59 targets. It’s a bit more complex with a hold above the neckline because there are still obstacles to contend with above there, namely, 102.79, 103.01, and the triangle resistance line.

Once price can take out all of these resistance tests, then there is heavy confluence at the PRZ between 104.37 and 104.77, note this area helps price exceed the daily Significant Level of 103.73 and get nearer to the upside target of 105.02.

Given this view, how can we apply it using Binary Options? Binary Options are an ideal tool for trading one’s market vision due to the easily quantifiable risk vs reward. Keep in mind, when we talk about binaries we do not mean any of the over-the-counter binary options you may see peddled out there. We mean exchange traded binary options due to their lack of counter party risk, ease of entry and exit and complete transparency. These criteria can best be met by trading binary options on the North American Derivatives Exchange, or Nadex. Nadex is a Designated Contract Market and Derivatives Clearing Organization, subject to regulatory oversight by the Commodity Futures Trading Commission (CFTC).

One of the many liquid products that trade daily on Nadex is the US dollar, Japanese yen pairing (USD/JPY). Given our analysis above, let’s look at some possible trades. We have a USD/JPY binary expiring at 3PM on June 20 with a settlement price of 100.75 which is quite close to our “Line in the Sand” price of 100.81. The market in this option at this writing (June 16, 1:50PM) is 95 bid, 98 offered, meaning that the market believes, as we do, that there is between a 95 and 98 percent chance that this price will not be breached.

However, if it is breached then it negates our bullish scenario. So, let’s sell the 100.75 at 95. This means that we risk $5 if the settlement price is 100.75 but make $95 per contract if our bullish scenario is indeed negated.

Just the same, we have a bullish view with clearly defined upside targets. So, in addition to selling the 100.75 we will buy the 103.75 (nearly identical to our first upside target of 103.73) at 2.50. This means we risk $2.50 per contract to make $97.50 at a price of 103.75 or higher.

What does this mean concretely in terms of risk versus reward? Let’s break it down.

- A close below 100.75 at 3PM on June 20 makes us $92.50 ($95 profit on the 100.75 against a $2.50 loss on the 103.75).

- A close above 103.75 makes us the same $92.50 ( $97.50 profit on the 103.75 against a $5 loss on the 100.75).

- Any settlement price between 100.75 and 103.75 costs us $7.50 ($5 on the 100.75 which settles at 100 and $2.50 on the 103.75 which settles at zero).

We see clearly that this trade combining two binary options has an extremely favorable risk/reward ratio of better than 8:1. Try and find that using any other trading vehicle!