The month of June has been relatively unkind to the dollar-yen as the pair has continued to decline sharply in the face of a surprisingly dovish US Federal Reserve. Subsequently, the currency pair is now at a critical juncture given that the 103.00 handle is nearing whilst the drums of intervention from the Bank of Japan are beating.

However, despite price action’s recent collapse, there are some signs that the pair might be readying for an attempt at a retracement back towards the 105.00 handle.

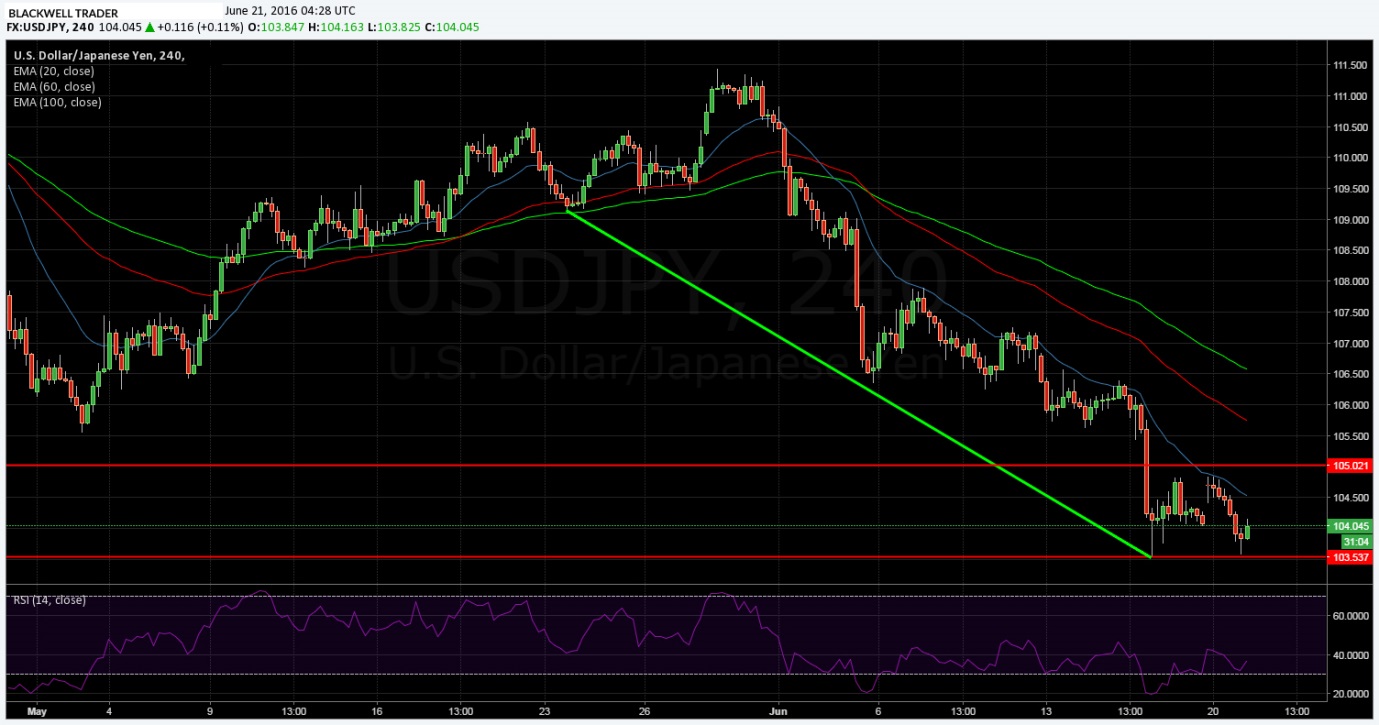

The USD/JPY’s medium term trend is relatively clear on the 4-hour chart with price action declining sharply over the past few weeks. In addition the 12, 30, and 100 period EMA’s are also strongly bearish as they continue to trend lower, acting as a dynamic cap on any upward price movements.

Subsequently, there has been a relatively strong range of bearish activity, as well as capital flows out of the US dollar of late.

However, despite the negative signs, the pair has just completed a Bat pattern as well as an ED wave and the RSI oscillator is now flirting with oversold levels on both the daily and weekly timeframes. In addition, there appears to be the early stages of a double bottom forming on the 4-hour chart which could also impact proceedings in the coming session.

Subsequently, there is plenty of evidence to suggest that the pair may need a corrective pullback towards the 105.00 handle before returning to the medium term bearish trend.

Ultimately, to demonstrate a bottoming of the pair, the major support and resistance level at 106.38 would need to be convincingly breached. In my opinion, this is likely to be a bridge too far given the amount of air that has evaporated from the USD following the Fed’s decision not to hike rates.

This may become even more evident if the central bank again fails to raise rates during the FOMC meeting in July. Subsequently, the most likely scenario is a temporary pullback towards the 105.00 handle before a recommencement of bearishness back towards the medium term target at 100.70 (125.85 long term Fibonacci level).