The USD/JPY has been climbing the charts slowly over the last 3 trading days, as the USD continues to find strength in global markets during the turmoil. Not surprisingly, this has translated into some nice bullish movements for the USD/JPY pair.

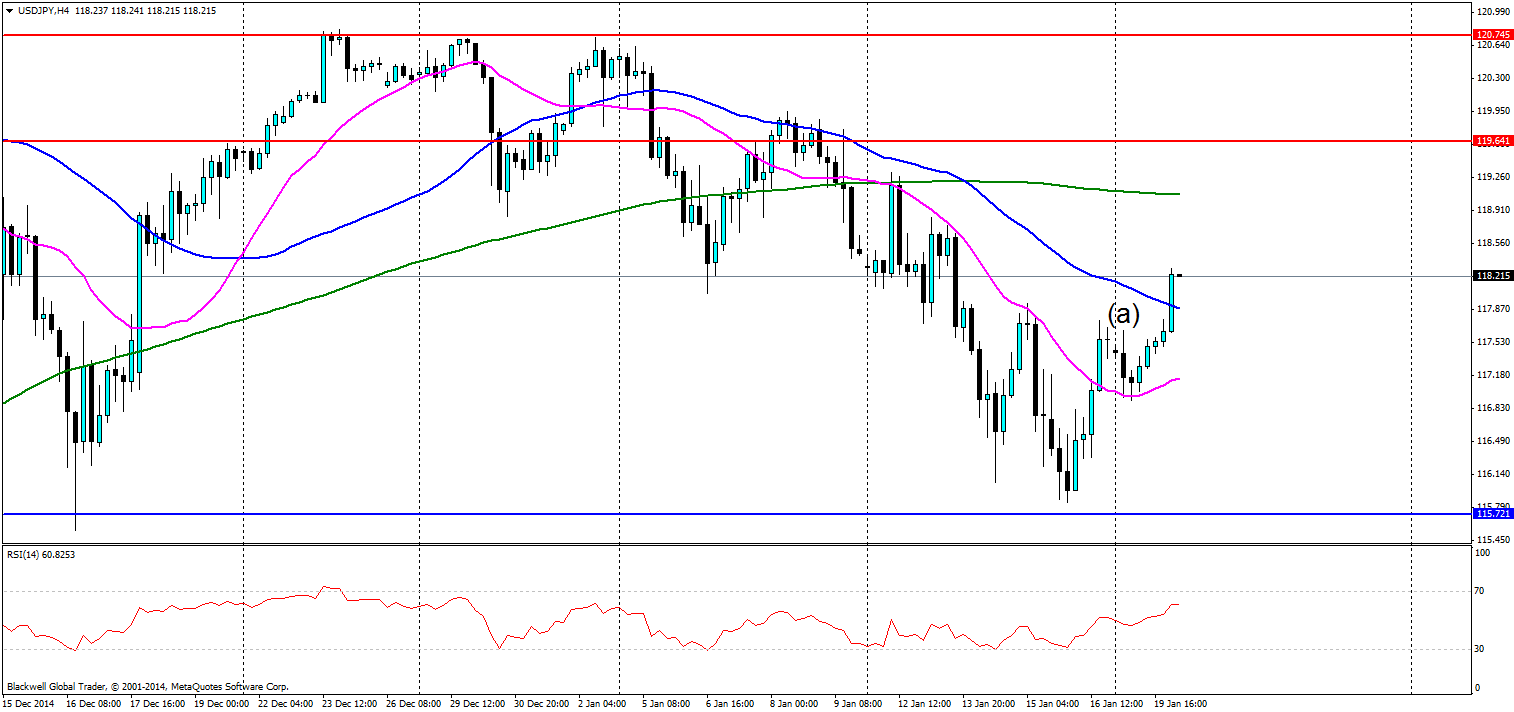

A quick look at the charts points to some very bullish movement as volatility has been strong, but also pullbacks at key levels have been weak and have lacked the previous week’s bearish movements. Monday morning saw a slight pull back on the chart that was impulsive in nature as it touched a key support level. The market, however rallied through as USD strength continued.

At present the USD/JPY has been bearish as investors rushed into the safe haven after the chaos caused by the Swiss National Bank (SNB). For the most part it looks like the chaos has subsided by the ECB is set to act and do QE but the market has also priced this in. The follow on effect though of euro weakness through QE is that the USD will rise sharply.

So with tonight’s market movements what can we expect? Well, at present we’ve seen minor pullbacks of that level. It’s possible we may see a slight pull back to the 50 MA before we see the next leg higher as we are sitting on a very solid resistance level. If we see a break down through the 50 MA I would target the 20 as a response.

Overall though the USD/JPY is looking like a nice trade in the next 12-16 hours, and markets will be looking to move it after China’s recent positive GDP data which should hopefully give a boost to the USD in the short term.