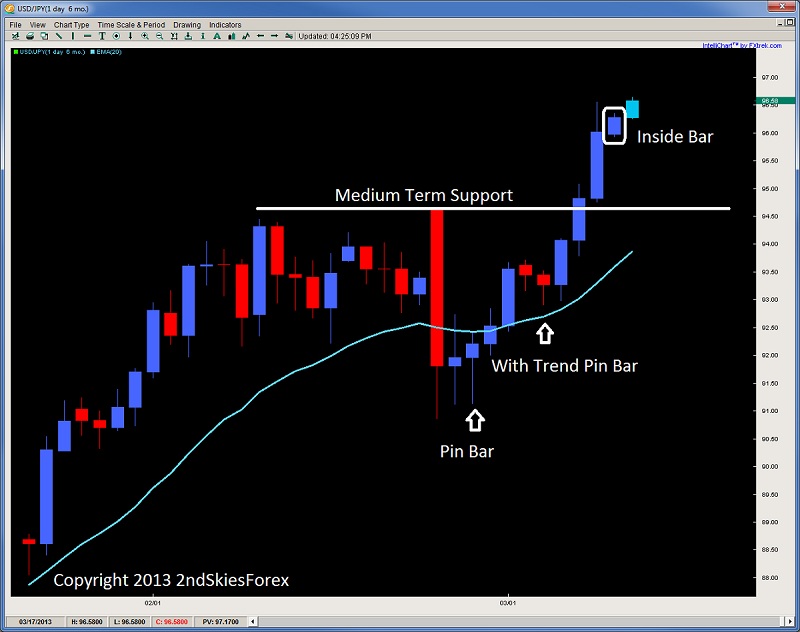

USD/JPY

Gaining 9 of the last 11 days (and pretty much tracking the S&P), the USDJPY continues to trek on without showing any signs of abating. We have already eclipsed the 2012, 2011 and 2010 highs, so had to go back to Aug. 2009 for the next resistance on deck which comes in at 97.78, so a fair amount of upside.

The pair has formed an inside bar setup on Friday, so there could be a good with trend setup here. Thus, watch for a break of 96.72 on the intraday charts for a potential breakout setup on the 1hr and below to get long. Pullbacks toward 94.50/60 can also be used as a chance to get long on the cheap, but we’ll stay with longs until a serious contender steps up for the bears.

USD/JPY" title="USD/JPY" width="624" height="468">

USD/JPY" title="USD/JPY" width="624" height="468">

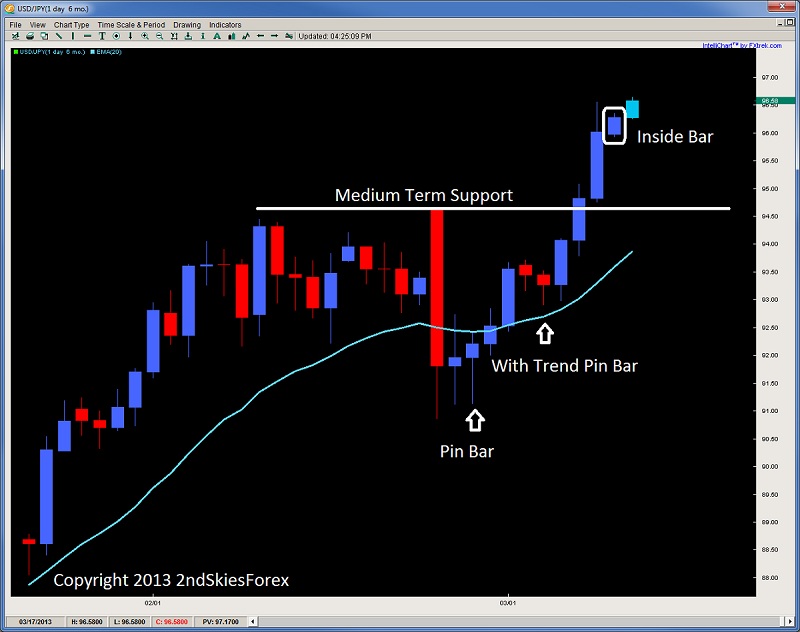

Original post

Gaining 9 of the last 11 days (and pretty much tracking the S&P), the USDJPY continues to trek on without showing any signs of abating. We have already eclipsed the 2012, 2011 and 2010 highs, so had to go back to Aug. 2009 for the next resistance on deck which comes in at 97.78, so a fair amount of upside.

The pair has formed an inside bar setup on Friday, so there could be a good with trend setup here. Thus, watch for a break of 96.72 on the intraday charts for a potential breakout setup on the 1hr and below to get long. Pullbacks toward 94.50/60 can also be used as a chance to get long on the cheap, but we’ll stay with longs until a serious contender steps up for the bears.

USD/JPY" title="USD/JPY" width="624" height="468">

USD/JPY" title="USD/JPY" width="624" height="468">Original post