The USD/JPY has risen up the charts on USD strength as the market continues to pummel the euro lower and commodity currencies at the same time.

So why the pain for Japan? Surely Abenomics is working? Well, it's not all that clear at this stage, even a few years later. Yes, Japan has reached its current targets of around 2% inflation, even despite the drop in oil. But at the same time it has also alienated neighbours and the world with its race to debase and has led to many central banks thinking this is a plausible solution in the long run.

So Abenomics is reaching its goal of driving inflation, but at home domestic demand has been weak and that is a worry and recent GDP results were much weaker than expected, coming in at 0.4%, even as exports receive a boost from the currency. This in turn has led to the market pushing higher further against the Yen but we may be running out of steam.

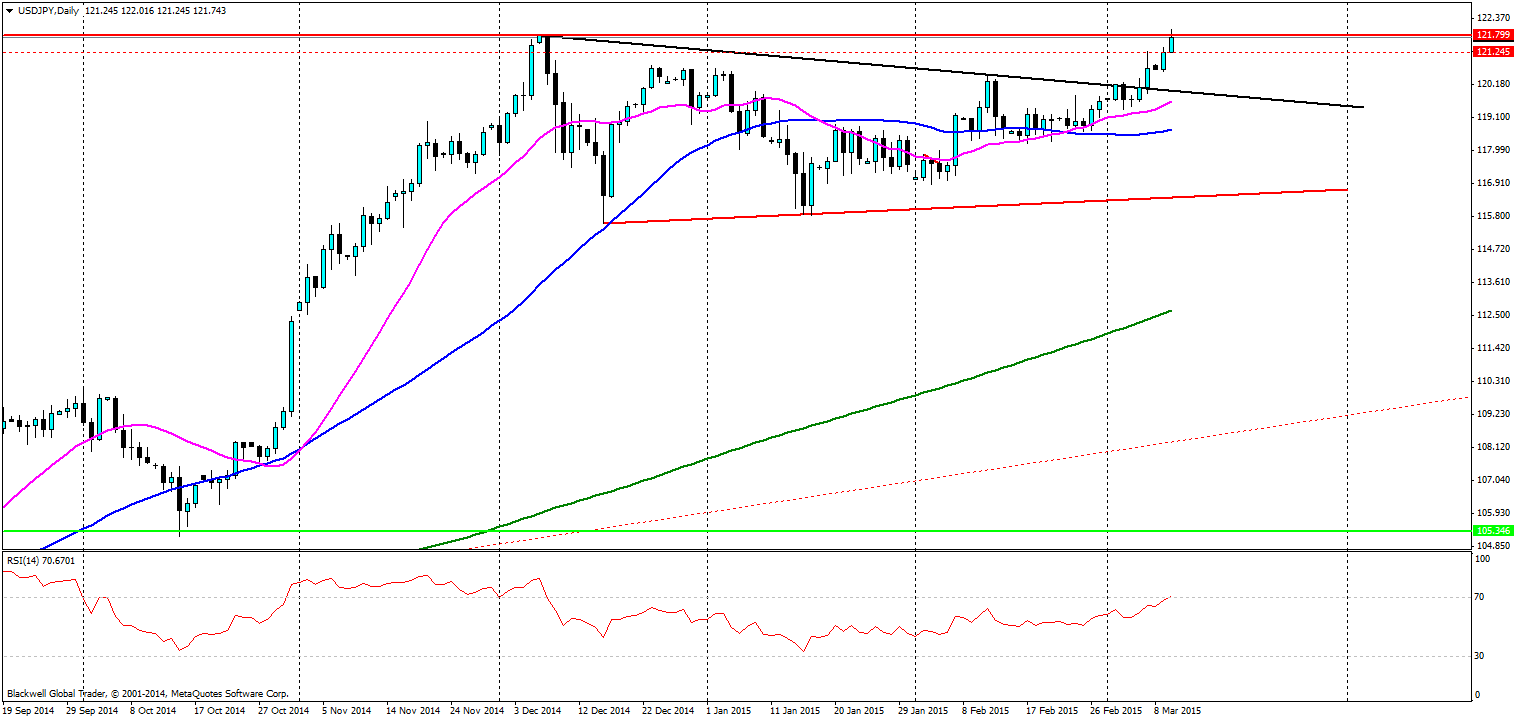

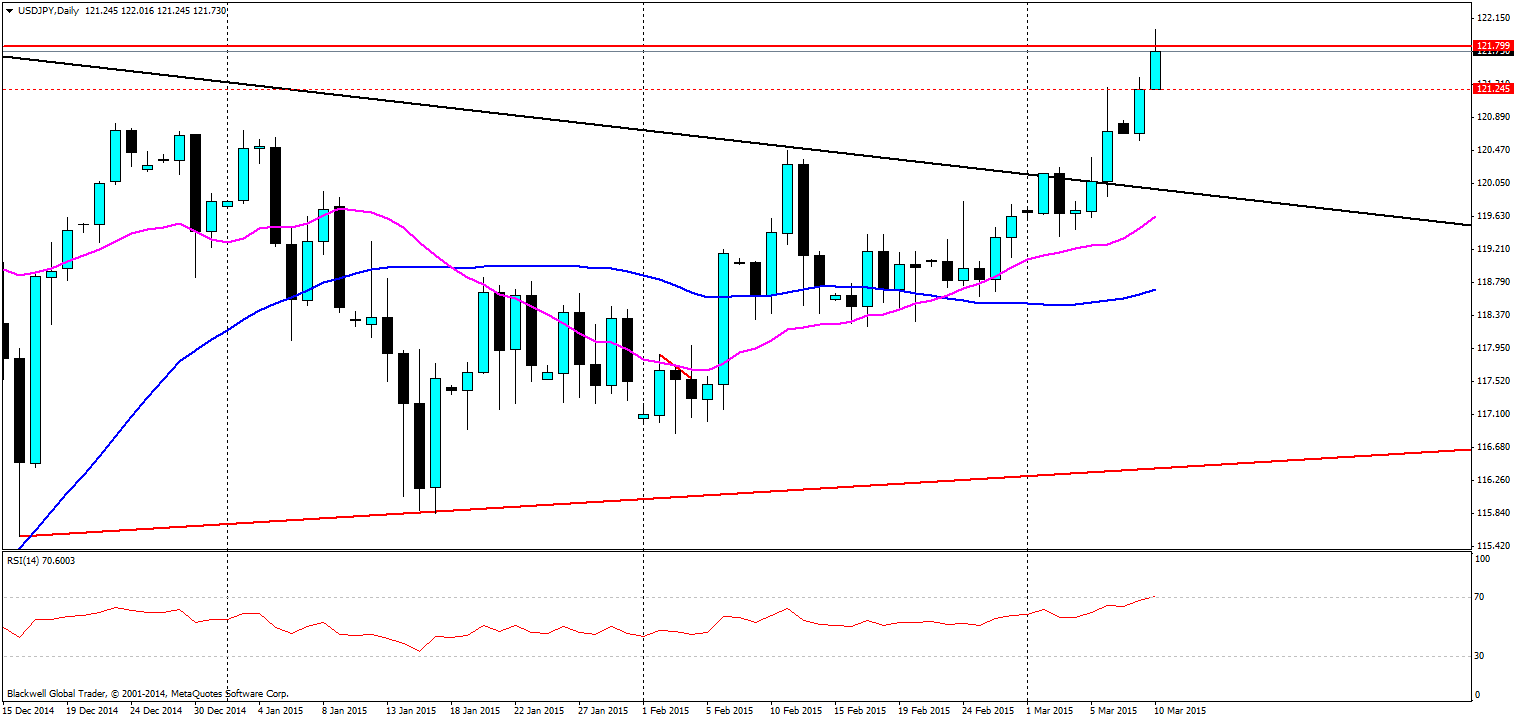

Currently we are finding strong resistance at 121.800, I like this level for a number of reasons. The first being that it’s a real test for the currency. A push through here would mean new highs and we can look for those quite easily on the historical charts. Secondly, previous breakthroughs generally flirt on the zone before we have a break out when it comes to the USD/JPY, so I’m not expecting a clean break out any time soon. In fact, what I am looking for here is a brief pullback and a target of a lower zone.

If we do see a pullback from this zone the market will be looking for 121.245 as a target point and then we could see more flirting with the current zone.

Either way resistance can be very strong in the USD/JPY and a second touch normally does not warrant a breakthrough, historically speaking over the last few years. So the market will be looking to play this one out and find some direction, but short term bears will be eyeing up this point as a reason to take a swipe.