USD/JPY volatility has been driven today almost entirely by two separate Bank of Japan JGB operations. One expected and one a surprise.

For some background and in layman’s terms, the Bank of Japan (BOJ) is operating a type of QE that manages the shape of the yield curve rather than indiscriminately buying bonds of any maturity. In the case, it is seeking to keep the yield curve out to 10 years at 0%.

It does this by having weekly bond auctions in the 5 and 10-year tenors whereby it buys JGB’s and T-Bills from the market to keep yields at or near to 0%. This is much the same principle as the Federal Reserve did with “Operation Twist” in their QE years. In Japan, it is known as “Rinban” operations. Which in English means rotation or turn.

JGB yields had spiked in the 10-year bucket, from 0% to 0.15% in the last 24 hours. This is above the 0% target set by the BOJ. The 450 Billion yen announced this morning disappointed the markets in its size and this saw USD/JPY open at 112.85 and then rapidly drop to 112.50.

USD/JPY Hourly

From a short-term perspective, the day’s high at 113.25 and the 100-hour d 200-hour moving average’s at 113.29 and 113.64 respectively are an initial resistance. Support sits at 112.50 and 112.05. The daily chart shows a more bearish picture.

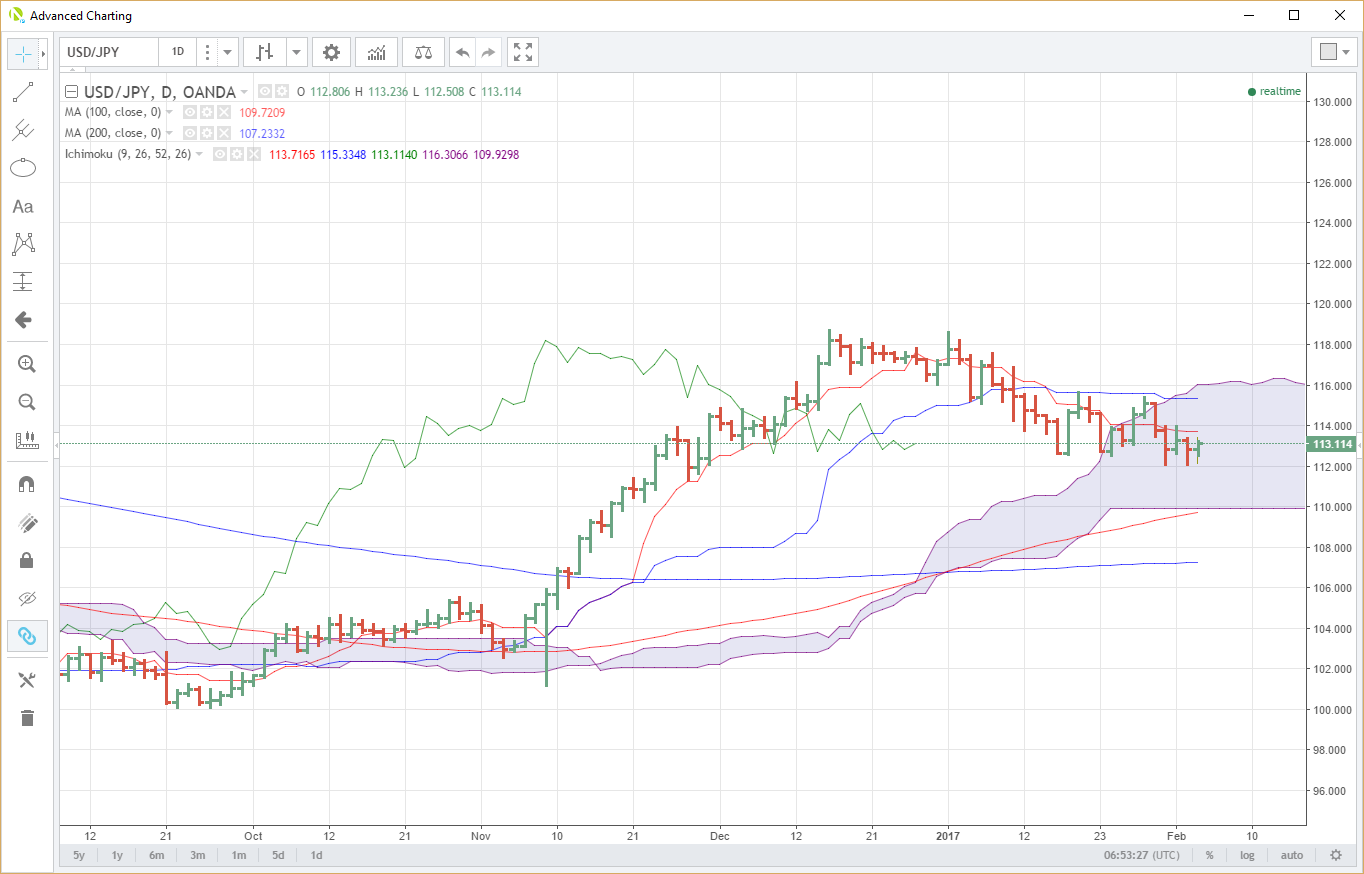

Clearly showing how a shrinking yield differential and U.S. politics has eroded the heady dollar bullishness of a few weeks ago. Today's Non-Farm Payrolls is almost certainly a make or break for USD bulls in the near term. We will need a blockbuster number well above 200,000 one suspects. Otherwise, the USD correction may have more to run. Looking at the daily chart USD/JPY has moved deep into the daily Ichi-moko Cloud.

Resistance is a double top at 114.00, and key support lies at 112.05 again the double bottom. Expect option related bids to be protecting knock-out options at 112.00 with the usual pile of stop losses behind. Long term support is, unsurprisingly, at 109.70/110.00 region. This contains the bottom of the Ichi-moko Cloud and the 100-day moving average.

USD/JPY Daily

Politics will sadly, also be a consideration. With the U.S. Administration vocally making currency manipulator noises about Japan’s QE operations unfairly devaluing the yen. The fact that the Federal Reserve used the same playbook a few years ago and caused the USD to depreciate seems to have been lost or overlooked by them. As is the fact that the yen is a free floating currency whose value is set by the market. (The BOJ last intervened in 2011.)

Thankfully for shorter term traders we can leave this aside and look at tonight’s Non-Farm Payrolls number, which will decide the fate of USD/JPY into early next week.