USD/JPY – Breaks Yearly High

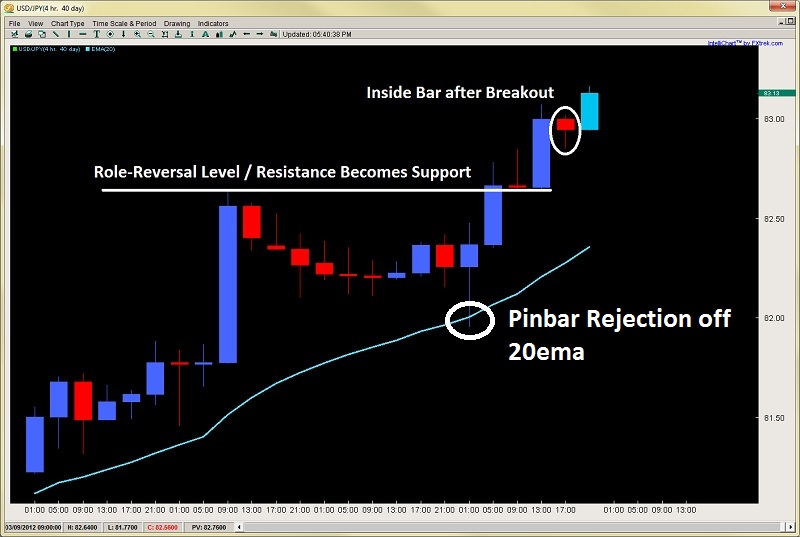

As we wrote about yesterday in our forex price action commentary, price had formed an inside bar at the top of the daily candle which we took as a trend continuation signal and price should break the yearly highs at 82.63. This is exactly how it played out as price broke the level and has been on the march since then now 50pips north of this key level so hopefully you took advantage of this.

We took a long on the pinbar rejection (see chart below) off the 20ema which many of our price action traders got in on and are now sitting on a nice 3:1 reward-risk play also targeting 83.50. USD/JPY" title="USD/JPY" width="800" height="534">

USD/JPY" title="USD/JPY" width="800" height="534">

What I would like to note is two key things;

1) Notice how price broke above the key level and then sat there, treating it as a role-reversal level communicating how this level that was resistance was now being treated as support.

2) Once again, price formed an inside bar on the last 4hr candle to close the NY session, also suggesting trend continuation. I’m suspecting price should make its way up to 83.50 by early London trading with near term support at the prior 82.63 former yearly highs.

Gold – Gets Hammered

Selling off from the London open, Gold got hammered today after the combo 1-2 punch from the Fed standing firm on their no QE3 plan (which I doubt since every Central Banker these days seems to only know one thing…and that is print money = higher gold), to JP Morgan announcing their dividend stock ($.30 per share) and $15Billion buy back all before the stress test results are released.

Needless to say, gold got smashed between the hammer and the anvil on both fronts and sold off aggressively the rest of the day, bottoming on the key $1662 level which was the prior lows from the last major sell-off from $1790 which stopped at…$1662. XAU/USD" title="XAU/USD" width="800" height="573">

XAU/USD" title="XAU/USD" width="800" height="573">

Price closed the day $11 off this key level which is only $.60 off the close the last time price action touched this level from the aforementioned sell-off. The last time this happened, price formed an inside bar and then climbed for two more days, gaining $50 off the lows and rejecting right off the daily 20ema. Since this rejection, its returned home back to this $1662 level.

Should this level hold, we expect price to return to the 20ema now clocking in around $1709. From here, we would wait for a price action trigger to either short the pair or watch for higher prices. But if the $1662 level fails to hold, then we are expecting $1650 and $1641 to be tagged shortly after before we see any buyers jump in.