A very strong Chicago PMI and upward revision to May's University of Michigan Confidence report have the USD/JPY avoiding a collapse through support once again. But next week is the real test for USD/JPY and most major currencies.

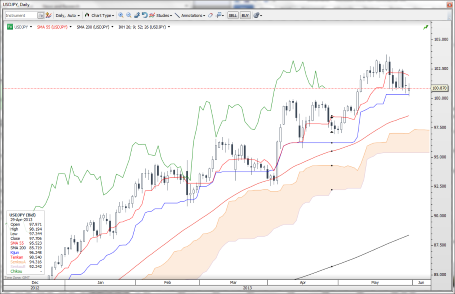

The USD/JPY tried to rally again late Friday, after coming close to challenging the 100.00 level again and having a peek below 100.50 local support. The strong U.S. data knocked the stuffing out of treasuries again, which appeared to be staging an end-of-month rally. It’s readily apparent that the USD/JPY zone between 100.00 and 100.50 is the critical zone of support from a technical perspective.

Next week's key data for almost all of the major currencies could push bonds/risk appetite and JPY crosses any which way. Just for a rundown of the major highlights, these include:

- Saturday - China’s May official Manufacturing PMI (getting close to 50 again...hasn’t been decidedly strong since April of last year)

- Monday - China’s May official Non-manufacturing PMI and US ISM Manufacturing (has the Chicago PMI today saved the month for this one?)

- Tuesday - Australia RBA (only tiny minority expecting a cut. Any support from AUD likely from positioning and not from anything supportive the RBA might have to say...)

- Wednesday - U.S. May ISM Non-manufacturing – last month’s was the worst in 9 months.

- Thursday - ECB (funding for lending noise – anything else worth mention?) and BoE (nothing expected – last meeting before Carney’s arrival)

- Friday - U.S. employment report (could be pivotal for whether this fixed income sell-off ends sooner or later)