US economic data came out worse than expected but it was not enough to hold stock markets back as the S&P 500 hit another record high, advancing past the 1880 level for the fifth time in a month.

Meanwhile, the euro took a boost on better than expected German unemployment numbers and the Australian dollar slipped after the RBA held rates at 2.50%.

Looking at the fundamental report this week we see some potential trading opportunities developing in USD/JPY and USD/CAD.

USD/JPY

The USD/JPY has been a strong performer this week with the currency’s advance coinciding with nice gains in stocks. A flow to the dollar has seen the USD/JPY move past 103, taking the market up for the third week in a row and through a key level of resistance.

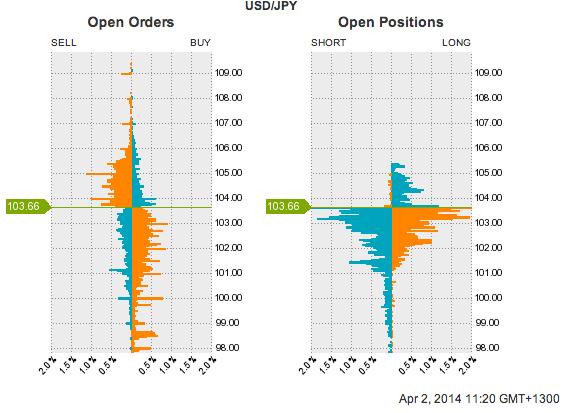

As you can see from the open position chart for USDJPY below, there are very few open short positions placed above the market level, while there are many more short positions opened below the market and now losing money.

This indicates two things. First, that shorts above the market have been quick to take their profits and second, that short traders below the market have very little support from higher levels. As a result, short traders may well bail out of their positions here and that exit would likely see the USD/JPY continue to advance.

USD/CAD

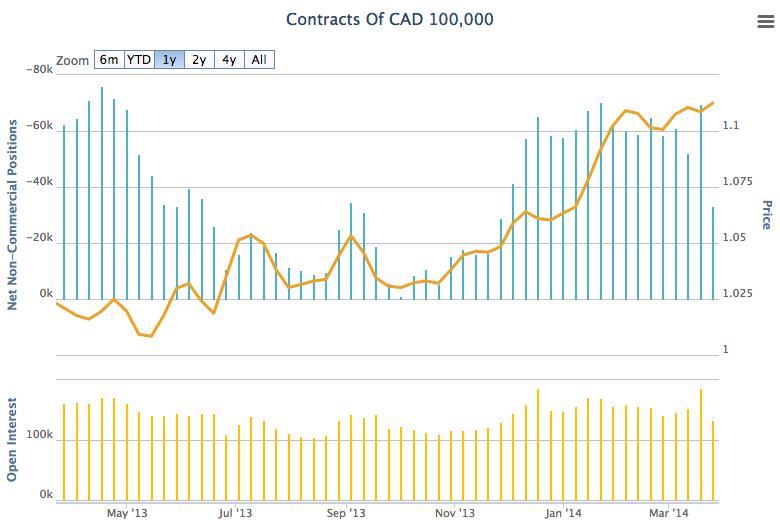

The USD/CAD has had a very strong start to the year but the currency dropped sharply last week, taking a hit of over 200 pips. That has taken the USD/CAD to the 1.10 level but what is most interesting is the data from the COT (Commitment of Traders) report.

As you can see, non-commercial traders reduced their short positions heavily last week, with net non-commercial positions dropping from -69,000 to -33,215 contracts, a drop of over 50%.

With non-commercial traders reducing their short positions so aggressively it would be no surprise to see the USD/CAD continue to fall over the next couple of weeks. The next key area of support is likely to be 1.09.