The rupee continued to hold a solid tone during the week and strengthened to a two-month high at 61.01 against the US currency. Overall dollar demand was generally weaker while rupee sentiment was also firmer. The government looked to issue a new bond which would attract capital flows and there were also moves to get India

included in the global bond index which would potentially boost capital inflows. USD/INR Movement" title="USD/INR Movement" src="https://d1-invdn-com.akamaized.net/content/pic6508c0a9d4a659bfab13ac98cf78861a.png" height="292" width="373">

Beginning of the week saw government’s intent to fight the menace of NDF market by preparing a plan to allow greater overseas participation in the domestic currency futures. Government is preparing a blueprint to persuade those active in NDF market to shift to the onshore currency futures market in India by easing restrictions. There was also some reduction in fears surrounding the current account deficit which is likely to be lower than expected for this year. Besides, there were quite a few important economic data released during the week including the surprise move by Reserve Bank of India (RBI) which cut the overnight marginal standing facility rate by 50 bps with immediate effect (discussed later). On Friday rupee strengthened for a second straight session, helped by good dollar sales by corporates. Moreover emerging currencies rose as risk sentiment improved on growing hopes for a U.S. debt deal in Washington. Traders are hoping for more clarity on the U.S. debt ceiling resolution. Another reason for Rupee’s rebound in recent past has been the surge in flows due to RBI’s special swap facilities. The RBI special swap facilities for banks bringing in foreign currency non-resident (FCNR) deposits and raising capital overseas have resulted in inflows of $5.6 billion in the past one month, according to RBI governor Raghuram Rajan. Flows could cross $15 billion and even touch $20 billion as banks rush to take advantage of this swap facility before the window closes in November. Moreover the absence of oil demand from the market has also helped ease pressure off the Rupee. The Dollar window for oil companies will be open until or before November 30 as per the government. For the week, the rupee gained 0.7 percent, its second straight weekly rise and moved in the range of 61.01-62.30 levels. Rupee ended the week strong at 61.07 compared to its opening of 61.50. In the forward segment, 1mth, 3mth, 6mth and 12 th annualized premia closed at 9.09%, 8.71%, 8.10% and 7.27% compared to the opening levels of 9.97%, 9.27%, 8.44% and 7.59% respectively.

REGULATORY MEASURES

RBI relaxed foreign borrowing norms or banks: The Reserve Bank further relaxed foreign borrowing norms for banks under the recently opened swap window by allowing them to raise funds through their head offices and correspondents besides overseas branches. Until now, the window was limited to overseas branches of banks only. Authorised dealer category-I banks may borrow funds in foreign currency from their head office, overseas branches and correspondents or any other entity as permitted by the Reserve Bank and avail of the this window to raise up to 100 percent of their unimpaired tier I capital or USD 10 million whichever is higher, the RBI said in a notification, amending the regulations issued on September 26. The central bank said the move is aimed at providing greater flexibility to banks in accessing overseas funds.

MACRO ECONOMIC INDICATORS

- Trade deficit came in at 30-month low in September at $6.8bn from $10.9bn last month as imports contracted 11.6%MoM sequentially on a seasonally adjusted basis while exports rose 1.9%MoM. Imports have declined sequentially in September even though gold imports were largely unchanged. The September data reflects a sharp improvement from the average $16.8bn trade deficit seen during Q1FY14, which led to CAD print of 4.9% of GDP in Q1.

- In a surprise move, RBI lowered borrowing rate on Marginal Standing Facility (MSF) by another 0.50% on Monday. The rate was reduced by 0.75% for the first time at the second quarter mid review of monetary policy. After these reductions now the MSF rate stands at 9.0%. The RBI also announced that it would conduct auctions every Friday when it would lend funds to banks for seven days and 14 days against government bonds. Equity and debt markets have reacted positively to this development as tide seems to be turning now. Few weeks ago, the MSF rate was hiked by 200bps or 2.0%. In a drive to stabilise rupee and curb speculation arising due to excess liquidity in the system; RBI had hiked short term borrowing rates. But this had put enormous burden on banks to meet their short term liquidity needs.

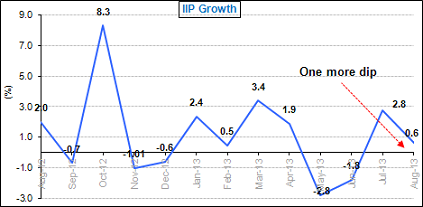

- IIP slowed down to 0.6% in August month, from a growth of 2.6% registered in the month of July. The July IIP was further revised upwards to 2.8%. The number was far below than market expectation of 2.0%, primarily on account of subdued activity of manufacturing and mining sectors. Manufacturing output, that constitutes about 76 % of industrial production reported a de-growth of 0.1% from +3.2% a month ago following weak investment and consumer demand. From used based category, capital goods output continued to remain volatile with -2.0% growth in August month as compared to 15.6% of July month.

- India's foreign exchange reserves rose to $277.73 billion as of Oct. 4, compared with $276.26 billion in the earlier week.

- India's headline inflation accelerated to a seven-month high of 6.46 percent in September, mainly driven by higher food prices, government data showed on Monday. Wholesale prices, India's main inflation measure, had risen 6.1 percent in August. Food prices rose 18.40 percent year-on-year last month, faster than an annual rise of 18.18 percent in August. The reading for July was revised to 5.85 percent from 5.79 percent, data released by the Ministry of Commerce and Industry showed.

INDIAN STOCK MARKET

The stock market witnessed gains in four of the five trading sessions and had a stellar run last week. The benchmark Sensex was up 3% and the Nifty edged higher by 3.1% for the week. The Sensex and the Nifty decisively closed above the 20,000 and the 6,000 mark respectively. In the broader markets, the smallcap index gained 2.7% and the midcap index stepped up by 2.4% over the past five trading sessions. Some of the positives that helped the investor sentiments were a sharp decline in trade deficit for September this year, RBI liquidity enhancing announcements for the banking system and finally a positive outlook from the Infosys management with an upward revision in revenue guidance for the full year. FIIs too took note of these developments and bought into the Indian markets. The 30 share S&P BSE Sensex closed at 20528 up by 612 points, while the NSE Nifty closed at 6096, up by 189 points.

IMF GLOBAL FORECAST

The International Monetary Fund cut its world growth forecast on Tuesday amid deteriorating emerging market prospects and urged authorities to shore up their economies. In its sixth consecutive downward revision, the IMF now expects global output to expand just 2.9 percent, down from its July estimate of 3.1 percent, making it the slowest year of growth since 2009. It predicted a modest pickup next year to 3.6 percent, below its July estimate of 3.8 percent. According to the IMF, the United States is driving much of the lobal recovery and U.S. output should pick up further next year as long as politics do not get in the way. The IMF said Japan had experienced an 'impressive' pickup since the government launched a massive stimulus program to spur the economy out of a prolonged stagnation, boosting output by about 1 percent. But growth should slow next year as the stimulus recedes and Japan moves ahead with higher consumption taxes, it added. In Europe a better mood more than any change in policy lifted the core economies of Germany and France. Even Italy and Spain should edge into positive growth territory next year. But the IMF added that the Eurozone must still address financial fragmentation, improve the health of banks and move closer to banking union.

Despite the improvement in growth in advanced economies such as the UK and US, the IMF warned that a slower pace of xpansion in emerging economies such as Brazil, China and India, was holding back global expansion. It expects growth in Russia, China, India and Mexico to be slower than it forecasted in July. In part, it says this is due to expectations of a change in policy by US central bank the Federal Reserve. Simply the expectation that the US could trim back its efforts to stimulate the US economy has already had an impact on interest rates in emerging economies, the IMF said. It said an increasing belief that China's growth rate would slow would also hit global growth. At the same time, the U.S. is preparing for the Federal Reserve to curtail its stimulus and wrestles with a budget impasse that threatens to derail the global recovery. However, emerging markets still account for much of global growth and their economies should expand nearly four times as fast this year as advanced economies. But the heady expansions some enjoyed in recent years may be a thing of the past, the IMF said. China in particular should slow over the medium term as its economy transitions away from investment to consumption drivers. Markets no longer expect the Chinese government to step in with stimulus if growth dips below 7.5 percent, the IMF said. Lower growth in China could spill over to others, especially commodity exporters dependent on China's insatiable appetite for energy. As regards India, the IMF said India's economy will expand 3.8% in 2013-14, a 1.8 percentage point reduction from its July estimate of 5.6%, the sharpest cut for any country in the World Economic Outlook. However, the Finance Minister P. Chidambaram and central bank governor Raghuram Rajan, publicly questioned the methodology of IMF and said that they do not share this pessimistic outlook on India. India's finance ministry expects the economy to grow at 5-5.5%. "With very good rainfall in the current year and a sharp increase in the sown area, we expect robust growth in farm output. We have also taken numerous reform measures over the past one year. We expect these measures to show their impact," Chidambaram said.

OUTLOOK

Fundamental

US budget and debt negotiations will continue to have a crucial short-term impact. The federal government shutdown continues resulting in postponing key federal government indicators. Markets are expecting some form of compromise and failure would trigger a sharp increase in volatility. However, the Beige Book and jobless claims will be released and likely will get extra attention to see if the labor market is improving enough for tapering to begin before the end of this year. The dollar will be hampered by expectations that the Fed will be reluctant to taper bond purchases this year, but the ECB will also be under increasing focus and under pressure to relax policy, especially if Euro-zone demand starts to falter again. Investors will watch out for monthly economic data from China for clues to global growth. On the domestic front too the developments in US will be the major issue which will decide the course of the Indian Rupee. In the meantime, the rupee will continue to gain some protection from a decline in US yields and reduced pressure on wider emerging-market assets, but with limited scope for gains. The prospects of a recovery in industrial growth appear weak following subdued investment activities, hence the industrial recovery warrants for expeditious decisions to accelerate investments, especially by easing policy constraints and removing major supply bottlenecks. After the latest September trade deficit data, the outlook on CAD has brightened. However, going forward trade gap could widen due to 1) festival demand pushing up gold imports; 2) some moderation in exports as suggested by PMI export orders which fell by 3.6pts in Sep. Though it could improve further in the event that gold imports do not pick up as envisaged. Another aspect to watch out for would be the impact on Rupee once the oil demand comes back in the market.

Technical

Rupee is facing strong resistance around 61.01 level, its 100 DMA on daily timeframe where it failed to gain further and is likely to hold below these levels. Unless it breaches this crucial level it may touch 62.10/62.30 this week. On technical charts Dollar will most likely hold 61 mark and appreciate further. On the upside if 62.98 is breached then the rupee will further depreciate to re-test 63.90 levels. On the flip side 60.80 is an important resistance level for Rupee and any gain beyond this level can trigger it further upside towards 59.67 in the near term. Between the level of 59 – 61.5, price has spent considerable amount of time in June – August and therefore this region will provide strong support to USD/INR pair. Price rotations were maximum in this region and it won’t be easy for the price to penetrate these levels. Long term trend of the price continues to remain on the upside and till price sustains below 58-59, the odds of price moving back to 68 level remains very high. Range for the week : 60.80-63.90. Trend : Two-way movement in USD/INR expected within a range with a bearish Rupee undertone.