- Increase in food prices disconcerting in light India’s CPI basket, inflation expectations.

- Reserve Bank of India to face challenges in capping inflation if we see another EM selloff.

- Higher volatility over summer could support USD, disrupt FX carry flows.

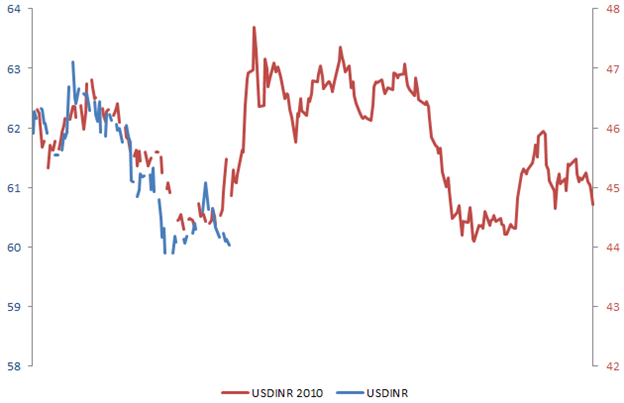

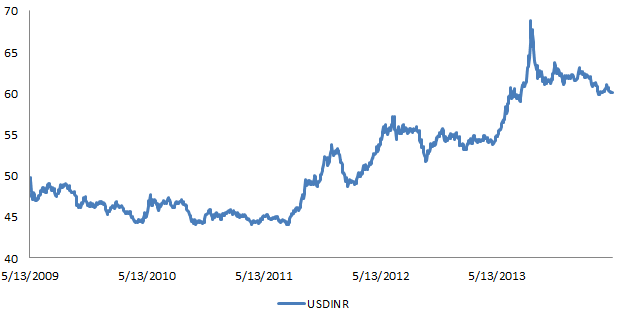

We have detailed over the past few weeks in our Indian Rupee pieces that the current INR run may be coming to an end. With election optimism likely to fade over the coming days / weeks and under the current inflation situation, it could be the case that we have set a low in the USD/INR cross or are very close to one. Further confidence in this bias comes with any return of USDollar strength moving into summer.

The Rupee strengthened recently along with other EM FX pairs as low volatility in markets has pushed global investors back into the carry trade. Nevertheless, a reach for yield can reverse quickly, especially in these somewhat illiquid and complacent markets. Very low periods of high volatility are more often than not followed by periods of very high volatility and this would not bode well for emerging markets, especially in the context of possible shocks stemming from a further slowdown in Chinese growth.

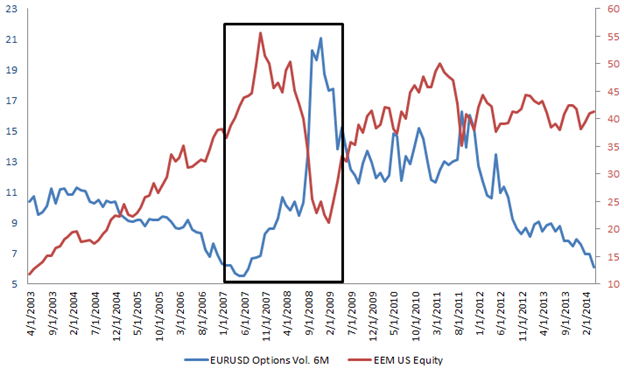

MSCI EM ETF vs. EUR/USD 6M Option Volatility

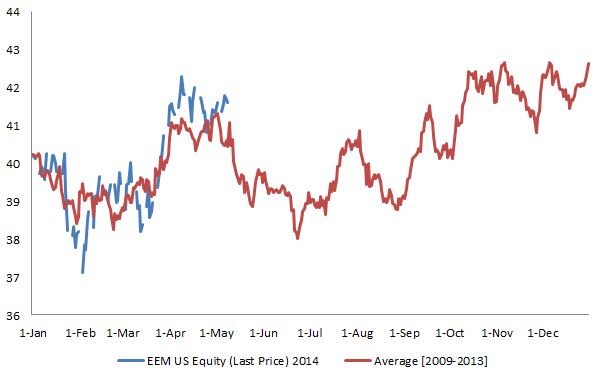

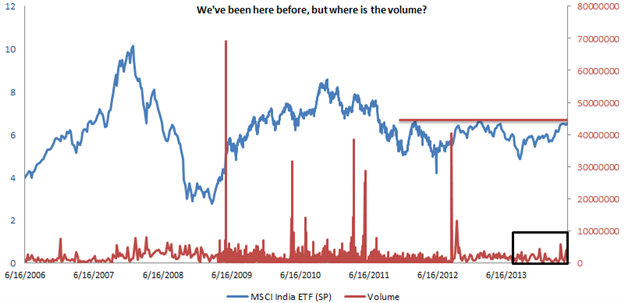

It is important to note trends that continue to hold are approaching key periods that could contribute to USD/INR volatility and strength. For one, the MSCI EM ETF 2014 analogue with the 5yr average continues to remain a relatively good fit, although the coming month will be a true test. In addition, the MSCI India ETF has had trouble breaching current levels before and this recent move has come with incredibly low volume. (The ETF fluctuates between a 0.5 and 1.0 negative correlation with USD/INR.)

Seasonality Analogue: MSCI Emerging Market ETF

MSCI India ETF

USD/INR: YTD vs. 2010