U.S. Dollar Index Speculator Positions

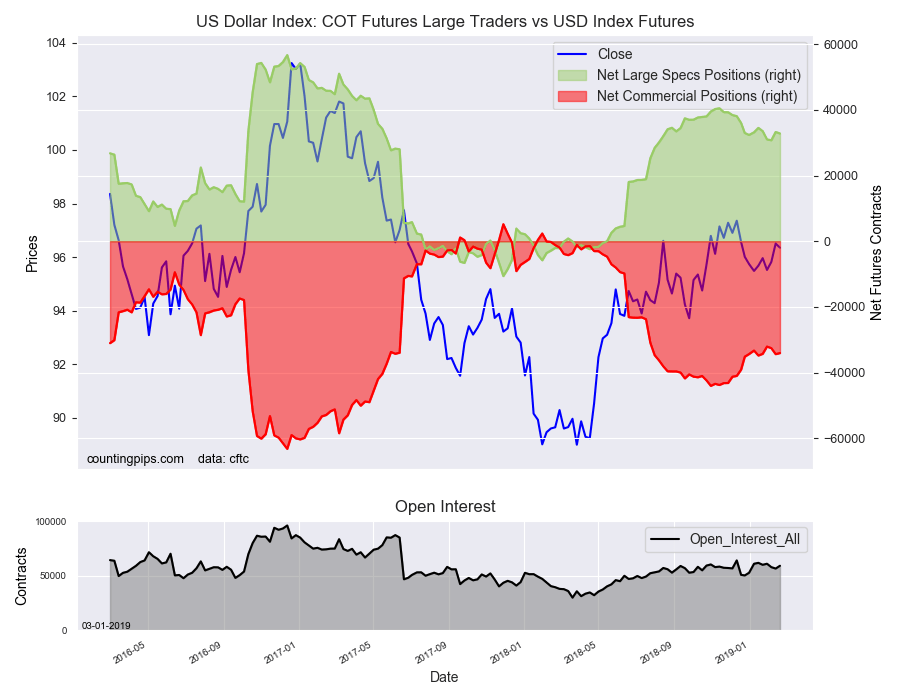

Large currency speculators cut back on their bullish net positions in the U.S. Dollar Index markets through mid-February, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

This latest COT data is from the middle of February due to the government shutdown which suspended the releases for approximately a month. The CFTC is releasing data on Tuesdays and Fridays going forward until the data is back up to date.

The non-commercial futures contracts of U.S. Dollar Index futures, traded by large speculators and hedge funds, totaled a net position of 32,839 contracts in the data reported through Tuesday, February 19th. This was a weekly reduction of -446 contracts from the previous week which had a total of 33,285 net contracts.

The net position was the result of the gross bullish position gaining by 1,898 contracts to a weekly total of 48,544 contracts compared to the gross bearish position total of 15,705 contracts which saw a lift by 2,344 contracts for the week.

The speculative U.S. dollar index positioning dipped for the fourth time in the previous five weeks through February 19th. The standing for USD index spec positions remained strong and above the +30,000 contract level for a twenty-ninth straight week.

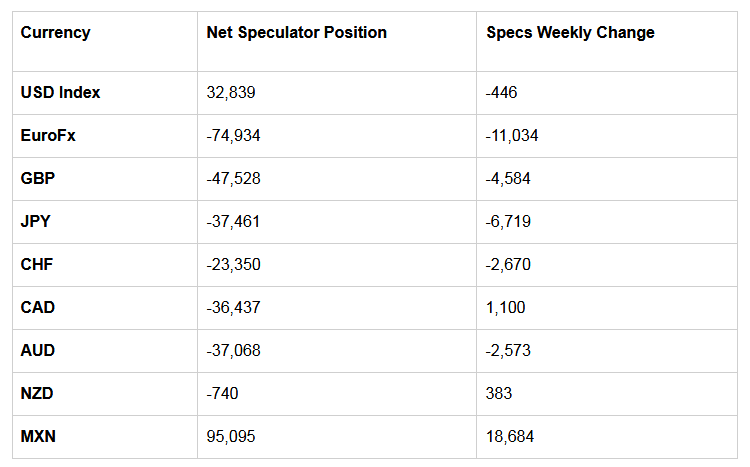

Individual Currencies Data this week:

In the other major currency contracts data, we saw two substantial changes (+ or – 10,000 contracts) in the speculators' category this week.

Euro bets dropped through Feb. 19th by over -11,000 contract. This was a fifth straight week of declining bets with positions falling by a total of -42,273 contracts over that period. The euro standing declined to the most bearish level since December 20th of 2016.

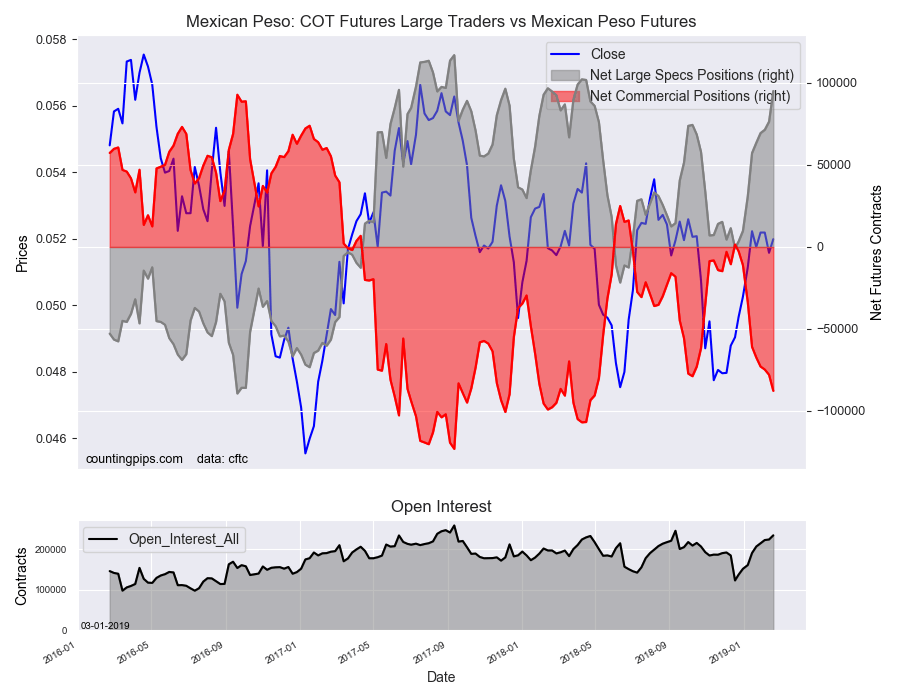

Mexican peso bets jumped by over +18,000 contracts on February 19th and rose for a ninth consecutive week (a gain of 95,864 contracts in that period). The peso positioning advanced to the best level since April of 2017 when the net position topped out above the +100,000 contract level.

Overall, the major currencies that saw improving speculator positions through February 19th were the Canadian dollar (1,100 weekly change in contracts), New Zealand dollar (383 contracts) and the Mexican peso (18,684 contracts).

The currencies whose speculative bets declined on the week were the U.S. dollar index (-446 weekly change in contracts), euro (-11,034 weekly change in contracts), British pound sterling (-4,584 contracts), Japanese yen (-6,719 contracts), Swiss franc (-2,670 contracts) and the Australian dollar (-2,573 contracts).

See the table and individual currency charts below.

Weekly Charts: Large Trader Weekly Positions vs Price

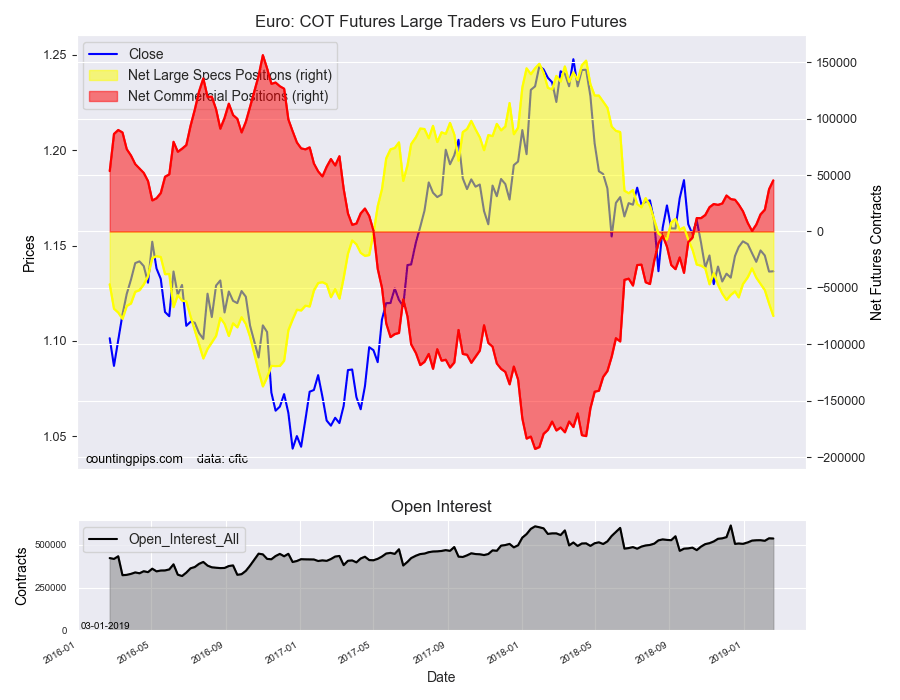

EuroFX:

The Euro large speculator standing this week totaled a net position of -74,934 contracts in the latest data reported. This was a weekly decrease of -11,034 contracts from the previous week which had a total of -63,900 net contracts.

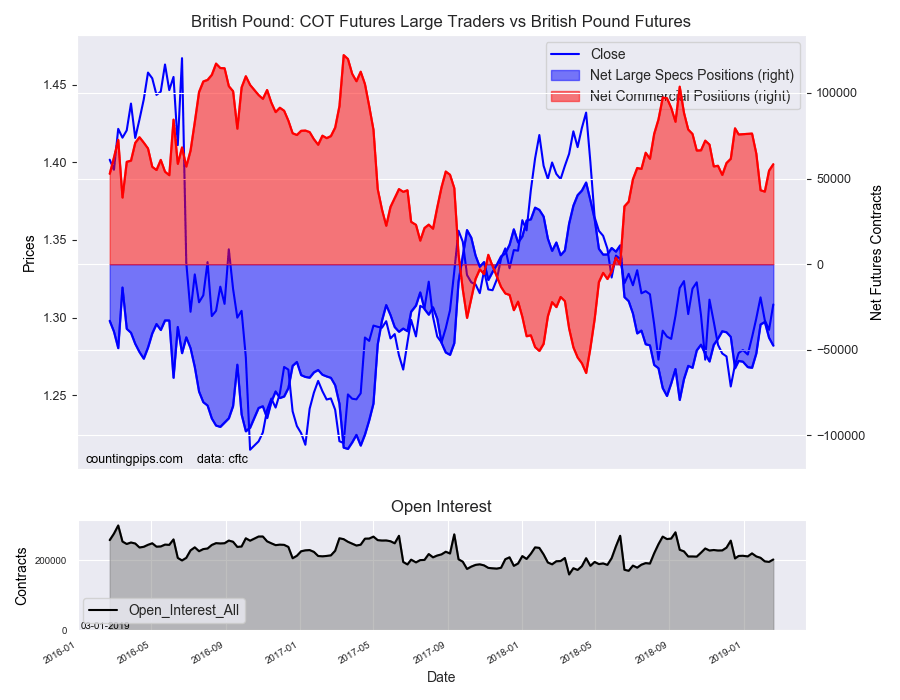

British Pound Sterling:

The large British pound sterling speculator level recorded a net position of -47,528 contracts in the data reported for February 19th. This was a weekly fall of -4,584 contracts from the previous week which had a total of -42,944 net contracts.

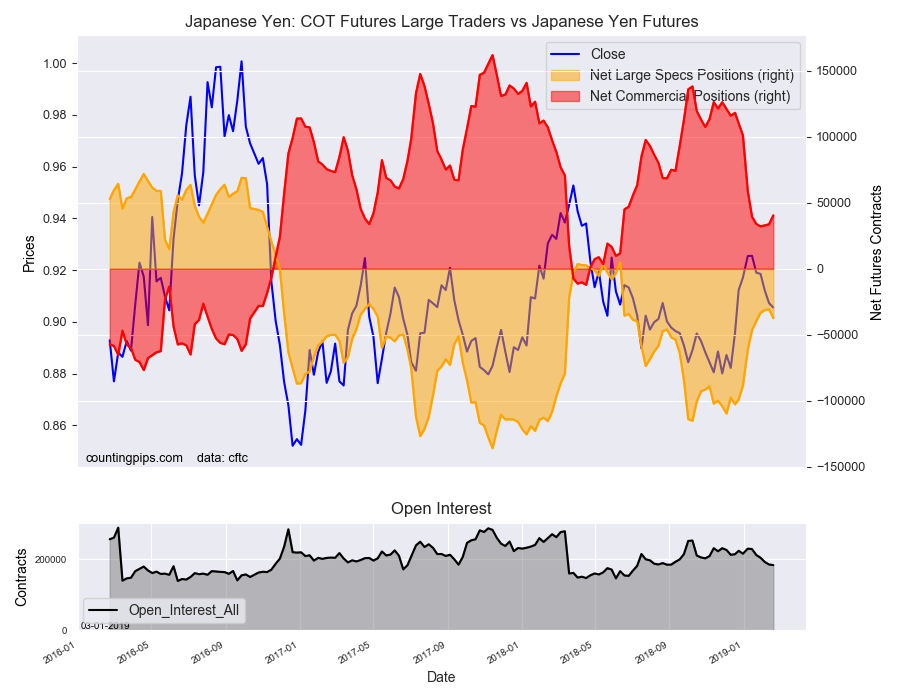

Japanese Yen:

Large Japanese yen speculators was a net position of -37,461 contracts in the latest data. This was a weekly decline of -6,719 contracts from the previous week which had a total of -30,742 net contracts.

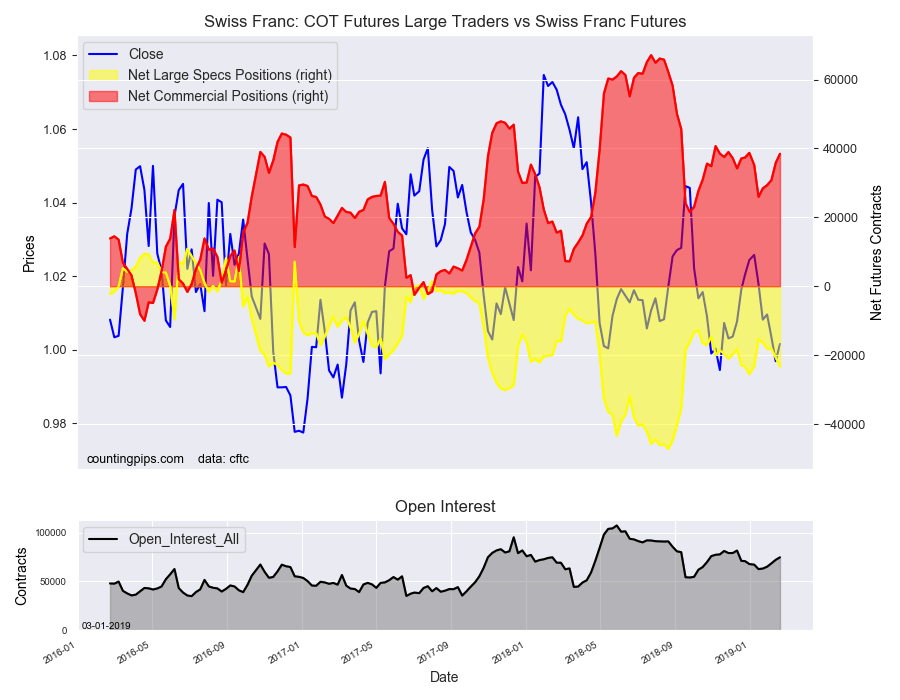

Swiss Franc:

The Swiss franc speculator standing this week totaled a net position of -23,350 contracts in the data through February 19th. This was a weekly decrease of -2,670 contracts from the previous week which had a total of -20,680 net contracts.

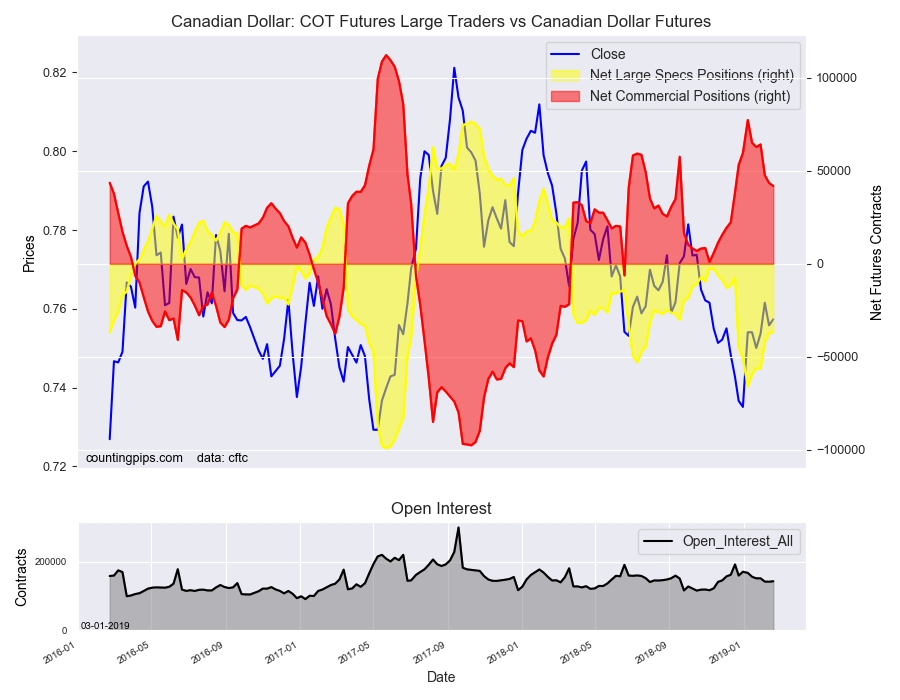

Canadian Dollar:

Canadian dollar speculators was a net position of -36,437 contracts. This was a lift of 1,100 contracts from the previous week which had a total of -37,537 net contracts.

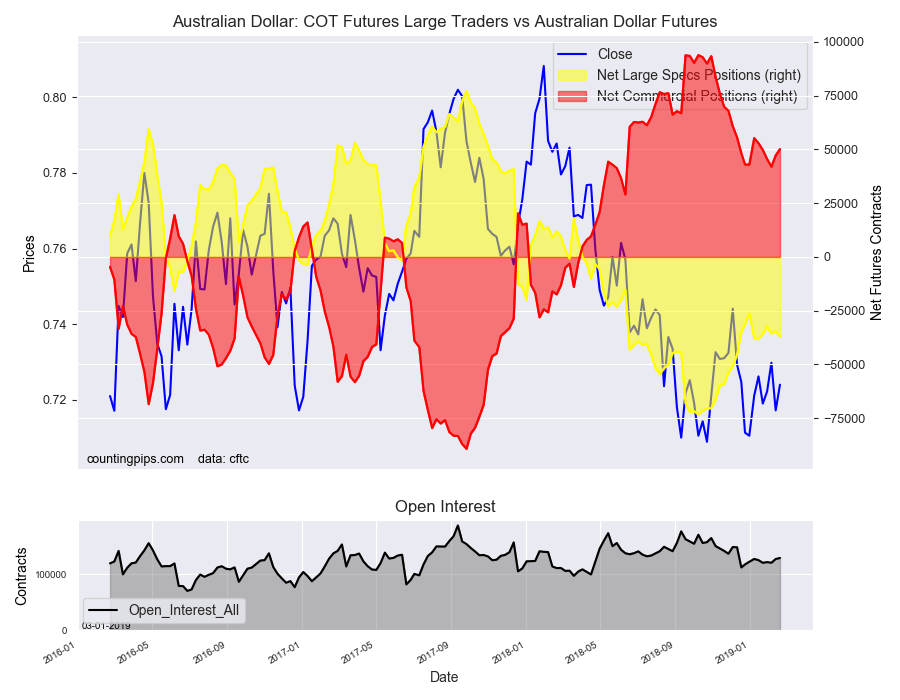

Australian Dollar:

The large speculator positions in Australian dollar futures reached a net position of -37,068 contracts this week in the data ending Tuesday, February 19th. This was a weekly decline of -2,573 contracts from the previous week which had a total of -34,495 net contracts.

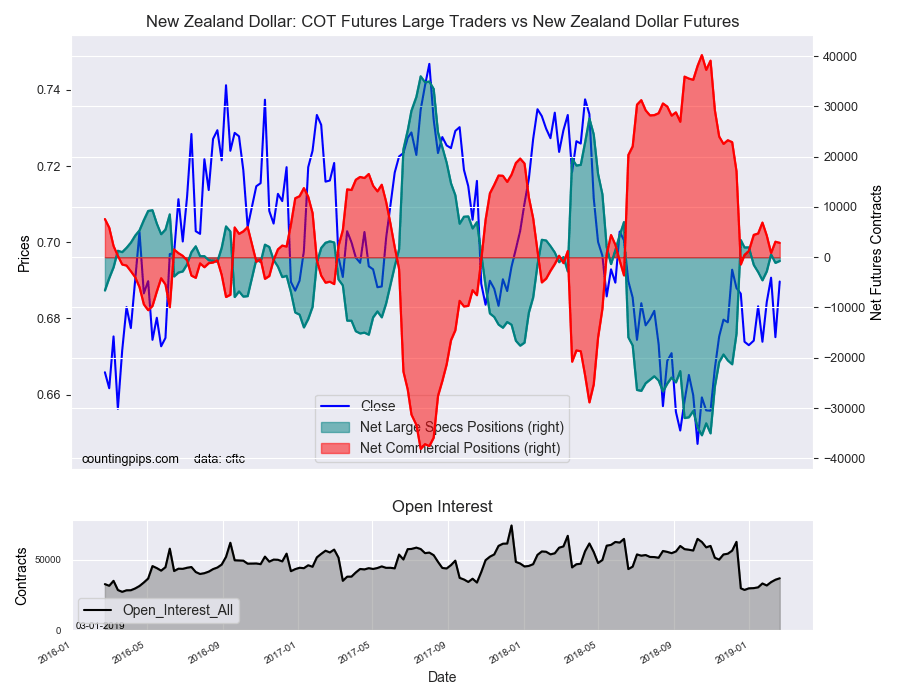

New Zealand Dollar:

The New Zealand dollar speculative standing came in at a net position of -740 contracts this week in the latest COT data. This was a weekly advance of 383 contracts from the previous week which had a total of -1,123 net contracts.

Mexican Peso:

Mexican peso speculators totaled a net position of 95,095 contracts for February 19th. This was a weekly lift of 18,684 contracts from the previous week which had a total of 76,411 net contracts.