- President Trump’s comments about potential tariffs on Canada and Mexico by February 1st caused increased market volatility and risk aversion.

- The US Dollar Index (DXY) experienced significant price swings due to uncertainty and shifting information.

- Tariffs are seen as potentially inflationary, which could reduce expectations of future rate cuts and support a stronger USD.

- The DXY broke below a key ascending trendline, suggesting potential further downside.

The US Dollar Index (DXY) broke below a key level as more information around proposals from the Trump administration filtered through.

President Trump’s first day didn’t include clear plans for tariffs, and officials said any new taxes would be applied slowly, which was good news for currencies affected by trade. The Euro and British Pound benefitted as it appeared the Trump team had no plans for tariffs on the EU or the UK. This could of course change in the coming days.

This morning however we got some clarity on the Trump administration’s plans. President Trump told reporters his team was thinking about tariffs on Canada and Mexico by February 1 which increased concerns that his policies may not be implemented gradually after all.

This saw risk sentiment increase with the likes of Gold rising as well as markets ponder the potential impact of wider trade wars.

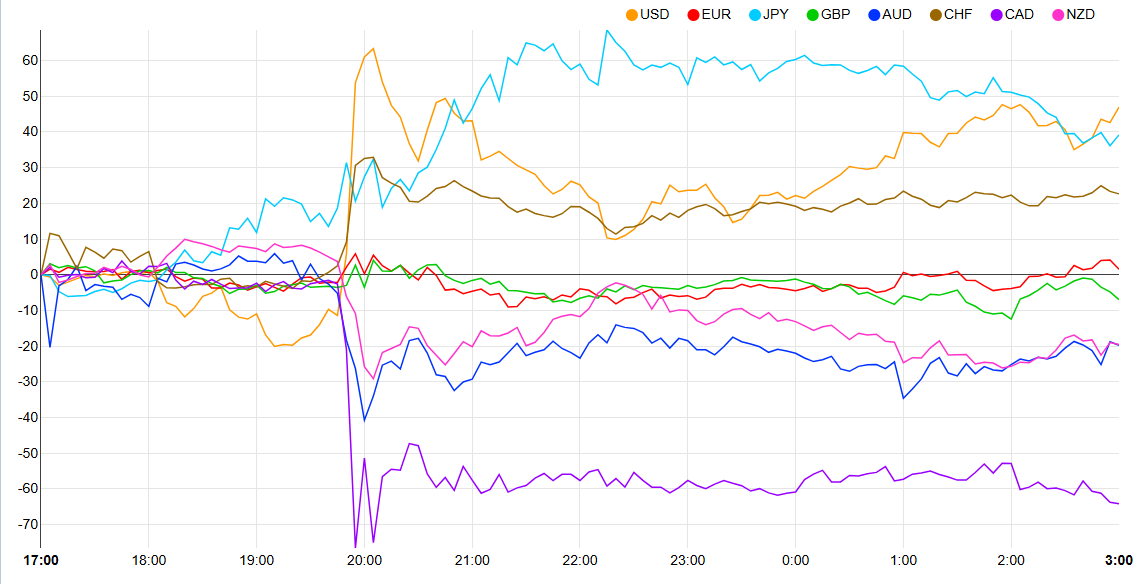

Currency Strength Chart: Strongest USD, JPY, CHF, EUR, GBP, NZD, AUD, CAD – Weakest

Source: FinancialJuice

Will the USD Appreciate Under President Trump?

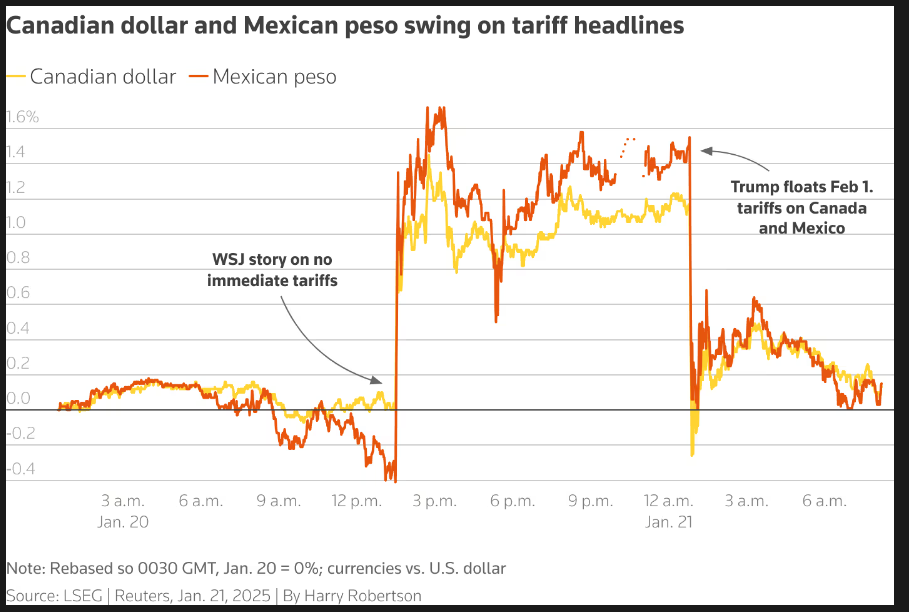

The impact of potential tariffs can not be understated as evidenced by the sharp swings we saw yesterday. Yesterday’s Wall Street Journal report about the potential for incremental tariffs and no specifics led to US Dollar weakness, while the Mexican Peso and the Canadian Dollar were the major beneficiaries.

This trend was reversed today with another bout of volatility as President Trump floated February 1 for potential tariffs against Mexico and Canada. Some analysts suggest that the lack of clarity could be worrying as it could mean that President Trump’s economic team is working on something big. If this is the case, volatility may be just getting started.

Source: LSEG

Tariffs also bode well for a stronger USD, at least in the interim. Markets see tariffs as potentially leading to heightened inflation and thus less rate cuts. However, given that President Trump signed an order looking at the cost of living issue, these fears could be arrested in the coming months. The question is whether that will be too late?

In Trump’s first term, the US dollar had a tough time. Now though, it looks like the dollar might enjoy a better run this time around. The only thing I know for sure, is that the next few days will be very unpredictable.

It’s a relatively quiet week on the data front from the US with tariff developments and US policy likely to take center stage and drive market movements.

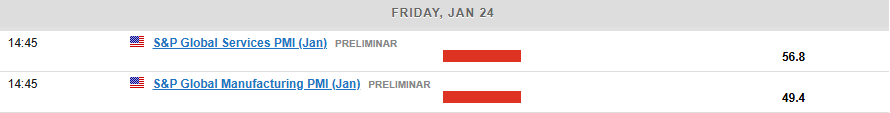

On Friday we have the US S&P Manufacturing and Services PMI data which could add some additional volatility.

Technical Analysis

US Dollar Index (DXY)

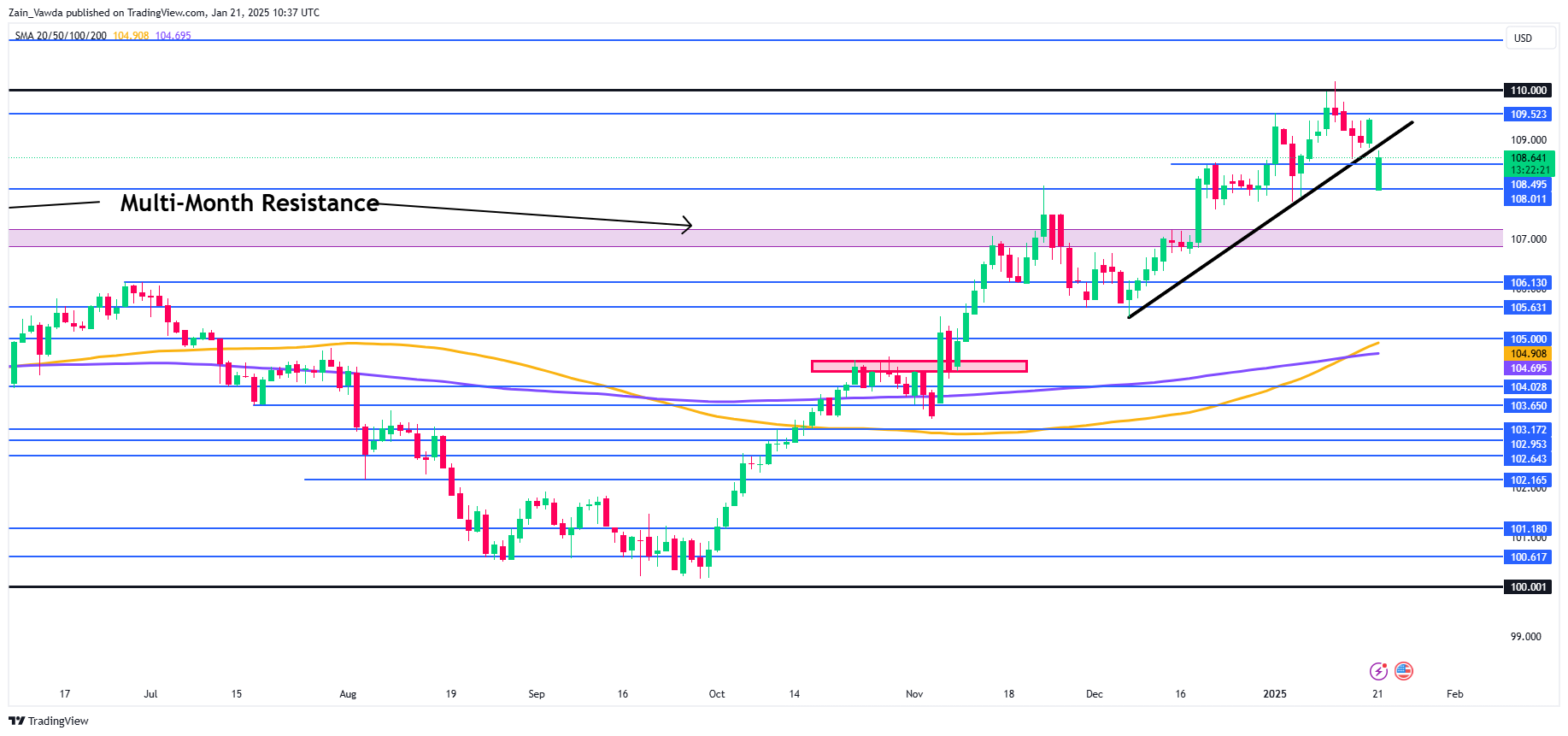

The US Dollar index has had an interesting ride as expected to start the week. The inauguration of President Donald Trump certainly stirred volatility yesterday with some whipsaw price action experienced by the US Dollar.

A jump to the downside when markets were closed in the US session saw the DXY on the daily timeframe break below a key ascending trendline hinting at further downside ahead.

US Dollar Index (DXY) Daily Chart, January 21, 2025

Source: TradingView.com

Dropping down to a H4 timeframe and price is currently testing the ascending trendline which is also where the 100-day MA rests, making this a key confluence area.

Price has shown an initial rejection here, showing signs that a further pullback may materialize. If this does not happen then a retest to close yesterday's gap at 1.09300 may become a real possibility.

Immediate support rests at 108.00 with a break lower finding the 200-day MA at 107.90 before the 107.00 handle comes back into focus.

If the price continues its recovery, the USD Index could find resistance at 108.82 before the 109.30 and 110.00 handle become areas of focus.

US Dollar Index (DXY) Four-Hour (H4) Chart, January 21, 2025

Source: TradingView.com

Support

- 108.64

- 108.00

- 107.60

Resistance

- 109.00

- 109.52

- 110.00