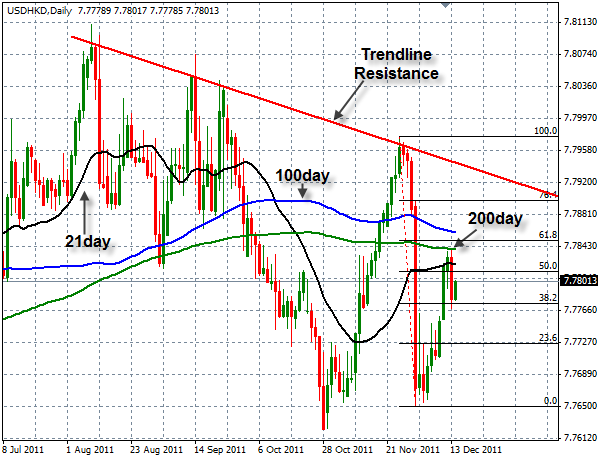

The USD bid could continue through the rest of 2011, giving the USD/HKD pair an opportunity to retest the 200day moving average/61.8% retracement of the latest move. A break above the 200 day could bring the 6 month trendline resistance into play.

USD/CNY Testing Hourly Trend Line Support Around 6.3759

The USD rallied during the New York session today as fears continue to mount in Europe. In recent trade the USD/CNY has found upward trend line support around 6.3759 with the 200 hour moving average coming in just below. With some selling being seen, the downward target is the trend line around 6.3782; bullish target at 6.39005.

1.3148 next stop for USD/SGD?

After finding support on December 5th at 1.27641, the pair has traded continually higher. It seems that there are no significant daily levels between the current market and the previous high of 1.31484. If we were to see a turn around in USD strength going forward, the downside level we would look to would be the 38.2% line.

USD/CNY 100day / 38.2%

The USD/CNY pair is pressing up against the 38.2% retracement of the latest move (and the 100 day moving average right above), a break on this test could be possible in 2011 as the China’s economy and subsequently there market continues its downward spiral. A test of the developing channel would follow and even perhaps revisiting of the 200 day.