With FOMC on Thursday morning, our focus shifts to the US dollar and its effect on the majors.

The bottom line is that the strong US Dollar is a problem for the Fed. In an economy of stunted growth with company after company featuring problems that a high USD poses for their bottom line in their reporting, you know you have a problem. The high USD doesn’t exactly help domestic inflation either and if you add in China and Europe’s race to the bottom then the Fed has got itself in a bind.

Janet Yellen has persistently cited the high USD as a problem for the Fed in moving toward interest normalisation and the beginning of the impending rate hike cycle and there is nothing to suggest that anything will change come Thursday’s statement. The expectation is very much that Yellen will look to pull back on the dollar and try to buy the US economy some more time if you will.

The arguments for a 2015 rate hike have been all but silenced as the Fed continues to manage expectations around a strong USD.

Turning to the majors and most specifically EUR/USD, we can see the expectations for a dovish Fed being factored in. Draghi made sure the Euro stayed weak last week by promising more QE but the Euro looks to possibly have found a bit of a bottom here as the USD narrative comes back to the fore.

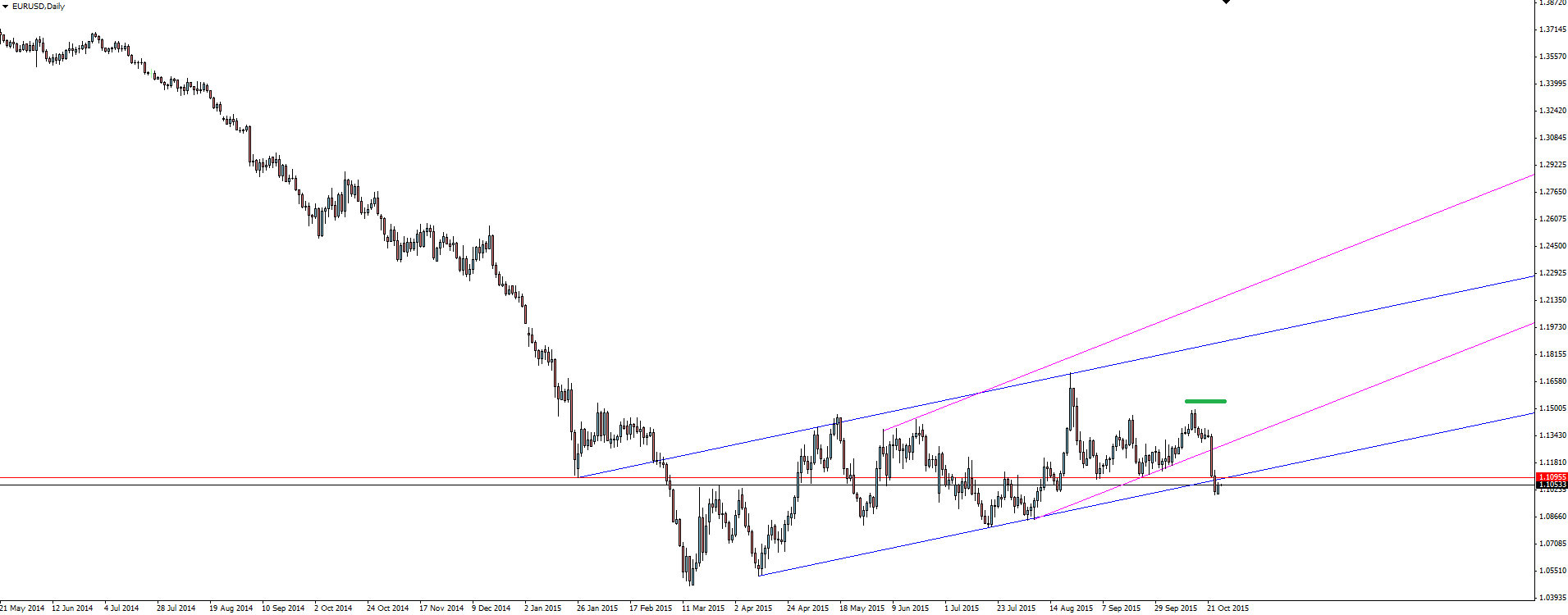

EUR/USD Daily:

Click on chart to see a larger view.

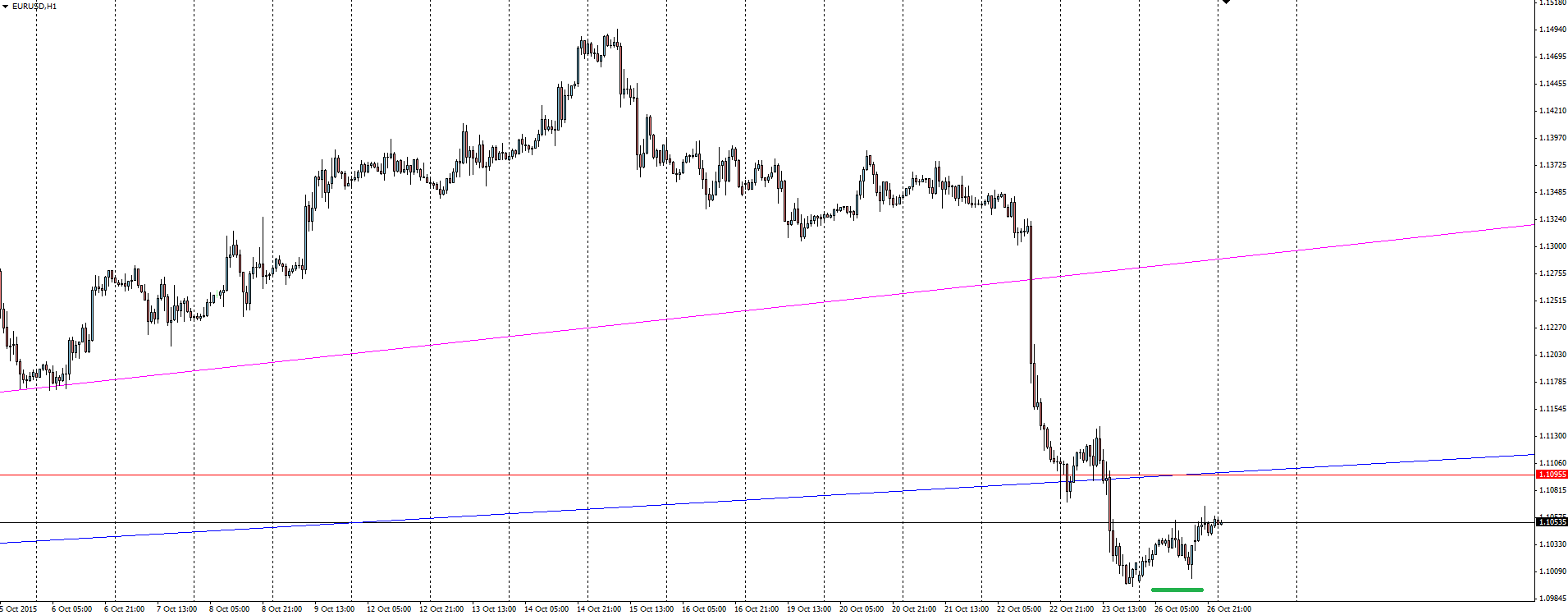

EUR/USD Hourly:

Click on chart to see a larger view.

Surrounding the FOMC meeting, the higher risk looks to be for a USD drop on the back of a harshly dovish statement. You have to ask yourself what the Fed would get out of anything but talking down the dollar, and the answer is zilch.

Take the path featuring the least likelihood of a major miss in expectation.

On the Calendar Tuesday:

NZD Trade Balance

GBP Prelim GDP q/q

USD Core Durable Goods Orders m/m

USD CB Consumer Confidence

Chart of the Day:

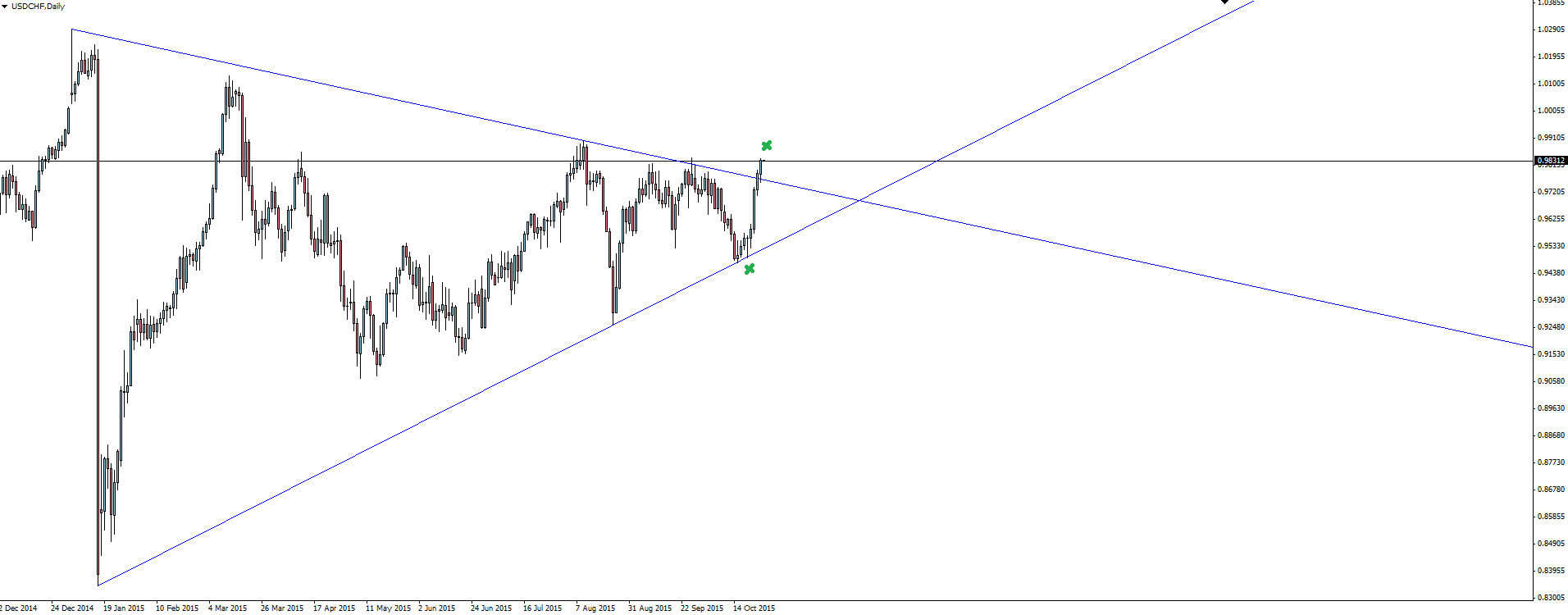

Today’s USD/CHF chart of the day is a follow up to yesterday’s EUR/CHF chart. After posting yesterday’s Swiss Ramble blog, the discussion of Euro weakness came up on Twitter (N:TWTR).

USD/CHF Daily:

Compare the two charts and you can see just how weak the Euro has been recently.

With price bouncing off trend line support and then rallying through resistance that formed the daily triangle pattern, we now sit at a short term swing high.

I’ve never really been much of a breakout trader myself, and can see the higher probability play being letting price tuck back into the triangle. It’s just too clean to be a textbook breakout.

Do you see opportunity in trading USD/CHF?

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex trading broker Vantage FX Pty Ltd, does not contain a record of our prices, or an offer of, or solicitation for, a transaction in any financial instrument. The research contained in this report should not be construed as a solicitation to trade. All opinions, news, research, Forex analysis, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person opening a trading account and acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness and Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.