Market Brief

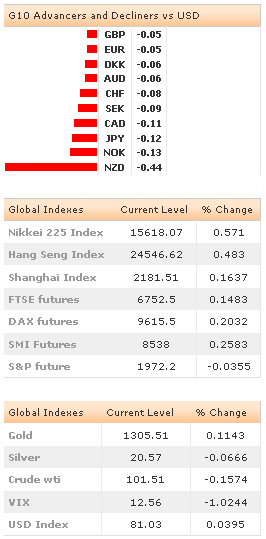

The FOMC starts its two-day meeting today, USD performs against its G10 peers and the majority of the EM currencies. The US 10-year yields are still below 2.50% as the USD faces data/event risk from Wednesday. Japanese jobless rate deteriorated from 3.5% to 3.7% in June, while overall household spending contracted by 3.0% on yearly basis (vs. -4.0% and -8.0% last).

The retail sales grew 0.4% in month to June (vs. 0.8% and 4.6% a month ago). BoJ Ishida said that the labor market is critical to boost spending, and that the BoJ cannot fight inflation otherwise. USD/JPY and JPY crosses were better bid. USD/JPY rallied to 102.00 in Tokyo, solid resistance remains at 102.00/102.10 (optionality / 200-dma), stops are eyed above. The USD-leg will be critical for direction this week (FOMC decision and GDP (Wed) and NFP (Fri)). EUR/JPY remains ranged with negative bias, offers trail above 137.00. Key support zone remains at 136.23/75, then 135.72 (March-July downtrend base).

EUR/USD consolidates losses, trend and momentum indicators are negative yet traders are sidelined pre-FOMC decision. Option related offers trail below 1.3450/1.3500 and the sentiment is comfortably bearish. However the short-term direction depends on US data and the FOMC tenor. Soft outcome in GDP and dovish policy statement should lead to sharp upside correction, thus is subject to event risk. EUR/GBP remains ranged within June-July downtrend band. The sentiment remains negative while slight recovery is balanced with offers intact pre- 21-dma (0.79286). More resistance is seen at 0.79602 (downtrend top).

The Cable remains well bid at about its 50-dma (1.6973), the buying interest at this level limits the downside as negative momentum lose pace. The critical support stands at year-to-date uptrend base (at 1.6903) and if holds, should suggest the end of downside correction building since July 15th (after hitting fresh high of 1.7192). Option barriers are eyed at 1.7000/25 for today expiry.

NZD/USD extends weakness to 0.8508 (at the time of writing), the selling pressures continue as pre-FOMC USD demand help capping the upside. Any disappointment out of the US should pull the pair back towards its daily ascending cloud cover (0.8591/0.8607). NZD/JPY consolidates losses as negative NZD momentum temporarily curbs the carry interest. The key support stands at 200-dma (86.304). The RBNZ/BoJ divergence and the rate spread should continue attracting NZD/JPY longs once the negative momentum cools down.

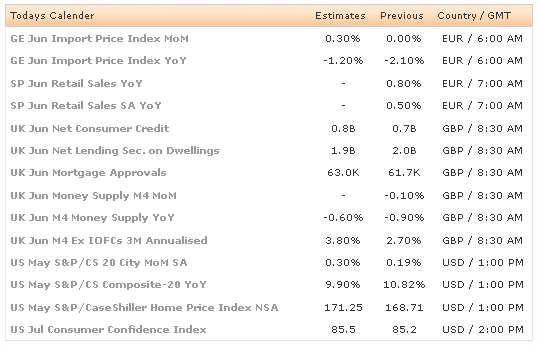

Today, traders are focused on German June Import Price Index m/m & y/y, Spanish June Retail Sales y/y, UK June Net Consumer Credit, Net Lending Secured on Dwellings, Mortgage Approvals and M4 Money Supply, US May S&P/CaseShiller Home Price Index ad July Consumer Confidence.

Currency Tech

EUR/USD

R 2: 1.3550

R 1: 1.3500

CURRENT: 1.3431

S 1: 1.3400

S 2: 1.3296

GBP/USD

R 2: 1.7105

R 1: 1.7000

CURRENT: 1.6979

S 1: 1.6962

S 2: 1.6923

USD/JPY

R 2: 102.27

R 1: 102.10

CURRENT: 101.99

S 1: 101.60

S 2: 101.07

USD/CHF

R 2: 0.9156

R 1: 0.9082

CURRENT: 0.9048

S 1: 0.9000

S 2: 0.8970