The USD hasn’t had much to brag about over the past 6 months, declining nearly 10% this year alone. That fall took it down last week to test a potential dual support point that could be important. See support and reversal points in the chart below.

Last week, King$ found itself testing potential dual support at (1). While testing this potential point of support, it created a bullish wick/reversal pattern. And as support was being tested at (1), weekly momentum was oversold, hitting a level not seen in years. The Euro also found itself at an interesting price point, as bullish euro sentiment was hitting levels rarely seen over the past decade.

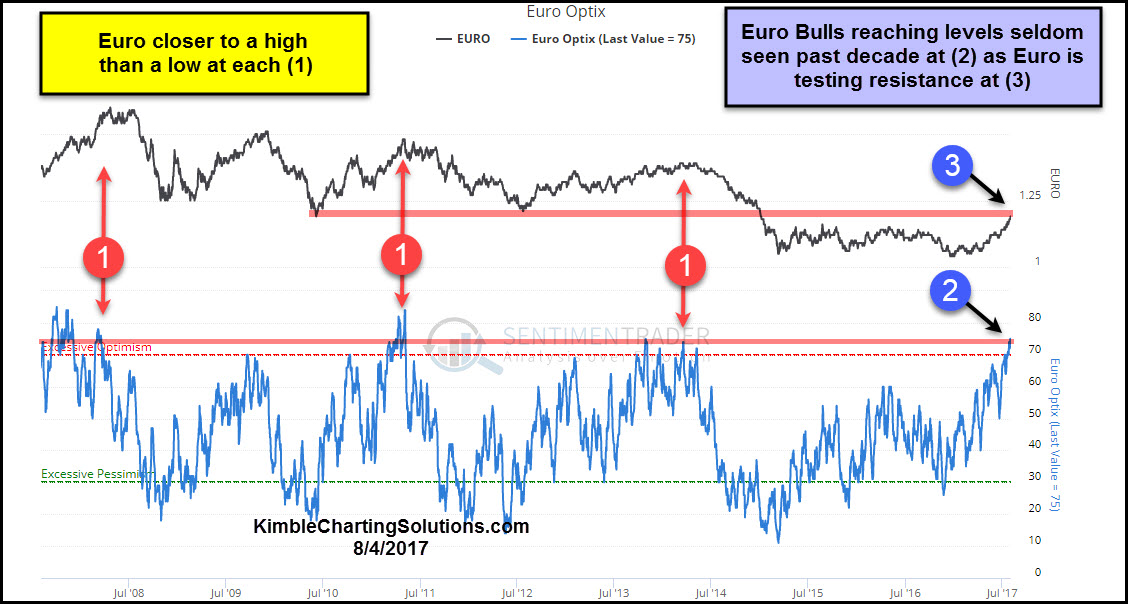

While the dollar has weakened, euro has been strong this year. Indeed, euro's rally has it testing old support as new resistance at (3). At the same time, the euro could be testing resistance and it is fairly easy to find investors bullish the euro at (2). Historically, when euro sentiment has been high at each (1), the currency has been closer to highs than lows.

Due to the test of support, oversold momentum and easy-to-find euro bulls, members took a position in this space last week, going against the crowd with a tight stop.