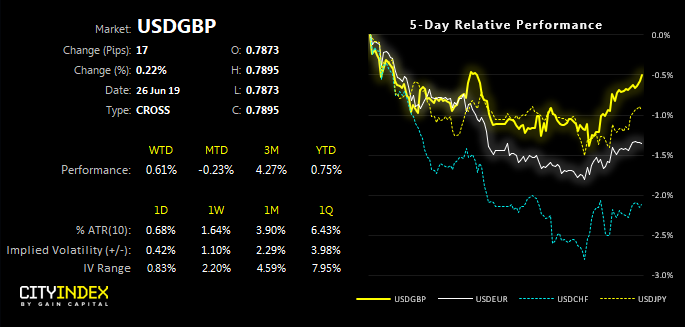

A bullish outside day on the U.S. dollar index above the March lows suggests a corrective bounce could be due. Less dovish than expected comments from Fed members Powell and Bullard helped break the dollar’s bearish streak since last week’s FOMC meeting, proving reversal candles across FX majors. Whilst the G20 could still impact the greenback, the change of tone from the Fed has removed a headwind for the greenback.

- GBP/USD is of particular interest, given its bearish engulfing candle which has formed beneath a resistance cluster.

- EUR/USD remains above a pivotal level but, due to its rally looking overextended, the bias is for a break back within range (even if only temporary)

- USD/CHF has also produced a 2-ar reversal near the (prior) 2019 lows. Whilst this too could see a bounce, we prefer setups on GBP/USD and EUR/USD, due to the strength of the bearish move on the Swissy which led to the lows.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.