A day after their biggest daily gains of the year so far, U.S. equity indices are heading for an unchanged open on Thursday as investors await more commentary from the Fed ahead of its blackout period.

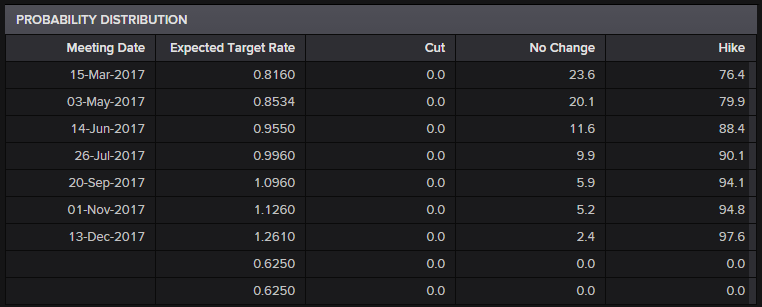

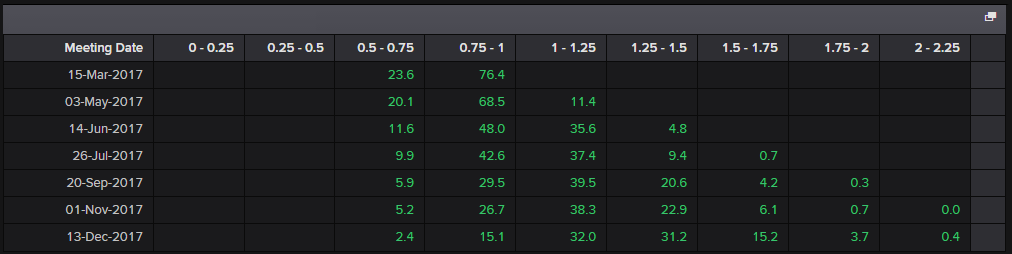

The language from the Fed has become far more hawkish over the last couple of weeks and yesterday’s comments from Lael Brainard – arguably the most dovish policy maker – was the icing on the cake. Not only is March now on the table, in many people’s eyes it’s the base case scenario which is a massive change from even a week ago. Regardless of whether the Fed opts to raise rates in two weeks or not, it’s quite clear now who is guiding who.

In what has already been quite a busy week on the Fed calendar, we’re still yet to hear from Loretta Mester today – a non-voter this year – and Chair Janet Yellen, Vice Chair Stanley Fischer, Jerome Powell and Charles Evans tomorrow –all of which are voters. Needless to say, expectations are likely to fluctuate a lot between now and close of play Friday, at which point the Fed’s blackout period will begin. With rate hike expectations now above 70% for March, the job of the remaining officials should be straightforward if keeping March on the table is in fact their aim.

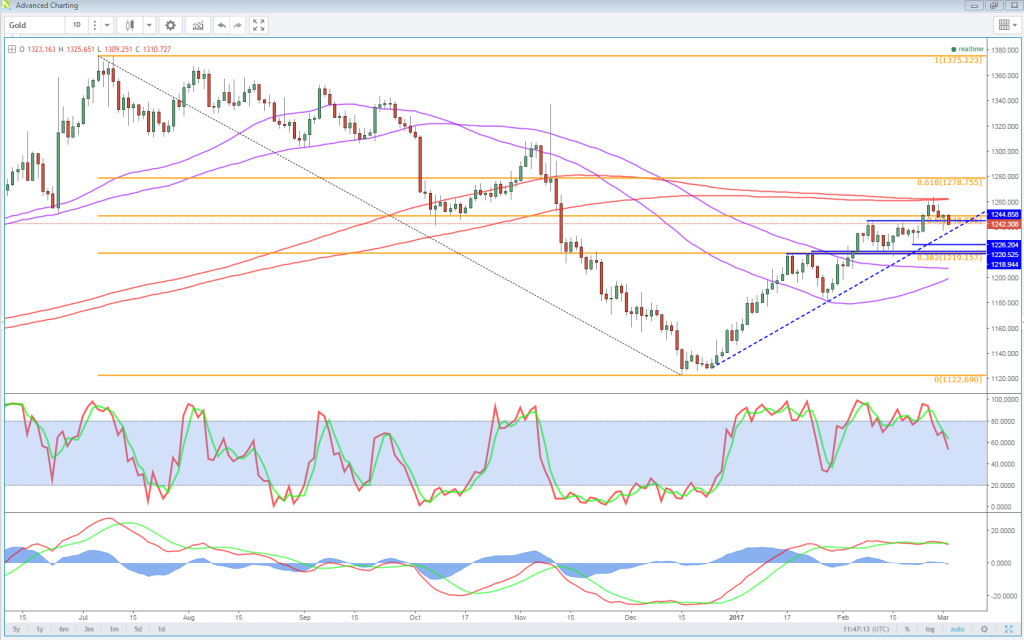

The sudden change in rate hike expectations has been accompanied by a strengthening of the dollar, which is of course to be expected, which is once again today putting pressure on Gold. The yellow metal has until now been very resilient to dollar strength, possibly a reflection of the political risk environment with Trump, Brexit and the French elections making investors a tad uneasy. Gold is trading around half a percentage point lower today and should we see a break below yesterday’s low – around $1,236.94 – it could trigger a sharper sell-off.

In the absence of much economic data today – jobless claims being the only notable release – attention is likely to remain on what the Fed is doing and what we expect it to do in two weeks. It will be interesting if the dollar builds on its gains ahead of all the Fed speeches tomorrow, which could continue to weigh on commodities and the related currencies such as the AUD, CAD and NZD.