Market Brief

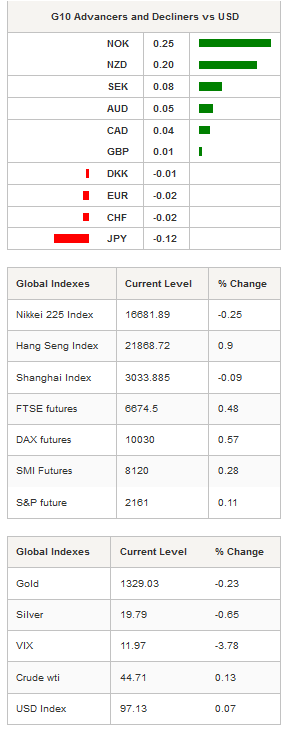

A shaky start into the week, we are looking at a quiet Asian FX session on Wednesday with most currency pairs consolidating. In the equity market, the rally lost some momentum as traders start to wonder whether further gains are sustainable. After sliding 0.70% on Tuesday, EUR/USD stabilised above the 1.10 threshold during the Asian. Since the Brexit vote, the single currency has been stuck in limbo between 1.09 and 1.12 amid persistent uncertainty about the EU’s future without the UK.

USD/JPY’s rally is running out of steam as the pair approaches the strong 106.84 resistance (high from June 23rd). We are not ruling our further JPY weakness but we would rather wait for the outcome of the next BoJ meeting due to take place in little more than a week. On the downside, a first support can be found at 103.85 (Fibonacci 61.8% on June 24th debasement).

Commodity currencies got a breath of fresh air as crude oil prices recovered. The Norwegian krone partially erased yesterday’s losses against the US dollar with USD/JPY sliding 0.30% to 8.4930. On the medium-term, USD/NOK is still trading within its uptrend channel against the backdrop of a stalling crude oil rally.

In New Zealand, the kiwi finally took a breather from the sharp debasement and stabilised above 0.7020 against the US dollar. NZD/USD rose 0.15% in Wellington and hit 0.7064. In our opinion, the bias remains on the downside as we expect the RBNZ to further ease its monetary policy by cutting its benchmark interest rate.

Similarly, the Australian dollar also took a break and consolidated the last few days’ losses at around 0.75. The pair was trading in a very low volatility environment. Just like the kiwi, the bias remains on the downside as the Reserve Bank of Australia is expected to deliver a cut rate in the coming weeks.

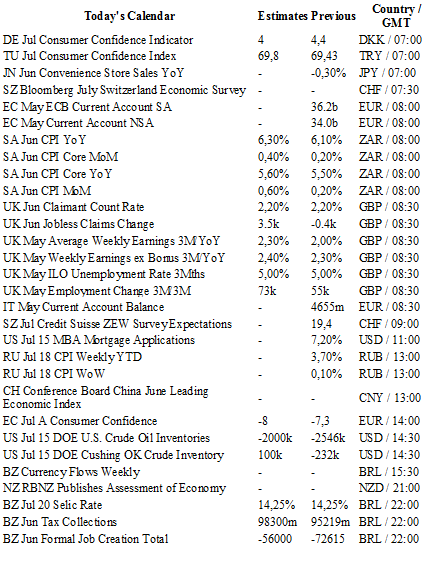

The economic calendar is relatively light today as no data will be released in either the US or the Euro zone. However, traders will be watching June’s CPI report from South Africa, ILO unemployment rate from the United Kingdom and crude oil inventories from in the US. The BCB (Brazilian central bank) is also expected to communicate its interest rate decision (no change expected).

Currency Tech

EUR/USD

R 2: 1.1428

R 1: 1.1186

CURRENT: 1.0991

S 1: 1.0913

S 2: 1.0822

GBP/USD

R 2: 1.3981

R 1: 1.3534

CURRENT: 1.3088

S 1: 1.2851

S 2: 1.2798

USD/JPY

R 2: 107.90

R 1: 106.84

CURRENT: 106.17

S 1: 103.91

S 2: 99.02

USD/CHF

R 2: 1.0328

R 1: 0.9956

CURRENT: 0.9870

S 1: 0.9764

S 2: 0.9685