The US and China are the two major powers in today's world.

Without any exaggeration, we might say that nothing gets done without close cooperation between the two nations – be it climate change, energy security and allocation, etc.

In this connection, the US election should not have an impact on China and US-China relations.

Also, have in mind that China is not cheap anymore.

After 2005, with the yuan being strengthened and wages in China rising, China today is no longer the great bargain it once was – whether for a tourist or a company looking for cheap goods to import.

Trump frequently claimed that China is a currency manipulator.

Trump states that China is artificially devaluing the currency to their benefit to win their fair share of trade.

Whether this means that Trump will instigate a currency war against the CNY is yet to be seen and perhaps also outside the current mandate of the US FED.

However, we would advise to stay away from trading the CNY/USD pair if Trump is in power…

...as we may see some structural changes outside usual market forces that could cause shock to this pair.

Clinton is slightly different than Trump in regards to China.

While Clinton takes on opportunities to talk hard on China, she doesn't mark China as a currency manipulator.

Instead, she has talked about denying China market economy status under US law, a status it does not enjoy in trade law anywhere in the world.

While she talks hard on China, to us it looks more like a noise than the actual action.

What both Trump and Clinton have in common regarding US-China relations is that they have been committed to repatriating US manufacturing jobs home from China while offering no concrete, workable policies and plans for doing so.

We think that from From China's standpoint, it probably doesn't make much difference who wins the White House.

In the end, business should be run as usual.

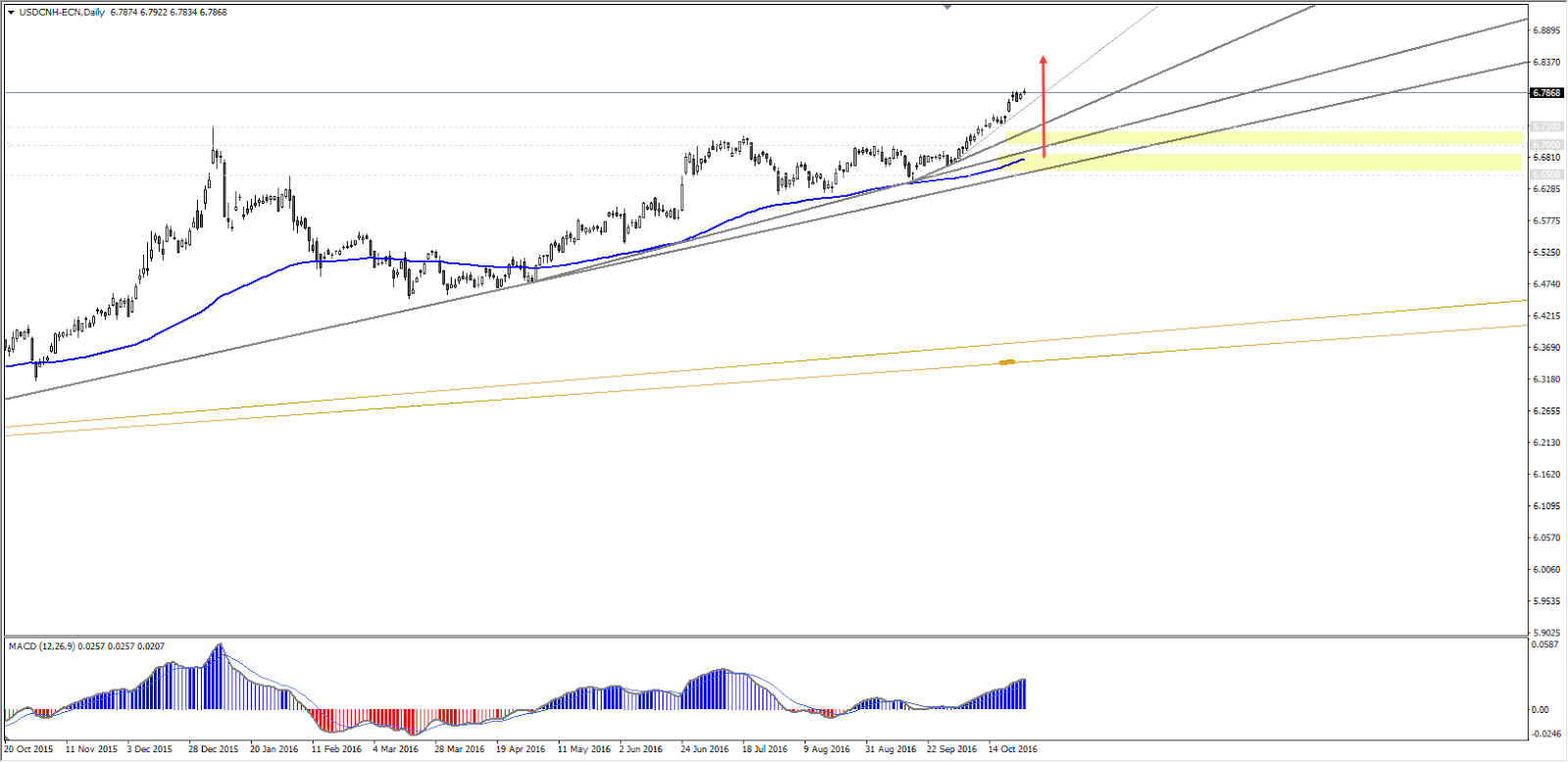

USD/CNY we think after the US elections

By opening a new approach and tougher negotiation strategy with China, both Clinton and Trump would be risking devaluing the yuan and the dollar in relation to the rest of the world's currencies.

Longer-term uptrend should be intact and the currency could be bought on dips 6.7291, 6.699, 6.650 – the levels to watch for towards the rounded numbers 6.800 and 6.850.

MEXICAN PESO

The term "Trump trade" has largely been involving around the Mexican Peso.

Trump has been constantly promoting the fact that US is losing money to China and Mexico, calling it a trade deficit.

Still, there is no proof that trade deficit is bad for such an advanced country like the US.

For example, Japan has had a massive trade surplus for last 25 years (meaning it exports more than it imports) and its trade has been squeezed by stagnant growth for decades.

In our opinion, the Mexican Peso (MXN) has become the barometer of Trump's chances to win.

Trump Presidency would be bad news for the MXN, so be aware of possible short trades on the USD/MXN pair – or stay away from this pair altogether.

The impact of Trump win on USD/MXN currency pair should be huge.

The MXN falls as Trump rises...

...and gains when he slumps.

USD/MXN we think if Clinton wins

There is a possibility of trend line break towards historical buyers and EMA89 confluence within 17.05-17.33 zone.

After that, we might see a breakout-pullback-continuation pattern towards the broken trend line and a drop below 17.04 towards 15.00 over the course of several weeks and months.

Short-term traders should watch the possibility of trend line break towards the above mentioned zone.

USD/MXN if Trump wins

The USD/MXN is already at historical highs and it should print new highs on Trump win.

The currency pair could reject the trend line strongly aiming for 19.90 and above.

Since we don't see any valid historical data, we need to target rounded numbers – just like banks do.

Targets will be 20.50 and 21.00.

US Dollar trend

- With a Trump presidency, we expect:

- the US Dollar to weaken as a first reaction

- To enter a period of volatility or sideways movement as the markets digest the political development and await the new direction from its next leader

- depending on Trump's actions, the USD could strengthen at first as the initial tax cuts boost the economy

- in the long run, the USD could weaken as the debt further increases.

Overall, Clinton presidency should see the US Dollar continue with its strength without any major hurdles.

With a Clinton presidency, we expect:

her plans to reduce and remove the political uncertainty that the elections have created, which should lead to the US Dollar strength as an initial reaction and the USD uptrend to continue

technically speaking, the US Dollar is in an uptrend and once the political event is out of the way, the USD should find new legs for a bullish continuation

most likely, the USD strength will be aided by monetary policy as well.

Why monetary policy?

The US Central Bank, the FED, would be more able to move the interest rates once the political process has been completed.

The FED is probably at least partially waiting with an interest rate decision until after the elections have been completed.