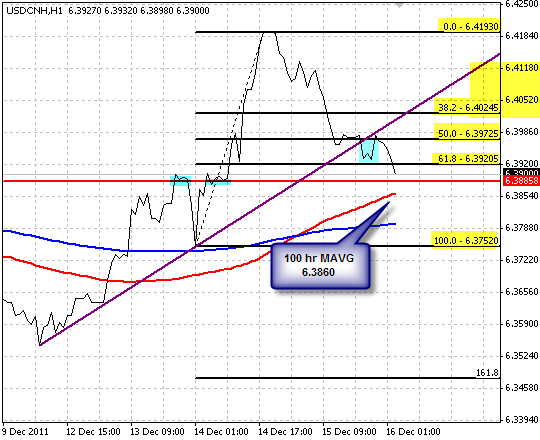

After reaching a high of 6.4193 yesterday, the pair has traded continually lower after risk appetite has slowly reared it’s head back into the market. Support was tested around 6.3972 for a short while, but with risk pairs making small gains in recent trade, the dollar has continued to weaken. To the downside we are approaching 6.3885, a resistance level from earlier in the week; further we have the 100 hour moving average.

USDHKD Ranging

The USDHKD pair has moved up former trendline support that has acted as resistance. The pair continues to range between the 38.2% – 61.8% and a break above the 100day/61.8%/trendline could give the pair an opportunity to test the November highs before year-end.

Hourly trend line developing in USD/SGD

Following the better than expected exports number out of Singapore, the SGD continues to make gains against the USD. Currently the pair is testing possible trend line support which began on December 7th. If support is broke, the 50.0% fibo line is the next stop to the downside.

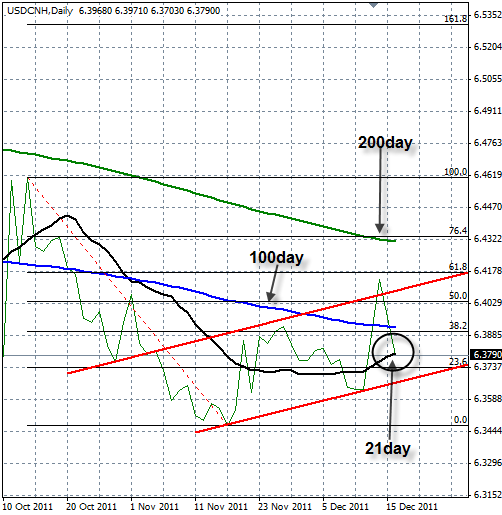

USDCNH Finds Support at Trending 21day MAVG