Investing.com’s stocks of the week

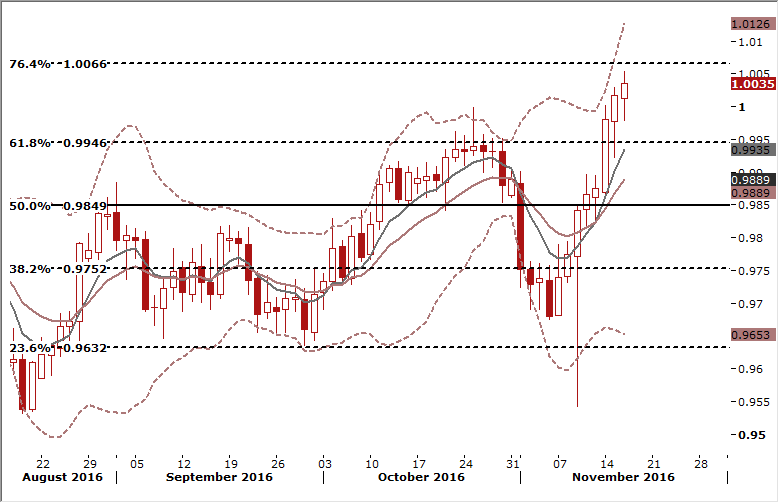

USD/CHF: Our Strategy Is To Buy On Dips

- The Swiss National Bank's two top policymakers underscored on Wednesday their commitment to rein in a strong Swiss franc that has risen to levels against the euro last seen in June when Britain voted for Brexit.

- SNB Vice Chairman Fritz Zurbruegg said currency market interventions had become an increasingly important tool since the financial crisis and the euro zone debt crisis had pushed up the safe-haven franc.

- SNB Chairman Thomas Jordan gave the Swiss government the same message at their annual meeting to discuss the state of the export-led economy and monetary policy. He pointed out that monetary policy with negative interest rates was geared to the current situation with a still markedly overvalued Swiss franc and that the National Bank is still active on the foreign exchange market if needed.

- On the other hand, Fed policymakers remain hawkish in their opinions. Boston Fed President Eric Rosengren said the Federal Reserve would hike interest rates more aggressively than planned if the newly elected U.S. government significantly stimulates the economy.

- Federal Reserve policymaker James Bullard said that it would need a surprise for the Federal Reserve not to raise U.S. interest rates next month. He said the only reason to hold off would be the kind of big shocks that caused it to pull back in the past, such as widespread global market volatility or bad U.S. jobs data.

- This divergence in monetary policies between the Fed and the SNB should support further rise in the USD/CHF. Our trading strategy is to buy the USD/CHF on dips. We think that a corrective move is likely when the USD/CHF reaches 1.0066 (76.4% of 1.0259-0.9439 drop).

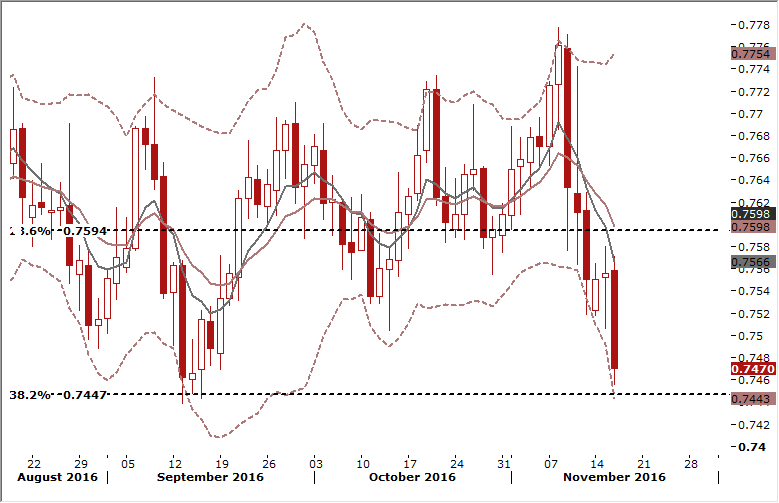

AUD/USD: Hawkish Lowe Did Not Help The Aussie

- Reserve Bank of Australia Governor Philip Lowe said household debt is at a record high and it is not in the public interest to encourage further borrowing. He added: “There remain reasonable prospects that inflation will return to around average levels over the next couple of years.”

- Minutes of its November policy meeting showed the Reserve Bank of Australia left rates at a record low 1.5% because it was more confident inflation would return to "normal levels" over time. The RBA also mentioned the economic benefits from a sharp rebound in the price of iron ore and coal – Australia’s two biggest exports.

- Futures markets imply only a 12% chance of another policy easing by mid-2017.

- Hawkish comments from Lowe were not enough to stop AUD/USD drop. A recent rebound in commodity export prices, which has boosted Australia's terms of trade, also did not help.

- Our AUD/USD long hit the stop-loss, but we stay bullish on the AUD/JPY pair (long opened at 80.90).

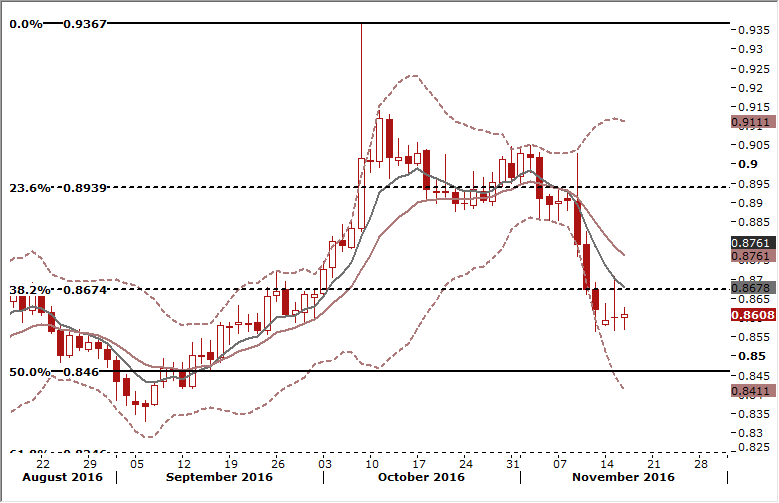

EUR/GBP: Trailing Stop Lowered To 0.8660

- Britain's unemployment rate fell in the first three months after the Brexit vote to its lowest level in 11 years but there were some signs that a slowdown in the labour market could be coming.

- The unemployment rate edged down to 4.8% in the July-September period, compared with a median forecast of 4.9%. But the number of people in work rose by 49k, the slowest increase since the three months to March this year.

- The BoE expects the unemployment rate to stand at 5.6% in two years' time and a survey of employers published on Monday by the Chartered Institute of Personnel and Development showed companies cutting back on hiring plans in late 2016.

- The number of people claiming unemployment benefits in October rose by 9,800, the biggest rise since May, the Office for National Statistics said, adding its measure of claimants had been revised up to take into account changes to the benefit system. September's claimant count increase was revised up to 5.6k from a previous reading of 700.

- The ONS said workers' total earnings including bonuses rose by an annual 2.3%, unchanged from their pace in the three months to August. Excluding bonuses, earnings rose by 2.4% year-on-year, the fastest increase in a year and in line with expectations.

- The ONS said productivity growth slowed in the third quarter. Output per hour growth fell to 0.2% compared with the previous three months, slowing from growth of 0.6% in the second quarter and the weakest improvement since late 2015.

- The break and sustained trading under the 0.8674 level, 38.2% retrace of the 0.7552 to 0.9365 (May-October rise), has weakened the market structure further. We are now short at 0.8690. We have lowered out trailing stop to 0.8660.