Key Points:

- Bearish 100 day EMA crossover.

- Parabolic SAR is bearish.

- Schiff Pitchfork signalling the pair is at a potential turning point.

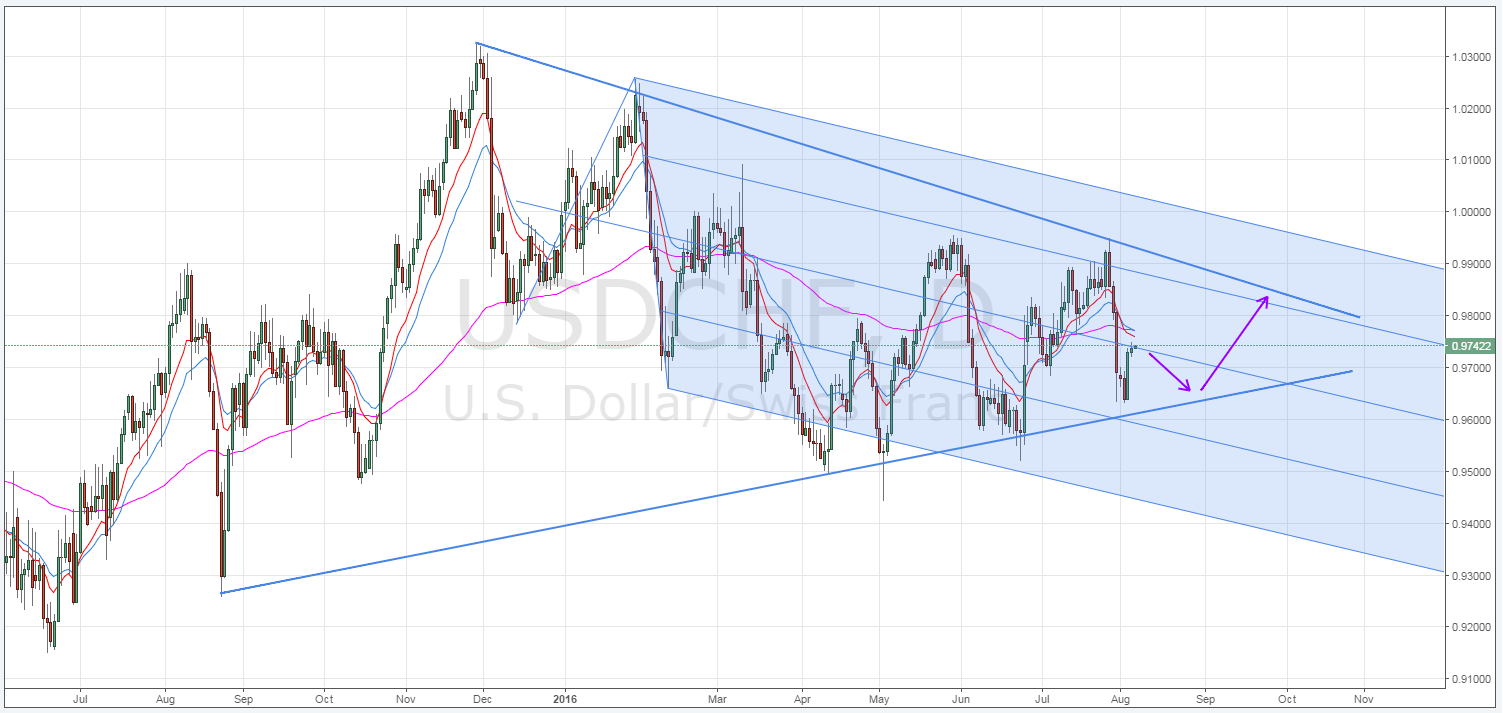

The swissie is continuing to complete its wedge pattern but it might be setting up to take a small dip lower before making an earnest attempt at challenging the upside constraint again.

Specifically, an imminent bearish EMA crossover and a number of other technical indicators are signalling that the USD/CHF could take a slide as the week comes to a close. However, keep in mind that the US employment data could prove to be a disruptive force if it comes in more favourably than predicted.

Firstly, the presence of the USD/CHF’s wedge has been fairly well established for a while now and the structure looks likely to remain intact. However, there is some uncertainty about which constraint is next on the agenda to be tested by the pair.

Recent bullishness could be hinting that a rally to the upside is the most likely move for the swissie in the near future. This being said, the imminent bearish crossover of the 100 day EMA is signalling that a double bottom and subsequent rally might be the better bet.

Supporting the latter option, a quick look at some Schiff Pitchfork analysis reveals that the pair might already be encountering a potential turning point at the 0.9742 level. Consequently, the swissie could reverse as this week comes to a close and subsequently become bearish as next week opens.

This move lower would be in line with the current Parabolic SAR readings which retain their bias for a downtrend.

If the move lower does eventuate, it should result in a double bottom pattern which could lead to a rather substantial rally in the second half of next week. However, this spike will likely run short of momentum as it approaches the resistance zones shown by the above pitchfork.

If the pair does push through these resistance levels, keep a close eye on the upside constraint of the wedge as a breakout could occur.

Ultimately, the USD/CHF will be somewhat at the mercy of fundamentals as this week winds down. Specifically, aside from the Swiss Foreign Currency Reserves results, the US NFP, Trade Balance, and Unemployment Rate figures are all due by week’s end.

Notably, the Unemployment Rate is expected to drop to 4.8% which would certainly see a surge in USD strength and, by extension, a rally for the USD/CHF. However, if the fundamentals fail to impact the pair strongly, expect to see the downside tested as a result of the technical bias.