The FOMC is tonight, and markets are short, everything but the dollar. Many are predicting Yellen to keep her game face onand so are we at Blackwell. The U.S. economy has not fallen off the rails, and the IMF downgrading U.S growth is a little tongue in cheek given their recent history of poor predictions on a global scale – especially Greek and UK predictions, which so far have led to apologies from the international agency.

But FOMC is likely to see tapering continue after last month’s strong nonfarm payroll data, I certainly don’t see them looking to slow down tapering at all, but instead reiterating their support for the economy if it’s needed. US CPI data last night was also positive despite forecasts for weakness; coming in at 0.3% compared to forecasts of 0.2%.

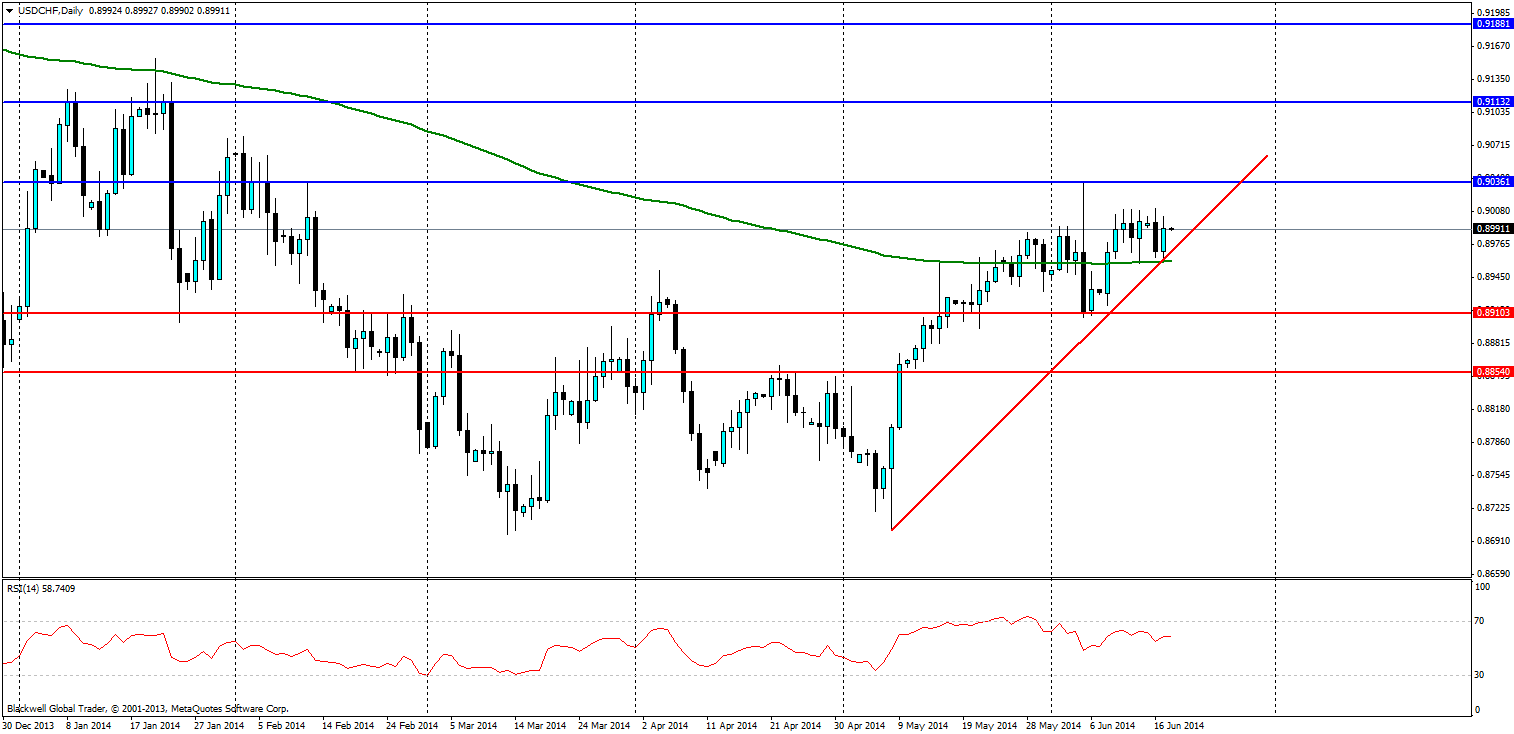

Source: Blackwell Trader (USD/CHF, D1)

The Swiss Franc has clawed heavily on the USD for some time, as the bears looked to smash it down over the course of a few years. However, over the last few months optimism in the USD has so far looked good and we have seen the bulls start to climb back into the market. And with markets expecting an “easy as she goes” approach tomorrow, it’s certainly looking good for the USD/CHF.

Technicals for further appreciation of the USD are appealing. Currently the RSI has been looking very bullish for some time, with strong buying pressure in the market and this looks likely to continue. We also have a strong bullish trend that has emerged in the market. The 200 day moving average so far has been acting as support in some cases, but is starting to finally turn and may signal further bullish movements higher.

The only hard part now is for the pair to break through the ceiling at 0.9036 after that markets will likely aim for 0.9113 which is seen as the next highest point for the market. Support levels are likely to find on the 200 day moving average or the current possible trend line. Solid support levels can also be found at 0.8910 and 0.8854 – these are unlikely to change or be tested unless we saw a sharply negative FOMC meeting.

Overall, the USD/CHF is starting to look very appealing, and investors should be aware of the long term potential for this pair to climb. FOMC will likely push it higher, and we should expect a solid result from this pair in the coming 24 hours.