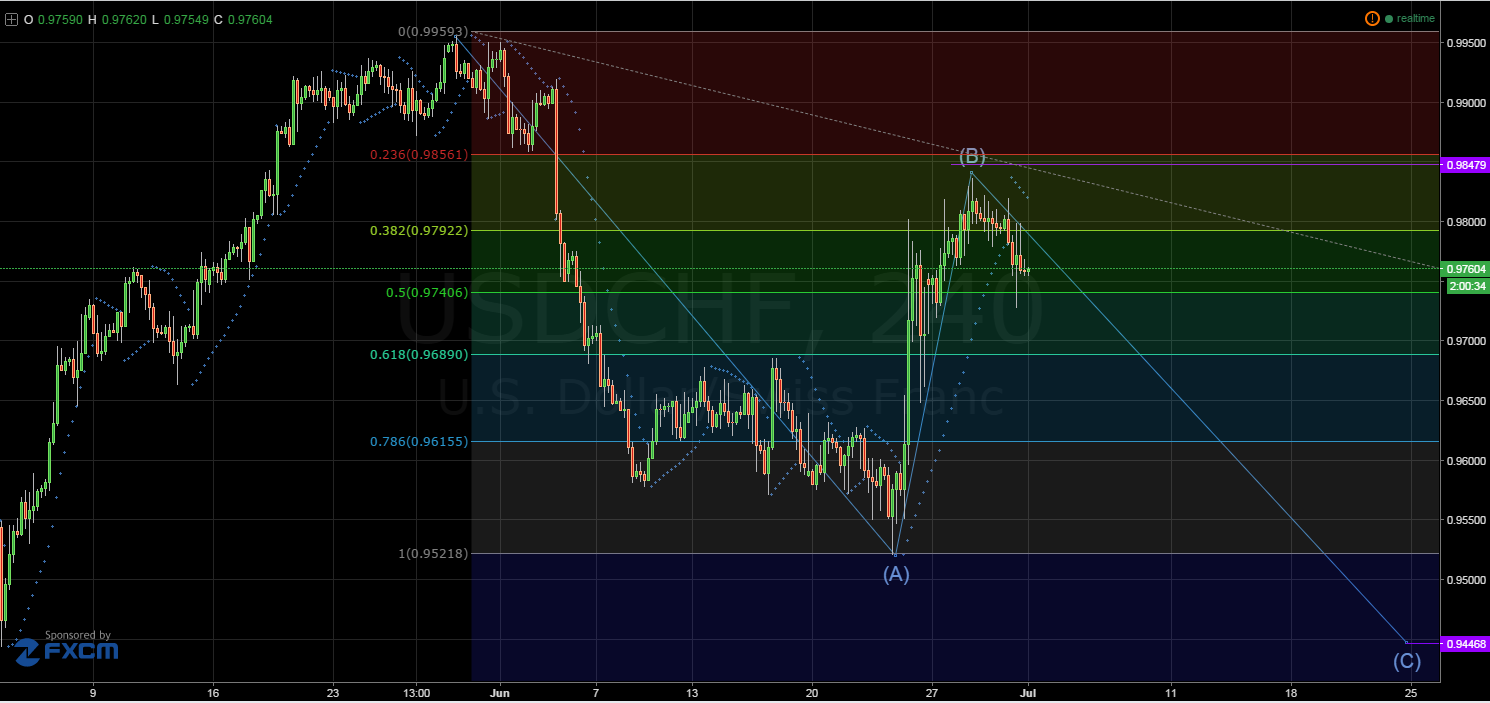

Now that the USD has begun to cede some of the gains it netted during the Brexit chaos, the Swiss franc could surge as an uncertain future looms for Europe. Prior to last week’s surprise vote, the USD/CHF was completing a corrective ABC pattern in the wake of a bearish bat pattern. Whilst the large rally has distorted the formation somewhat, the integrity of the corrective wave remains intact and could carry the pair back to recent lows.

As shown on the daily chart, a plunge following a bearish bat pattern is taking the form of a corrective ABC pattern. As a result, the Swissy is highly likely to begin its journey to the downside in the coming days. In fact, the pair may have already reached its turning point around the 23.6% Fibonacci level at 0.9856. Going forward however, the USD/CHF will likely need to break the 50.0% level at 0.9740 before the downtrend is confirmed conclusively.

In addition to these chart patterns, the daily stochastics and H4 Parabolic SAR readings are signalling that the swissy is well due for a protracted period of bearishness. As shown above, the stochastic oscillator has strayed into oversold territory which will be causing selling pressure to mount. Furthermore, a quick look at the H4 chart shows that the Parabolic SAR indicator is now bearish and signalling that the pair is poised to tumble lower.

If the 50.0% Fibonacci support level is broken, the swissy should retrace to the May low at 0.94468. However, it is worth noting that there remains a relatively strong zone of support around the 0.9614 level which could prove difficult to breakthrough without some strong fundamental results.

This being said, the uncertainty surrounding the future of Europe should supply a significant degree of downwards momentum for this pair as investors retreat to this classic safe haven currency.

Ultimately, despite the rallying effects of the Brexit vote, the USD/CHF is looking set to resume its long-term bearishness. The corrective ABC pattern still has some significant downside potential in store for the pair and the other technicals tend to be in agreement. Additionally, the general climate of uncertainty presently gripping the markets should help the CHF to gain on its US counterpart over the proceeding weeks.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.