USD/CAD 1" title="USD/CAD 1" name="Picture 1" align="bottom" border="0" height="303" width="602">

USD/CAD 1" title="USD/CAD 1" name="Picture 1" align="bottom" border="0" height="303" width="602">

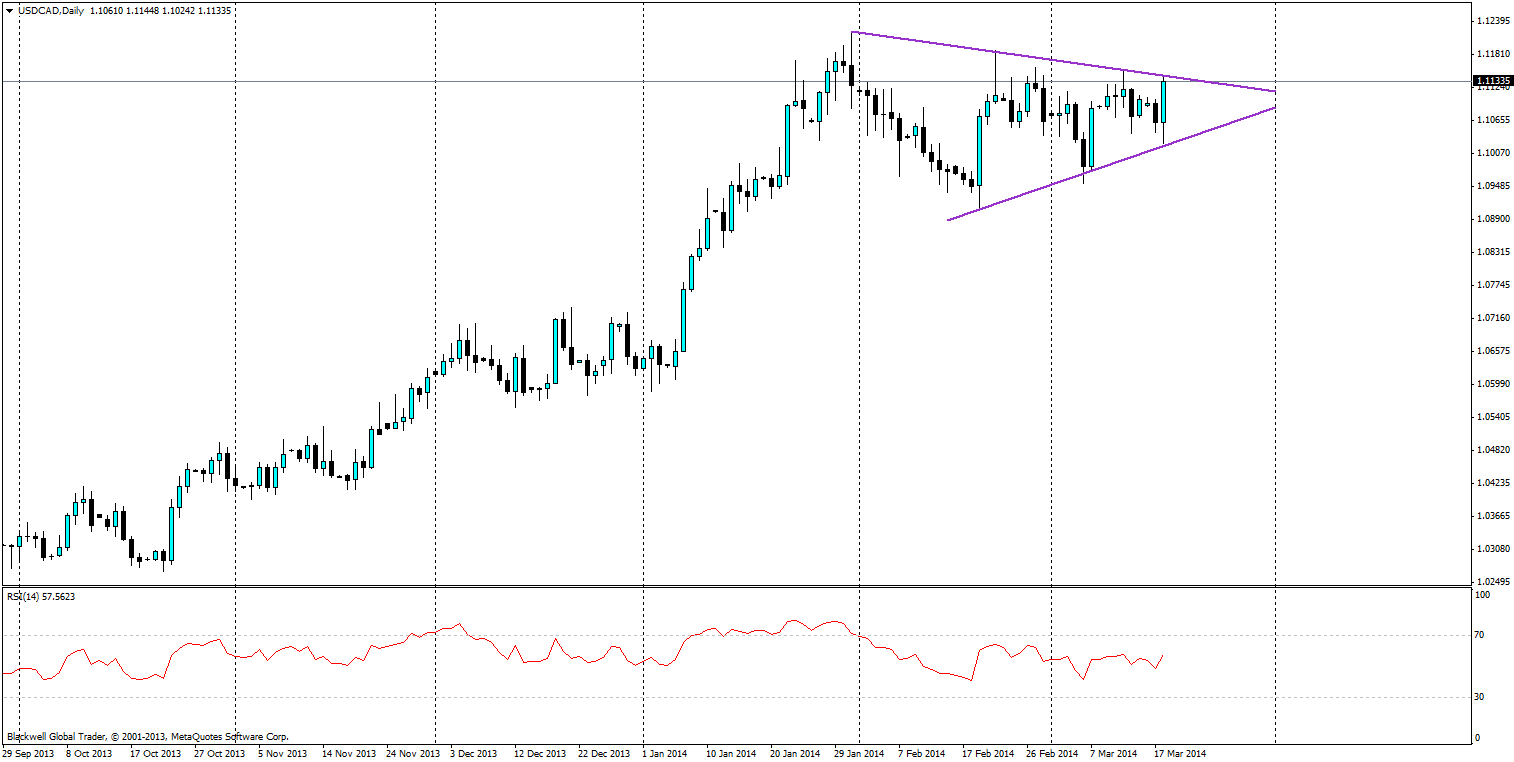

The USD is looking stronger against the CAD after the Central Bank of Canada warned of stagnation in the Canadian economy, while in the US, the FOMC meeting tonight is mostly expected to be positive, though it's hard to tell from market watchers. With the advent of Tapering likely to increase and labour forecasts apparently to get a boost, we could certainly see the wedge tested in the nights to come.

Looking to trade the wedge is likely to be a bullish exercise given the recent bullish trending market which has occurred over the last 2 years. With all of this in mind, it’s a good strategy to place yourself on the outside of the wedge and catch the upward momentum that is likely to occur when it breaks out.

USD/CAD 2" title="USD/CAD 2" height="303" width="602">

USD/CAD 2" title="USD/CAD 2" height="303" width="602">

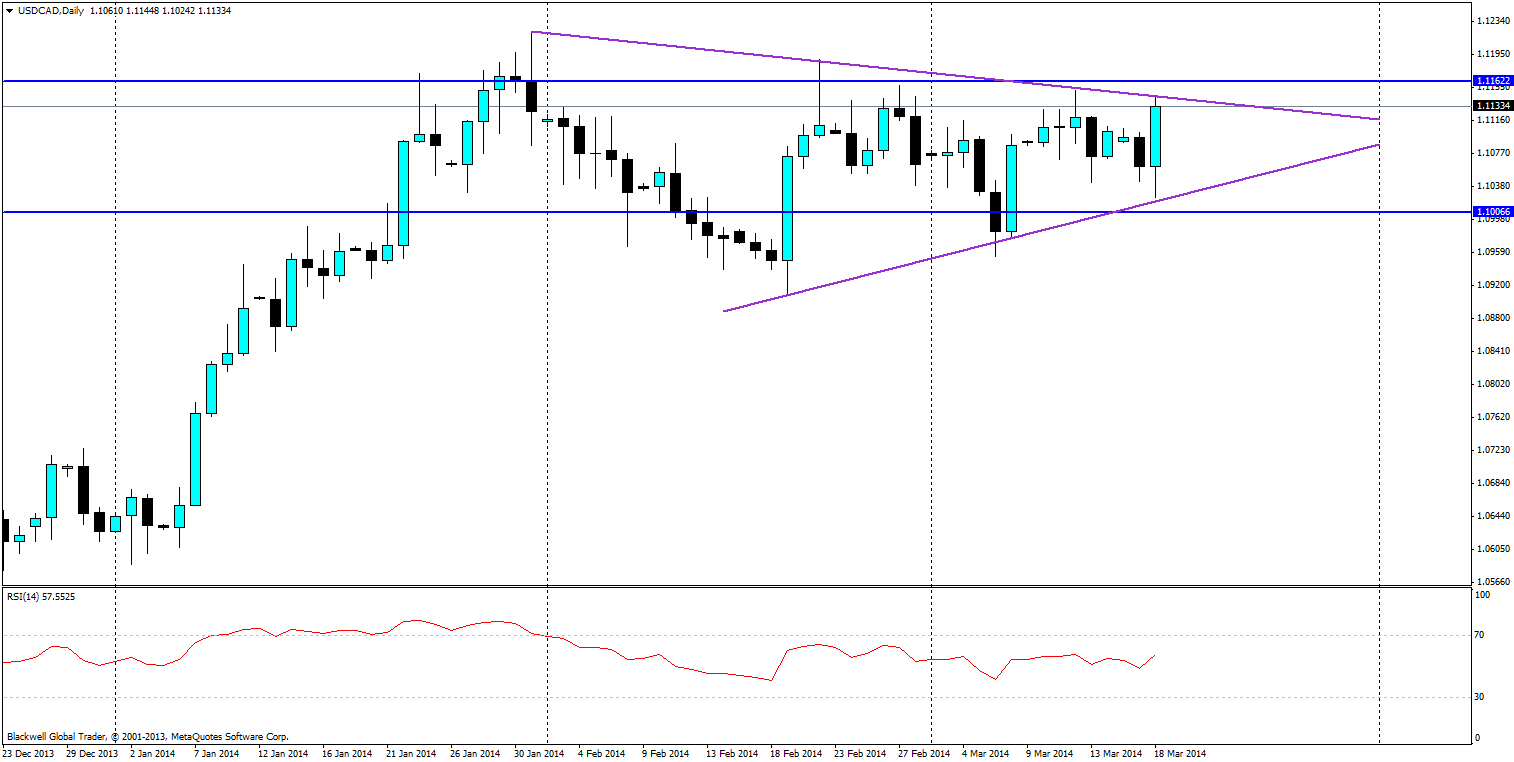

Currently, for price target action, I would look for the 1.162 mark just above resistance in the marketplace - in order to catch the break out upwards. I have set this point as markets can push out to test wedges before pulling back in and this resistance level will be the most likely point to test in this scenario.

While this wedge may not come into fruition immediately, it’s a solid trading strategy and an option for market traders, especially traders who are learning the importance of wedges when it comes to trading and any opportunity to catch an upward trend is certainly a good one.