The US dollar is up sharply against its Canadian counterpart on Friday, as the greenback takes full advantage of weak Canadian retail sales and inflation numbers. The pair has jumped close to one cent, as it trades in the high-1.04 range early in the North American session. On Thursday, the US dollar posted sharp gains after mixed releases. US Unemployment Claims disappointed, but there was better news from Existing Home Sales and the Philly Fed Manufacturing Index, both of which beat market expectations. There are no US releases scheduled on Friday.

Canadian inflation and retail sales numbers were a big disappointment on Friday. Core CPI posted a gain of 0.2%, missing the estimate of 0.3%. CPI also gained 0.2%, shy of the 0.4% estimate. Core Retail Sales slumped to a five-month low, declining by 0.3%. The estimate stood at 0.0%. Retail Sales rose 0.1%, missing the forecast of 0.2%. The figures point to continuing weakness in the Canadian economy, and the US dollar sent the loonie tumbling in response to the poor Canadian numbers.

There was plenty of movement in the currency markets on Wednesday, after Federal Reserve chair Bernard Bernanke said that QE would likely be scaled down in 2013, and could be terminated in 2014, if the economy continues to improve. The Fed said it expects the U.S. economy to grow between 2.3% and 2.6% this year, and unemployment should fall to between 6.5% and 6.8% by the end of 2014. This means that if the US economy shows stronger growth and unemployment falls, there is a strong likelihood that the Fed will scale down QE. It should be remembered that the Federal Reserve is not making any changes at present to QE, which involves bond purchases of $85 billion each month by the Fed. Bernanke’s comments boosted the dollar against the major currencies, since winding up QE is dollar-positive.

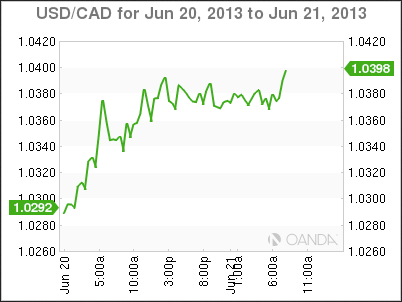

G8 summits are often little more than photo-ops and an opportunity for the leaders to take a short break from the workload back home. However, this week’s G8 meeting in Northern Ireland served more than the usual fare, as the G8 leaders used the occasion to announce the start of negotiations on a free trade agreement between the European Union and the United States. The stakes are very high – the EU and US produce 50% of the global output, and a third of world trade. The deal would be the largest bilateral trade pact ever, and could add up to $100 billion to the economies of each partner. Negotiations will get underway in Washington next month, with a deal expected to be signed by the end of 2014. Canada has a free trade agreement with the US, and is presently negotiating a pact with the EU. Canada will be certainly monitoring the talks between the US and the EU. USD/CAD" width="402" height="302">

USD/CAD" width="402" height="302">

USD/CAD June 21 at 13:40 GMT

- USD/CAD 1.0472 H: 1.0473 L: 1.0363

USD/CAD: Technicals" width="608" height="63">

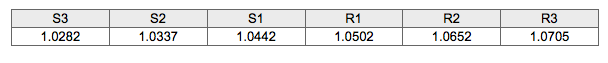

USD/CAD: Technicals" width="608" height="63">USD/CAD is up sharply, and is testing the 1.04 line in the European session. 1.0442 finds itself in an unfamiliar support role as the pair has climbed sharply. 1.0337 is the next support level. This line has strengthened as the pair trades at higher levels. On the upside, the pair faces resistance at 1.0502. This line has remained in place since June 2012, but has weakened as the US dollar continues to move higher. Will it hold firm? This is followed by a strong resistance line is at 1.0652.

- Current range: 1.0442 to 1.0502

- Below: 10442, 1.0337, 1.0282, 1.0229, 1.0157 and 1.01

- Above: 1.0502, 1.0652, 1.0705 and 1.0780

USD/CAD ratio continues to point short positions on Friday. This is consistent with what we are seeing from the pair, as the US dollar is hammering the Canadian currency. The ratio has made sharp moves towards short positions in the past few days, resulting in a strong majority for short positions. This indicates a strong bias towards the pair continuing to move upwards.The US dollar continues to push hard against the loonie, and has gained over three cents this week. We could see the US make more gains on Friday, thanks to today’s weak Canadian data.

USD/CAD Fundamentals

- 12:30 Canadian Core CPI. Estimate 0.3%. Actual 0.2%

- 12:30 Canadian Core Retail Sales. Estimate 0.0%. Actual -0.3%

- 12:30 Canadian CPI. Estimate 0.4%. Actual 0.2%

- 12:30 Canadian Retail Sales. Estimate 0.2%. Actual 0.1%