The US dollar has not let go of its tight hold on its Canadian cousin, as USD/CAD punched through the 1.03 line in Wednesday’s European session. The greenback got some help as Canadian retail sales numbers fell below expectations. In the US, all eyes will be fixed on the Federal Reserve, as Bernard Bernanke testifies before a Congressional Committee and the Fed releases the minutes of its previous policy meeting. The US will release Existing Home Sales later in the day, the first key event of the week.

The loonie has struggled since hitting some turbulence late last week, as Canada posted weak inflation numbers. Core CPI, a key event, posted a weak gain of 0.1%, missing the estimate of 0.2%. CPI recorded its first decline since January, dropping by 0.2%. The estimate stood at 0.0%. These are the weakest Canadian inflation numbers we’ve seen since October 2009. The weak numbers out of Canada continued on Wednesday, as Core Retail Sales slipped badly, dropping from 0.7% to -0.2%. This marked a three-month low for the key indicator. Retail Sales brought no relief, as the indicator slid from 0.8% to 0.0%. The markets had expected a 0.2% gain. These readings point to weakness in consumer spending, a key engine of economic growth.

The Federal Reserve will be front page and center on Wednesday, as Fed Chairman Bernard Bernanke testifies before a Congressional committee and the Fed releases the minutes of the last FOMC meeting. The $64,000 question is whether the Fed will make any changes to its current round of quantitative easing, which involves the purchase of $85 billion in assets each month. There are signs that the Fed is mulling making a move, despite lukewarm US numbers of late. Last week, John Williams, president of the Federal Reserve Bank of San Francisco, stated that the Fed could begin reducing QE this summer and terminate bond buying late in 2013. As the QE program is dollar negative, any moves by the Fed to wind up QE could have a strong impact on the movement of USD/CAD.

US releases have not looked good lately, and last week’s numbers were, for the most part, disappointing. Inflation and manufacturing numbers fell below expectations, and housing data did not meet the forecast. Unemployment Claims had looked impressive in recent readings, but was well above expectations, pointing to weakness on the job front. There was better news from Building Permits, and the UoM Consumer Sentiment shot up to wrap up the week. Trying to determine the extent of the US recovery continues to be difficult, as the economy has yet to demonstrate sustained growth and produce continuous positive releases.

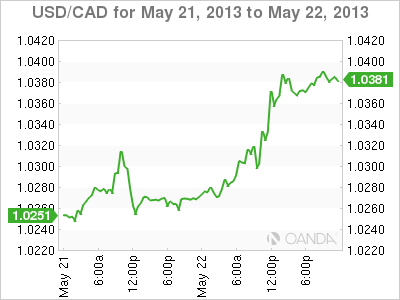

USD/CAD May 22 at 13:20 GMT

USD/CAD 1.0317 H: 1.0330 L: 1.0257 USD/CAD Technical" title="USD/CAD Technical" width="601" height="80">

USD/CAD Technical" title="USD/CAD Technical" width="601" height="80">

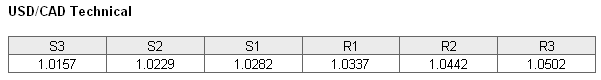

USD/CAD continues to move higher, as the pair barreled across the 1.03 level in the European session. The pair is receiving weak support at 1.0282, and this line could face pressure if the retreating Canadian dollar shows any improvement. There is a stronger support level at 1.0229. On the upside, the pair continues to face resistance at 1.0337, a line which has not been tested since early March. This is followed by a stronger line of resistance at 1.0442.

- Current range: 1.0282 to 1.0337

- Below: 1.0282, 1.0229, 1.0157, 1.01, 1.0041 and 1.00

- Above: 1.0337, 1.0442, 1.0502 and 1.0658.

USD/CAD ratio has reversed directions in Wednesday trading, and is pointing to movement towards short positions. This is not reflected in what we are currently seeing from the pair, as the US dollar continues to push higher against the Canadian currency. If the pair continues to stay active, we can expect the ratio to swing back into action.

The US dollar continues to post gains, and has crossed above the 1.03 level. Will the greenback muster enough momentum to remain in 1.03 territory? There’s a lot going on in the US on Wednesday, as Federal Reserve Chairman Bernard Bernanke testifies on Capitol Hill and the Fed releases the minutes of its most recent policy meeting. As well, US Existing Home Sales, a market-mover, will be released later today.

USD/CAD Fundamentals

- 12:30 Canadian Core Retail Sales. Estimate 0.2%. Actual -0.2%

- 12:30 Canadian Retail Sales. Estimate 0.2%. Actual 0.0%

- 14:00 US Existing Home Sales. Estimate 4.99M

- 14:00 US Fed Chairman Bernard Bernanke testifies before Congress Joint Economic Committee

- 14:00 US Treasury Secretary Jack Lew Speaks

- 14:30 US Crude Oil Inventories. Estimate -0.4M

- 18:00 US FOMC Meeting Minutes