Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

- US CPI in focus

- USDCAD outlook mixed

- Geopolitics mirrored by movie hits

Both Ukraine and Bank of England (BoE) politics gave European traders something to mull over this morning. The validity of the eastern Ukraine referendum vote comprised one discussion while a Financial Times (FT) report was another. The FT said that the BoE will be having detailed discussions about raising interest rates this week, which gave sterling a lift. This week also brings a number of data releases from the UK and the Eurozone, which could see GBP/USD rise while EUR/USD drops. Across the pond, Canadian traders are still pondering the ramifications (if any) stemming from the surprisingly weak employment report. In the United States, the focus will be on CPI and retail sales. It remains to be seen if the CPI data reopens the debate on whether or not the US Federal Reserve will move forward the timing of its next rate hike.

Key US Data releases:

Tuesday: April Retail Sales (Forecast, 0.4 percent, 0.6 percent, ex-autos, month-over-month). The forecast expects some payback from the strong March print with soft auto sales a factor. The data should be US Dollar Index neutral.

Thursday: April CPI (Forecast, 0.3 percent, core 0.2 percent, month-over-month). There are many economists concerned over the possibility that another upside surprise to CPI could renew talk of an earlier US rate increase.

Thursday: Industrial Production and Capacity Utilisation (Forecast 0.1 percent, and 79.2 percent). The risk of some sort of payback following two months of strong gains may undermine the US dollar in the short-term.

Friday: April Housing Starts, Building Permits (Forecast 980,000, Permits, 1.01 million). The better weather in April should lead to a rebound in both starts and permits, which should support the US dollar.

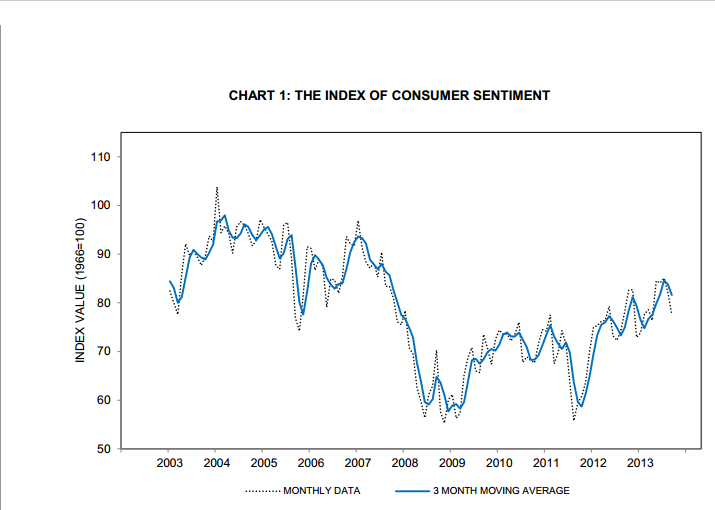

Friday: Reuters/Michigan Consumer Confidence Survey (Forecast 84.5). There is a risk for a better than consensus result, in part due to the improvement in the weather, which should give the US dollar a boost.

Chart: Reuters/Michigan Consumer Confidence

Source: Trading Economics/Thompson Reuters/University of Michigan

Key Canadian Data Releases

Tuesday: Bank of Canada (BoC) Review-The quarterly Bank of Canada review will provide a more current view of the bank's outlook for the domestic economy. The prospect of improving growth should help to alleviate concerns that rate cuts are a realistic prospect.

Thursday: March Manufacturing Shipments (Forecast, 0.5 percent). FX traders generally ignore this data, which should be the case this week as well. A better-than-expected result will merely be another piece of steadily improving data and provide "big picture" support to the Canadian dollar.

USD/CAD sentiment is mixed.

The bullish USD/CAD view is supported by the failure of the US dollar to extend gains below the daily uptrend line from September 2013, which currently resides in the 1.0800-10 area. Friday's weak employment data is more evidence of the Canadian economy's under-performance. The Canadian housing market is still viewed by many as ripe for a correction and China's struggles to engineer a "soft landing" are seen to undermine commodity currencies. The Bank of Canada governor Stephen Poloz was extolling the virtues of a weaker Canadian dollar when the currency pair was trading at 1.1150. With the currency currently at 1.0890, it wouldn't be much of a stretch if Poloz were to use the Bank of Canada review on Tuesday as a forum to abase the loonie again. EUR/CAD is also providing support although it is well off its March 2014 peak of 1.5580. The short-term downtrend has not extended losses below the long-term uptrend line from May 2013, which is intact above 1.0860 and is supported by multiple daily bottoms in the 1.4860-90 area.

Source: Saxo Bank

The bearish USD/CAD view is predicated on the definitive breech of the 2014 uptrend line at 1.0940 combined with the series of lower highs from the March peak of 1.1270. A series of better-than-expected Canadian data releases (except for the employment report) and evidence that positioning still favours long USD/CAD by nearly 2:1 (Commitments of Traders Report) should encourage further upside. The diminished risk for domestic rate cuts and expectations that the improving outlook for the US economy will lead to gains in Canada have effectively rebutted the January-February argument for buying USD/CAD. GBP/CAD has also provided Canadian dollar support with the break of uptrend line support at 1.8460 pointing to further losses towards 1.7900.

Source: Saxo Bank

Captain America, Godzilla and the Expendables

The three big blockbuster movies this month are Godzilla, Captain America and The Expendables, which accurately depict the geopolitics in Eastern Europe. Vladimir Putin is obviously Godzilla, in western eyes although Putin may view himself more as Robocop -- champion of the downtrodden. Voters in Eastern Ukraine (The Expendables) opted for independence in a referendum vote at the weekend, a result not seen as legitimate by the Ukrainian government, the US (Captain America) or Europe. Americans have conveniently forgotten that their Declaration of Independence in 1776 wasn't seen as legitimate by Great Britain, either. The Americans and Europeans say the vote lacks credibility as people were seen to be voting many times over. The polling stations were staffed by separatist activists and there was no international oversight. The complaints are eerily similar to the 2000 US presidential election, which gave the world George W. Bush over Al Gore when the term "hanging chad" entered the lexicon. Despite the uncertainty and the risk of expanding hostilities, the Vix index (or fear index) is well off its 2013 peak, suggesting that the financial markets are unperturbed.

Source: Saxo Bank