NZD/USD: RBNZ Cut Rates By 25 bp, As Expected

- The Reserve Bank of New Zealand cut rates by 25 bps to 2.0%, as expected. The RBNZ said unprecedented easing by central banks around the world was putting upward pressure on the kiwi dollar and making it harder to lift inflation domestically.

- The RBNZ said its projections and assumptions indicate that further policy easing will be required to ensure that future inflation settles near the middle of the target range. The central bank said weak global conditions and low interest rates relative to New Zealand were placing upward pressure on the NZD. It expects that domestic growth will be supported by strong inward migration, construction activity, tourism, and accommodative monetary policy.

- Reserve Bank of New Zealand Governor Graeme Wheeler said that the central bank cut interest rates by 25 bps because of exchange rate pressures on the economy. RBNZ Assistant Governor John McDermott said the central bank is likely to cut rates once more and possibly twice.

- The NZD/USD rallied after the RBNZ decision. In fact the market had priced in a 20% chance of a 50 bps cut. We still expect there will be another easing in November. In our opinion further easing should not stop the NZD rise in the long term. The kiwi is rising on the back of strong investor appetite for higher yields. New Zealand 10-Year government bonds have a yield of around 2.1%, compared with negative yields in Japan and Germany.

USD/CAD: We Stay Short

- The Canadian dollar strengthened to a three-week high against its broadly weaker US counterpart on Wednesday, although gains were pared as crude oil fell.

- Oil fell sharply after data from the US Energy Information Administration showed crude inventories rose 1.1 million barrels in the week ended August 5.

- Overall production from the OPEC, of which Saudi Arabia is the de-facto leader, also increased, boosted by producers such as Iraq and Iran, who offset the impact of militant attacks in Nigeria. Based on figures OPEC collects from secondary sources, the organisation pumped 33.11 million bpd in July, up 46,000 bpd from June.

- The International Energy Agency in today’s monthly report forecast that oil markets will begin to tighten in the second half of 2016 after month of oversupply.

- Investors are waiting now for a speech by Federal Reserve Chair Janet Yellen at the US central bank's August 26 symposium in Jackson Hole. The market expects a more hawkish tone from Yellen after Friday's jobs report for July showed better-than-expected employment gains.

- We stay USD/CAD short. Our short-term target is 1.2900.

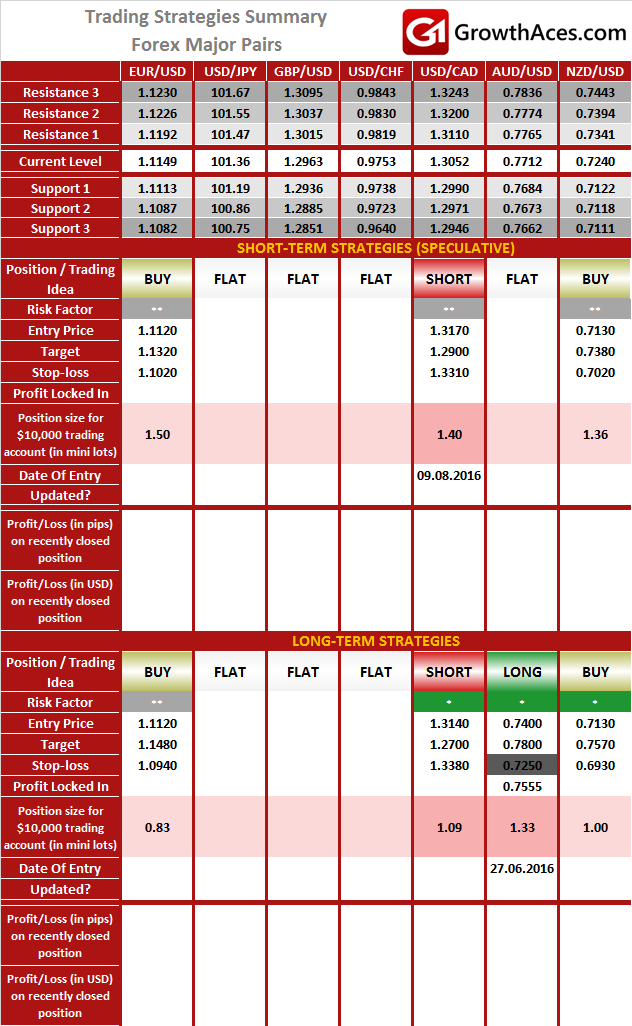

FOREX - MAJOR PAIRS:

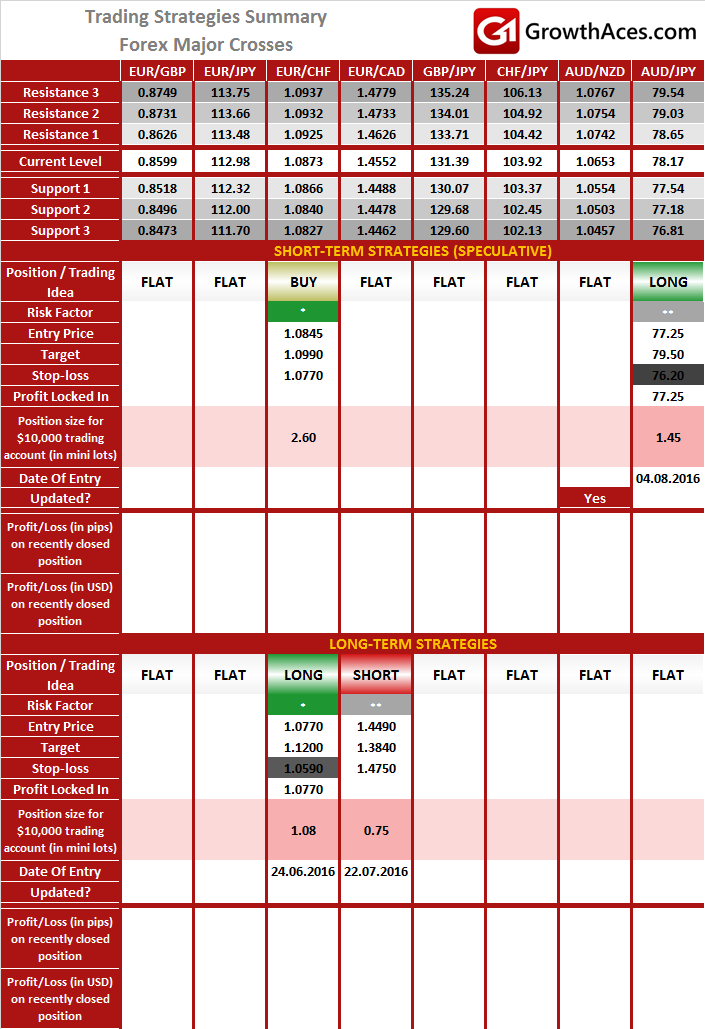

FOREX - MAJOR CROSSES:

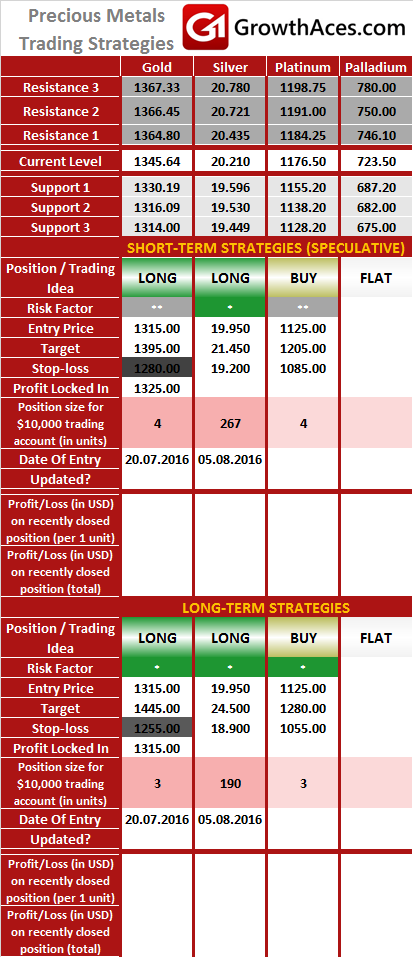

PRECIOUS METALS:

It is usually reasonable to divide your portfolio into two parts: the core investment part and the satellite speculative part. The core part is the one you would want to make profit with in the long term thanks to the long-term trend in price changes. Such an approach is a clear investment as you are bound to keep your position opened for a considerable amount of time in order to realize the profit. The speculative part is quite the contrary. You would open a speculative position with short-term gains in your mind and with the awareness that even though potentially more profitable than investments, speculation is also way more risky. In typical circumstances investments should account for 60-90% of your portfolio, the rest being speculative positions. This way, you may enjoy a possibly higher rate of return than in the case of putting all of your money into investment positions and at the same time you may not have to be afraid of severe losses in the short-term.

How to read these tables?

1. Support/Resistance - three closest important support/resistance levels

2. Position/Trading Idea:

BUY/SELL - It means we are looking to open LONG/SHORT position at the Entry Price. If the order is filled we will set the suggested Target and Stop-loss level.

LONG/SHORT - It means we have already taken this position at the Entry Price and expect the rate to go up/down to the Target level.

3. Stop-Loss/Profit Locked In - Sometimes we move the stop-loss level above (in case of LONG) or below (in case of SHORT) the Entry price. This means that we have locked in profit on this position.

4. Risk Factor - green "*" means high level of confidence (low level of uncertainty), grey "**" means medium level of confidence, red "***" means low level of confidence (high level of uncertainty)

5. Position Size (forex)- position size suggested for a USD 10,000 trading account in mini lots. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size). You should always round the result down. For example, if the result was 2.671, your position size should be 2 mini lots. This would be a great tool for your risk management!

Position size (precious metals) - position size suggested for a USD 10,000 trading account in units. You can calculate your position size as follows: (your account size in USD / USD 10,000) * (our position size).

6. Profit/Loss on recently closed position (forex) - is the amount of pips we have earned/lost on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.

Profit/Loss on recently closed position (precious metals) - is profit/loss we have earned/lost per unit on recently closed position. The amount in USD is calculated on the assumption of suggested position size for USD 10,000 trading account.