USD/CAD was steady on Thursday, as the pair trades in the mid-1.09 range in the North American session. On the release front, the news was not positive. Canadian Building Permits and Ivey PMI were well off their estimates. In the US, Unemployment Claims rose and also missed the forecast.

Canadian numbers continue to struggle. Building Permits broke a string of declines, posting a gain of 1.1%. However, this was way off the estimate of 4.1%. Ivey PMI slipped to 48.2 points in May, its first reading below the 50-point level this year. The sub-50 reading points to contraction in the economy, and follows a weak GDP release last week. The Canadian dollar has now lost about 100 points in the past week, and we could see some movement from USD/CAD on Friday, as both Canada and the US release key employment numbers, highlighted by US Nonfarm Payrolls.

US employment numbers have not looked sharp so far this week. On Wednesday, ADP Nonfarm Payrolls slipped to 179 thousand, well off the estimate of 217 thousand. Official Nonfarm Payrolls will be released on Friday, and a weak reading could weigh on the US dollar. Meanwhile, Unemployment Claims rose to 312 thousand, up from 300 thousand in the previous reading. The estimate stood at 309 thousand.

US manufacturing and services sectors are pointed in the right direction, according the ISM Business Survey Committee. The ISM Manufacturing and Non-Manufacturing PMIs both improved in May. There was some confusion earlier in the week, as the Manufacturing PMI was based on faulty data, with the original report stating that the manufacturing index had softened in May. This was later corrected, as the index actually improved to 55.4 points in May, up from 54.9 points a month earlier. Meanwhile, the Non-Manufacturing PMI hit a nine-month high last month, climbing to 56.3 points, ahead of the estimate of 55.6 points.

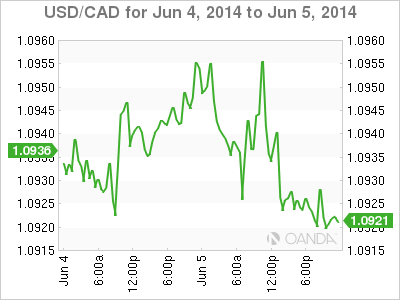

USD/CAD June 5 at 15:20 GMT

USD/CAD 1.0951 H: 1.0960 L: 1.0917

USD/CAD Technical

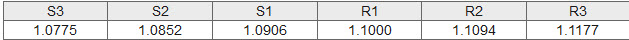

- The round number of 1.1000 is providing resistance. This is followed by a stronger resistance line at 1.1094.

- 1.0906 is a weak support line. 10852 is stronger.

- Current range: 1.0906 to 1.1000

Further levels in both directions:

- Below: 1.0906, 1.0852, 1.0775, 1.0706 and 1.0678

- Above: 1.10, 1.1094, 1.1177 and 1.1278

OANDA's Open Positions Ratio

USD/CAD ratio is evenly split between long and short open positions, indicative of a lack of trader bias as to the direction that the pair will take.USD/CAD has edged higher on Thursday. The pair is unchanged in the North American session.

USD/CAD Fundamentals

- 11:30 US Challenger Job Cuts. Actual 45.5%.

- 12:30 Canadian Building Permits. Estimate 4.1%. Actual 1.1%.

- 12:30 US Unemployment Claims. Estimate 309K. Actual 312K.

- 14:00 Canadian Ivey PMI. Estimate 56.3 points. Actual 48.2 points.

- 14:30 US Natural Gas Storage. Estimate 116B.

- 17:30 US FOMC Member Narayana Kocherlakota Speaks.