The run-up in USD/CAD paused in early December after which CAD traders seemed to take a month-long holiday, but I suspect 2014 will bring new multi-year highs sooner or later for USD/CAD, possibly as soon as today if the Ivey PMI release is a weak one. Also weighing on CAD is the tremendous sell-off in crude prices that kicked off the year, with WTI spot crude plummeting six dollars from late-December highs.

The Canadian and US economies are in very different places as we enter 2014. The US has a cheap currency and is largely in a post-bubble environment in housing and private-debt terms, even if it is easy to argue that there is considerable further potential deleveraging in the pipeline if private balance sheets are to revert all the way back to historic norms. Meanwhile, Canada’s currency is still relatively dear in historic terms and its manufacturing sector has been hollowed out by years of high currency levels.

Canada’s private balance sheets are wildly extended and the private-debt load is one of the world’s highest at over 160 percent of GDP. Over the last 10 years, Canada’s housing prices have spiralled far higher than they ever did in the US relative to their level 10 years ago. So assuming the Canadian housing market is topping out here, which widespread evidence suggests is the case (activity slowing, price gains slowing rapidly), this could serve as a significant brake on confidence and consumer activity in the New Year.

The number of construction jobs per capita in the Canadian economy and the weight of construction activity in the Canadian economy are multiples of US counterparts. With interest rates already so close to zero, a weak Canadian economy could quickly lead to anticipation that the Bank of Canada may cut interest rates or, in extremis, some kind of quantitative easing, neither of which is even on the market’s radar for the moment as visions of recovery continue to dance in our heads. Even if things don’t turn out poorly for Canada this year, its relative prospects to those for the US are very modest, given the headwinds of already very higher private sector leverage.

My baseline outlook for the rest of the year is for USD/CAD to rise toward 1.1500 and we may already get a start on that path this week or at least in January. I suspect the market action could overshoot significantly above that 1.1500 mark if we get a weak North American economy this year rather than a strong one.

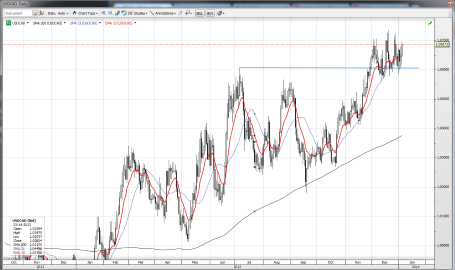

The Chart

USD/CAD has been poised in an orderly 1.06-1.07 range as the year gets under way. I suspect the action this year will see an expansion of the range back toward 1.2000, with a weekly close above 1.0700 as the first potential trigger. A bout of stronger-than-expected data here could disappoint the CAD bears for a time, particularly if the pair closes back through 1.0500, but I doubt that any downside action will prove durable.  USD/CAD" title="usdcad" width="948" height="563" data-lightbox-src="/images/blog/original/16fb4695-ea5a-4f57-ad84-095b0b2675fa.png" data-lightbox="image" data-lightbox-desc="usdcad">

USD/CAD" title="usdcad" width="948" height="563" data-lightbox-src="/images/blog/original/16fb4695-ea5a-4f57-ad84-095b0b2675fa.png" data-lightbox="image" data-lightbox-desc="usdcad">

By John J Hardy

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD/CAD: It’s Decision Time — Again

Published 01/07/2014, 11:01 AM

Updated 07/09/2023, 06:31 AM

USD/CAD: It’s Decision Time — Again

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.